Euro Pushes For Parity As Tentative Calm Returns Elsewhere

Tentative calm returned to global markets on Wednesday, with the recession-obsessed euro slumped at a two-decade low, stocks inching higher and oil back above $100 a barrel following a near 10% plunge a day earlier.

Traders certainty weren't giving the all-clear but the tumultuous moves of the last 24 hours had at least eased off.

The euro, which has lurched towards parity with the dollar this month, was lower again at $1.02. But with stocks and Brent up [.EU][O/R], Norway's gas strike off and Wall Street expected to go sideways later [.N], the intensity had dropped noticeably.

Euro zone government bond yields also continued to tick lower although Britain's pound barely flinched after the country's finance minister and a dozen others dramatically quit in protest against UK Prime Minister Boris Johnson.

The broad European STOXX 600 rose 1.6%, with London, Frankfurt and Paris up 1.7%, 1.5% and 1.4% respectively as retail, travel and miners led the gains. [.EU]

Nevertheless, the worries about the world economy now grinding to a standstill that have stalked markets were lingering, analysts said.

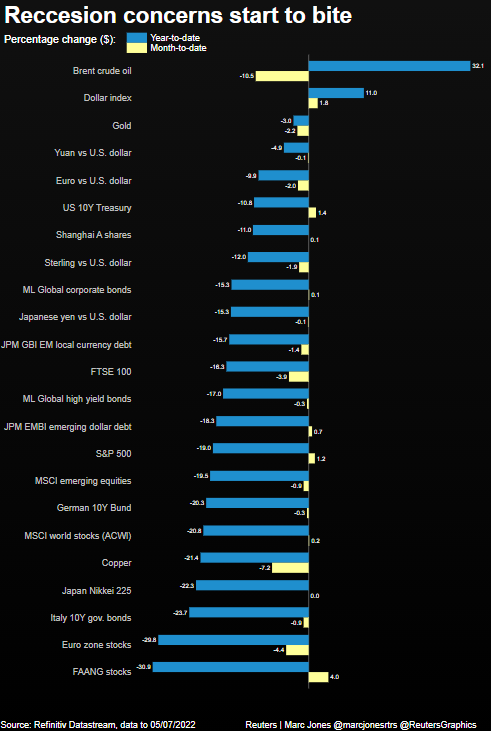

"The market moves over the past couple of days have been classic recessionary pricing," said Hugh Gimber, global market strategist at J.P. Morgan Asset Management. "Investors are really becoming more cognisant of the risks."

The dollar's six currency index added to a 20-year peak at 106.97, with others safe havens also in demand, including the Japanese yen. [/FRX]

Despite Europe's gains MSCI's world equity index, which tracks shares in 47 countries, was flat having lost 20% this year.

S&P 500 futures pointed to dips of about 0.1%-0.3% on Wall Street with most focus on the minutes of the Federal Reserve's latest meeting which will be published later.

Overnight, MSCI's index of Asia-Pacific stocks outside Japan fell 1%, led by a COVID flare-up in China's markets [.SS] and 2% drops for Taiwan and South Korea's indicies..

Hans Peterson, the global head of asset allocation at SEB investment management in Sweden, said for global markets to feel better again oil prices and inflation now had to come down and stay down.

"The things we are looking at is how consumers are reacting and also the central banks and when will they be satisfied with what they have done," Peterson said referring to interest rate rises and stimulus withdrawal.

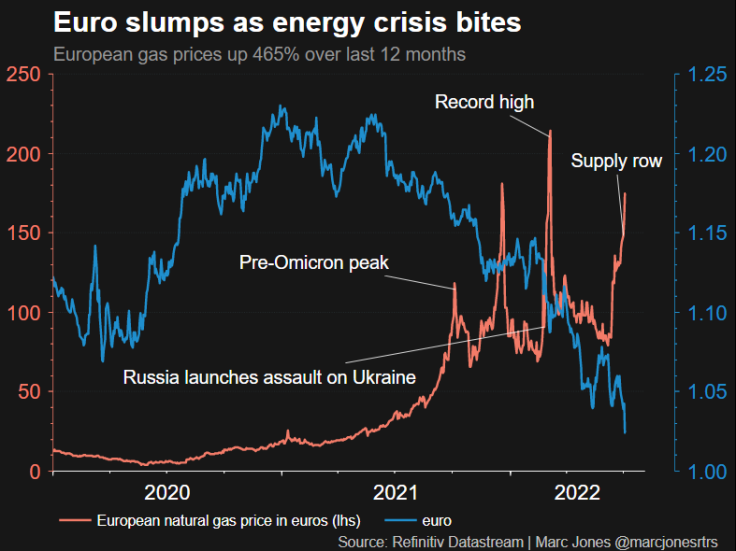

Graphic: Euro hurtles toward parity as gas prices surge,

GAS GAS GAS

Brent crude futures headed into U.S. trading at $103.87 a barrel having risen as far as $105.85 earlier as supply concerns balanced the recession angst.

Uncertainty over Europe's gas supply has led the latest round of growth worries, sending prices rocketing. Benchmark Dutch gas prices have doubled since the middle of June.

Yet they dropped 7% on Tuesday after the Norwegian government intervened to end an industrial strike that had looked set to worsen Europe's energy crisis, where warnings of rationing have now emerged.

Some investors worry that flow along the Nord Stream pipeline, which brings gas from Russia to Germany, might not resume after a ten-day maintenance shutdown from July 11 and that winter supply shortages will then prompt rationing and a sharp drop in economic activity.

The backdrop is rising interest rates.

The Federal Reserve's minutes later should provide insight on its June meeting, where it announced the sharpest hike in the U.S. benchmark interest rate in nearly 30 years. It is likely to foreshadow more hikes as Fed officials have said their top priority is fighting inflation, even at the cost of growth.

A key part of the U.S. Treasury yield curve - the two-year and 10-year range - stayed inverted for a second straight day on Wednesday, in a sign of growing angst in the world's biggest bond market over recession risks. [US/]

An inversion of this part of the Treasury curve is viewed as a reliable indicator that a recession is looming, usually 18-24 months down the line.

The two-year, five-year section, which on Tuesday inverted for the first time since Feb. 2020, also stayed inverted

"The probability of a soft landing had massively declined," August Hatecke, the co-head of UBS Wealth Management Asia Pacific told investors at a conference in Singapore.

Graphic: Recession fears start hitting global markets

(Addtional reporting Sam Byford in Tokyo and Tom Westbrook in Singapore; Editing by Chizu Nomiyama)

© Copyright Thomson Reuters {{Year}}. All rights reserved.