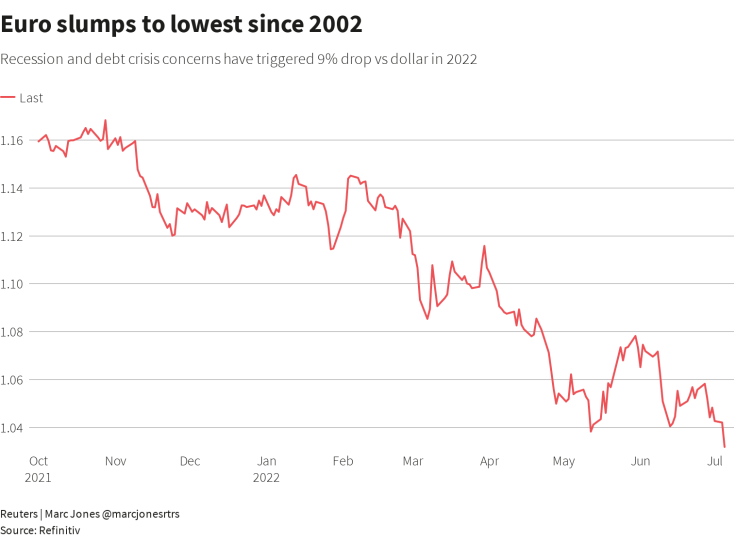

Euro Slides To Two-decade Low, Equities Sink As Recession Fears Intensify

Wall Street's major stock indexes followed European stocks lower on Monday, and the euro sank to its weakest level against the dollar since late 2002, as investors sought safety after the latest data piled on to fears about a global economic slowdown.

Recession fears were exacerbated by increasing natural gas prices, along with Tuesday's data showing a sharp slowdown in business growth in June and Monday's release showing a seasonally adjusted May trade deficit of 1 billion euros ($1.04 billion) in Germany versus expectations of a surplus.

Oil prices plunged as concerns about a possible global recession curtailing demand outweighed supply disruption fears related to an expected production cut in Norway. [O/R]

U.S. equity and bond markets were playing catch-up after closing for Monday's holiday, with stocks opening lower and bond prices rising as investors fled from riskier assets.

"The demand for the safety of dollar-based assets is up as expectations for economic activity are significantly lower," said Shawn Cruz, head trading strategist at TD Ameritrade in Chicago, noting that Germany's news was causing a "major reassessment" among investors.

"If people are concerned there's going to be a slowdown and put their money in the safest place and cut back on unnecessary spending, it can become a self fulfilling prophesy."

The euro dropped by as much as 1.77% against the dollar to $1.0237, its weakest since December 2002. It was last down 1.66% against the dollar.

Meanwhile the dollar index, which pits the greenback against a group of major currencies, was up 1.532% after hitting its highest level since December 2002. The dollar is seen as a safe haven during times of acute economic uncertainty.

The Japanese yen weakened 0.15% versus the greenback at 135.89 per dollar, while sterling was last trading at $1.1904, down 1.66% on the day.

GRAPHIC:

The Dow Jones Industrial Average fell 655.4 points, or 2.11%, to 30,441.86, the S&P 500 lost 72.4 points, or 1.89%, to 3,752.93 and the Nasdaq Composite dropped 107.54 points, or 0.97%, to 11,020.30.

The pan-European STOXX 600 index lost 1.94% and MSCI's gauge of stocks across the globe shed 1.83% but was still managing to stay above its June 17 trough, which had been its lowest level since November 2020.

Benchmark U.S. Treasury yields tumbled and a key part of the yield curve inverted for the first time in three weeks as concerns about economic growth dented risk appetite and increased demand for the safe haven U.S. debt.

Benchmark 10-year notes last rose 24/32 in price to yield 2.8181%, from 2.904% late on Friday while the 2-year note last rose 2/32 in price to yield 2.8062%, from 2.845%.

Investors are watching out this week for the U.S. Federal Reserve and European Central Bank minutes from their most recent policy meetings and U.S. payroll numbers for June due on Friday.

News that Norwegian offshore workers began a strike on Tuesday that will reduce oil and gas output has added to fears about a European energy shortage.

U.S. crude recently fell 7.13% to $100.70 per barrel and Brent was at $104.64, down 7.81% on the day.

Spot gold dropped 2.3% to $1,767.19 an ounce. U.S. gold futures fell 0.95% to $1,781.90 an ounce.

Bitcoin was down 3.9% at $19,420.84.

© Copyright Thomson Reuters {{Year}}. All rights reserved.