Global Car Companies Hunt Big Game In Africa's Growing Automotive Market

With the European automotive market suffering from over-capacity and depressed consumer demand, North America stymied by cutthroat competition, and China's economic juggernaut beginning to wane, what are the world's car companies to do? Go on Safari, that's what. Established global automakers joined by upstart Chinese and Indian competitors are looking to Africa as the next big thing, a continent with massive growth potential hindered only by, well, troubling realities, including crippling poverty, civil wars and political unrest.

But if one puts those realities aside for a moment, it’s hard for any global business to completely ignore Africa now. The economy in sub-Saharan Africa is booming, with annual GDP up an average of 5.2 percent throughout the first decade of the 21st century, compared to negative growth in the 1990s, according to The World Bank. That’s better than the GDP numbers in Russia and Brazil (along with India and China, two of the so-called BRICs countries that are touted as the gold standard for developing countries).

Some of this growth has come about as Africa’s commodities sales have soared. Exports of gold, diamonds, oil, gas, coffee, sesame seeds and beans are on the rise, as are prices for most of these products. The value of the four-year-old Ethiopian Commodity Exchange, which trades agricultural products and is the most advanced commodities exchange in Africa, reached approximately $1.2 billion for the year in July, an increase of 21 percent over the same period the year before. And in 2011, the 18 African nations in the region combined had proven oil reserves of 77.2 billion barrels of oil, with the vast majority of it in Nigeria, Algeria, Angola, Sudan and Egypt, according to the CIA World Fact Book.

Consequently, for some African countries, GDP per capita is finally climbing toward respectable levels, at least in terms of developing countries. South Africa’s per capita GDP is over $8,000 (on par with China's); so is Botswana’s. And Gabon’s is over $11,000. And, not surprisingly, foreign direct investment has risen along with these economic numbers -- reaching $33 billion between 2001 and 2010 -- compared to just $7 billion in the 1990s.

In part because they have been so disconnected from the rest of the global economy and also due to political and financial reforms earlier in the decade, African nations like Ethiopia weathered the 2008-2009 economic crisis better than most developed nations, leaving them in a relatively strong macroeconomic position even as more successful countries stumble through a slow recovery, according to The World Bank.

Until the twenty-first century, used cars that were continually repaired and resold dominated the African automotive market. But as transportation infrastructure and per capita income improve, new car sales in sub-Saharan Africa is gaining traction. In Botswana, for instance, sales of new cars rose more than 20 percent in 2007, 2008 and 2010, according to Business Monitor International -- and 10.6 percent growth is estimated for 2011. And in South Africa, vehicle sales were up 16 percent in 2011, to about 570,000 units.

French automaker Renault SA (Paris: RNO) forecasts that African annual auto sales will approach South American rates of about 6 million vehicles -- up from 1 million currently -- in the not too distant future, with Kenya and Nigeria as well as South Africa expected to drive a lot of the growth.

“Africa is stabilizing,” Jean-Christophe Kugler, Renault’s senior vice president for the region, told Automotive News. “It’s better [for companies] to take positions right now to have new growth drivers when other markets start to mature.”

Renault has been one of the most aggressive automakers in the African market, boosting its sales in the Euro-Med-Africa region by 8 percent in the first half of 2012 and locking down a 15.7 percent market share in the region. But China’s Geely Automobile Holdings Ltd. (Hong Kong: 0175), India’s Tata Motors Limited (NYSE: TTM) and American automaker Ford Motor Company (NYSE: F), among others, are also making inroads on the continent.

Perhaps the biggest factor drawing automakers to Africa is the less than encouraging signs from China, which was counted on as a huge sales opportunity, but which has proved to be a lackluster market so far, which surprised many since the country has so few automobiles. In July, China’s annualized vehicle sales rate fell to 19 million units from 19.4 million units two months earlier. Experts feel that without government subsidies or an incentive program, Chinese consumers, notoriously penurious and concerned about saving money to buy homes or put towards their retirement, are not likely to go on an auto buying spree any time soon.

It's generally assumed that there are two divergent paths companies can take to enter the African automotive market: building localized production capacity or importing cars from other low-cost manufacturing markets. Renault is ambitiously taking the former approach. Much of the company’s impressive growth in Africa has come from factories it already operates in Morocco. And recently, the Renault-Nissan Alliance announced plans to spend €1 billion ($1.26 billion) to build the largest factory in Africa there, capable of producing 400,000 vehicles per year by 2015.

In addition, Nissan said last week that it would spend more than $122 million on expanded South African production and a company executive told reporters that the Japanese automaker may begin to sell its low-cost brand, Datsun, in Africa as well. The South African expansion would double Nissan's annual production there from its current level of around 50,000 units; all told, Nissan makes about 90,000 vehicles per year in Africa.

"It makes sense (for Renault) to focus on Africa and indeed to add manufacturing in Africa," said Columbia Business School Charles E. Exley Professor of Management Awi Federgruen.

For one thing, Renault has said that it does not plan to return to the overly competitive U.S. market, and given the sickly nature of the European automotive market, the company has declared its intention to focus on emerging markets. Moreover, adds Federgruen, by dint of the long tradition of French mercantilism in Africa, Renault has existing business connections with families on the continent. If Renault is able to establish its brand presence now in Africa, "it may give them a lasting advantage over other manufacturers," Federgruen noted.

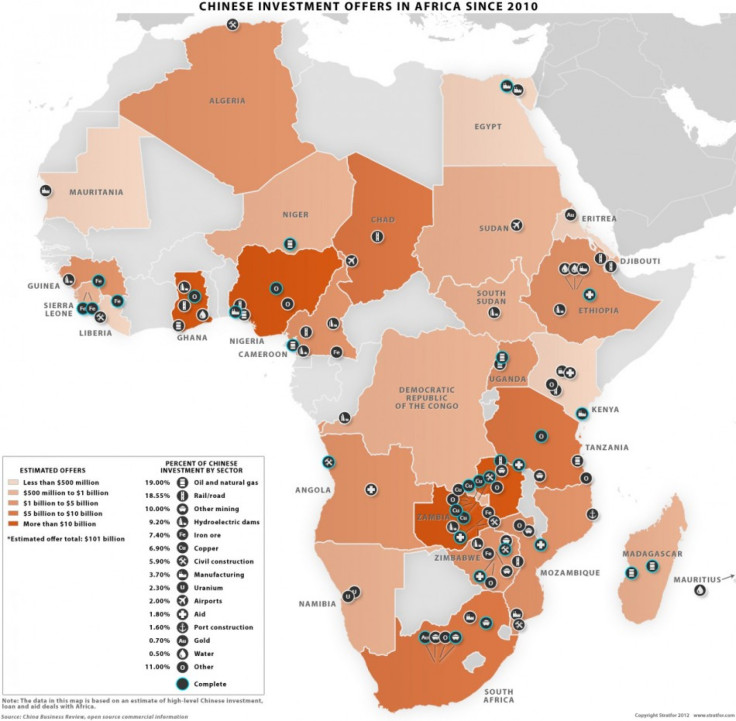

Most of the other automakers are taking the import route into Africa. For example, Chinese companies like Geely, SAIC Motor Corporation Limited (Shanghai: 600104) and Great Wall Motor Co. (Hong Kong: 2333) are increasingly sending vehicles made in the home country to Africa, rather than to other Asian nations. In 2009, "Chinese auto exports to Africa reached a total of 102,000 vehicles and $1.74 billion in sales, surpassing those with Asia and making Africa the largest destination continent for Chinese auto exports," said the Forum On China-Africa Cooperation, the Chinese government’s business liaison between Africa and China.

But with Chinese worker wages on the rise – up anywhere from 10 to 20 percent in the past year, depending on the region – the once low-cost manufacturing country is quickly becoming less competitive against other cheap labor markets, like Africa itself. However, productivity is extremely high in China, offsetting some of the salary increases and enabling Chinese companies to potentially flood Africa with sufficiently inexpensive imports. Consequently, observers like Guggenheim Partners analyst Matthew Stover believe that the early days of the African automotive boom may be a race between Renault’s factories and its attempts to build brand awareness on the continent and China's export powerhouse.

Indian automakers like Tata, Mahindra & Mahindra Limited (Bombay: 500520) and Maruti Suzuki India Ltd. (Bombay: 532500) are essentially following the Chinese approach. Tata has made limited investments in Africa -- about $700 million since 1994, including a $13.2 million factory expansion in South Africa in July -- but the other companies have mostly shipped cars in. So far to good effect: Mahindra & Mahindra, well known for its pickups and off road vehicles, has enjoyed increased sales in South Africa of 124 percent in the first five months of 2012.

Meanwhile, Ford sees Africa as a critical region for overflow vehicles made in India, particularly as the Indian domestic market for cars has slowed to only a 2.8% gain in May from 7% the same month a year earlier. A slowing economy, higher fuel prices and currency weaknesses are blamed for these disappointing numbers.

Ford completed a $72 million expansion of an Indian engine plant in Chennai last month to boost the factory’s capacity by 36 percent. Of the 340,000 engines produced at the plant annually, 40 percent of them are destined for export outside of India, primarily to Thailand, Taiwan and South Africa. Moreover, Ford is building seven new factories in India to feed exports to its Asia-Pacific and Africa regions.

The automaker is especially hopeful about big sales in these regions for the inexpensive small SUV Ecosport, which will be made in India and has already enjoyed substantial popularity in South America, said Ford India president and managing director Michael Boneham. Overall, Ford sales in South Africa have increased dramatically in recent months, surging 10.5 percent in the first half of 2012 and surpassing 300,000 units.

To be successful in Africa, though, companies must be prepared for any number of challenges, including whether economic growth will continue at a steady pace and, perhaps most worrisome, the potential for political and social unrest that could disrupt imports, factory output and consumer confidence, even in the few democratic countries in the region. Indeed, South Africa, the hub of the growing African automotive industry and the continent's largest economy, has been rocked in the past few weeks by violent protests at a platinum mine where 44 activists were killed. This incident "highlight(s) structural problems" that may weigh on the entire South African economy, Fitch Ratings wrote in a report. "High unemployment is already associated with widespread crime, which is regularly cited as one factors deterring foreign investment in (South Africa). Over time it could also threaten social and political stability, damaging the investment climate further."

The laundry list of Africa’s problems is, of course, overwhelming. Historically, the continent has suffered from "secessionist struggles by minority groups, long-running guerilla insurgencies, coups, urban unrest in sprawling slums, clashes between paramilitary thus with ties to political parties," and a host of other discomforting problems, is how a report published in 2009 by Stanford University's Freeman Spogli Institute for International Studies put it.

Moreover, it can be particularly difficult to generalize conditions in each of the 57 nations in Africa by looking at the continent from 30,000 feet, as each has its own unique political and social issues, obstacles and divisions, a factor further complicating investment decisions for automakers.

However, because of promising recent developments on the continent, many people believe that Africa is in the position to finally take two steps forward for every step backwards it must endure. "There is an expectation that over a long arch of time, political stability will emerge," Stover said.

Indeed, the political improvements and global economic integration that emerged from the fall of apartheid in South Africa two decades ago was largely responsible for the establishment of the South African automotive industry, according to a May 2012 study produced by the Harvard University’s Kennedy School of Government.

In recent years, South Africa has produced over 500,000 motor vehicles, on par with Belgium and well above places like Romania, Hungary and Australia.

But for every South Africa there is a country like the Democratic Republic of the Congo, where GDP per capita is only $400. In fact, after South Africa, the largest African countries in terms of auto production are Egypt (82,000 vehicles per year), Morocco (60,000) and Kenya (3,000). And according to the World Bank 47.5 percent of Africans still live on $1.25 or less a day (significantly less than the income required to buy a new car, even an ultra-cheap offering like the $1,800 Tata Nano); the good news is, though, that that percentage has fallen from 58 percent in 1999.

Which means that for automakers Africa remains a decided risk, but still an extraordinary opportunity. With 1 trillion people on the continent and the lowest per capita number of automobiles of any continent on the planet, global manufacturers can’t help but be intrigued by the possibilities.

"It's going to be a while [before investments in Africa pay off]," Stover said. "When the market expands, you're there to capture the gains. But I don't think anyone looks at their investments and says 'this is the key to our (company’s) five year plan.'"

© Copyright IBTimes 2025. All rights reserved.