Groupon Expects $478M in IPO, Crushes LinkedIn IPO

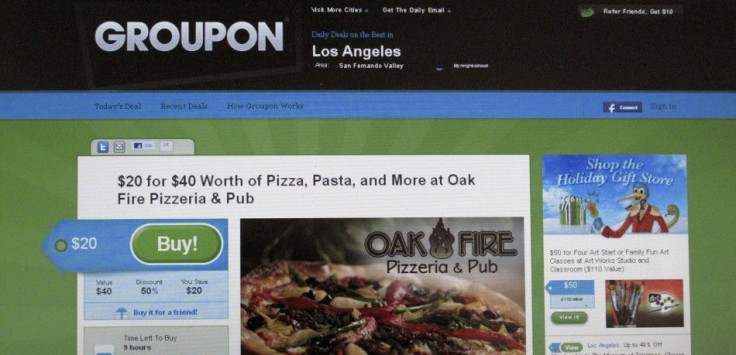

Groupon is going public. Well, it's not official just yet, but the company has applied to list their Class A common stock on the NASDAQ Global Select Market under the symbol GRPN according to a regulatory filing made today.

Groupon will be offering 30 million shares—five percent of the company—between the prices of $16 and $18 per share. The company expects the net proceeds from the offering to be approximately $478.8 million, which assumes all shares are sold at $17 per share. This is about 35 percent less than the company initially hoped to raise. Still, the numbers are big.

The offering is set to crush numbers put up by the last monumental tech IPO—Linkedin—which had the fifth largest day gain in the post-Google-IPO era, ending their day at $45 per share, a 109 percent increase on the day, leaving the company with a $4.6 billion valuation. Linkedin raised $352 million on its May 9 initial public offering on the New York Stock Exchange.

Groupon's initial public offering would place the company at a $10.8 billion valuation, which, though nearly half of what they originally wanted, is still much higher than Linkedin's current $8 billion valuation. It's also much more than the $6 billion dollars that Google offered them in December 2010.

Groupon plans to use the net proceeds from the offering for working capital and other general corporate purposes, which may include the acquisition of other businesses, products or technologies. They company states that it does not have any commitments for any acquisitions at this time.

Unlike LinkedIn, which faces very few imminent threats in the recruiting market, Groupon has been targeted by some of the largest companies in Silicon Valley. Amazon, Microsoft, Google and Facebook have all launched programs directly targeting Groupon's audience--and they're not the only companies to do so. Companies such as Guilt Groupe, which is considering going public in 2012 according to The New York Times, have made a splash by offering deals from local businesses to consumers.

Groupon's public offering will serve as a litmus test to several other tech companies that are expected to go public soon -- namely, Facebook, Zynga and Gilt Groupe.

Groupon was launched in October 2008 and has seen tremendous growth since that period. The company's revenue increased from $1.2 million in the second quarter of 2009 to $430.2 million in the third quarter of 2011. That's a 35,750-percent increase in just over two years. The company reports 142.0 million subscribers as of Sept. 30.

© Copyright IBTimes 2025. All rights reserved.