How Do You File For A Tax Extension 2016? Get Six More Months To Do Your Federal And State Taxes

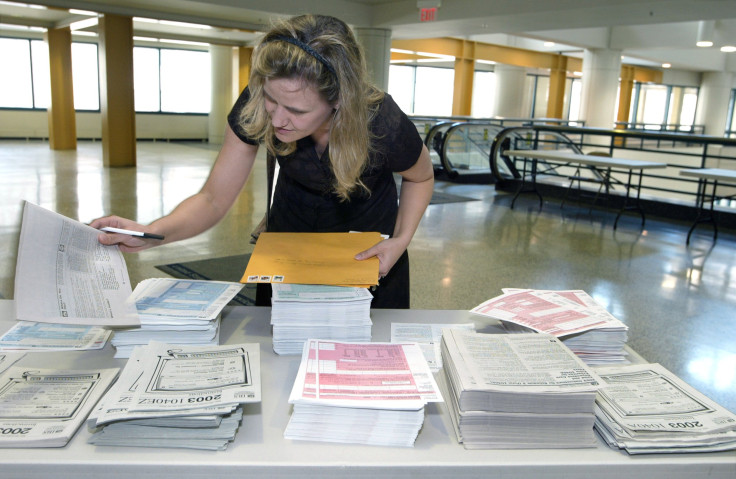

Even though you have a few extra days this year to file your taxes — they are due next Monday, April 18, not Friday, April 15 — some of you might be scrambling to collect all the necessary paperwork. If you need to file for an extension, here’s everything you need to know.

Federal tax extensions must be filed by April 18; the only exception is for residents of Maine and Massachusetts, who have until April 19 since the 18th is Patriots Day. The extension will give you an extra six months to fill out all the necessary tax paperwork.

Extensions can be filed online using the free file service through the Internal Revenue Service’s website. You can also request an extension by using the Form 4868 and mailing it to the IRS by April 18. If you live overseas or serve in the military, special rules apply.

Remember that filing for a tax extension does not mean you avoid making payments to the government. It is an extension on filing your return, not an extension on making payments. Tax extensions allow you to get your records and paperwork in order, but you still have to estimate how much you owe the government and make the payment by April 18 in order to avoid paying interest or penalties. You can make your payments online through the IRS Direct Pay system or over the phone. Another option is pay your taxes in installments if you cannot pay them in full.

For your state taxes, you will also need to file a separate extension. Here’s a rundown of information by state about how to request an extension. The majority of states require you to file by April 18, but some states have different deadlines, so be sure to double-check.

If you're wondering about whether or not you will receive a refund, click here for a guide on how to check your refund status. Happy tax season!

© Copyright IBTimes 2025. All rights reserved.