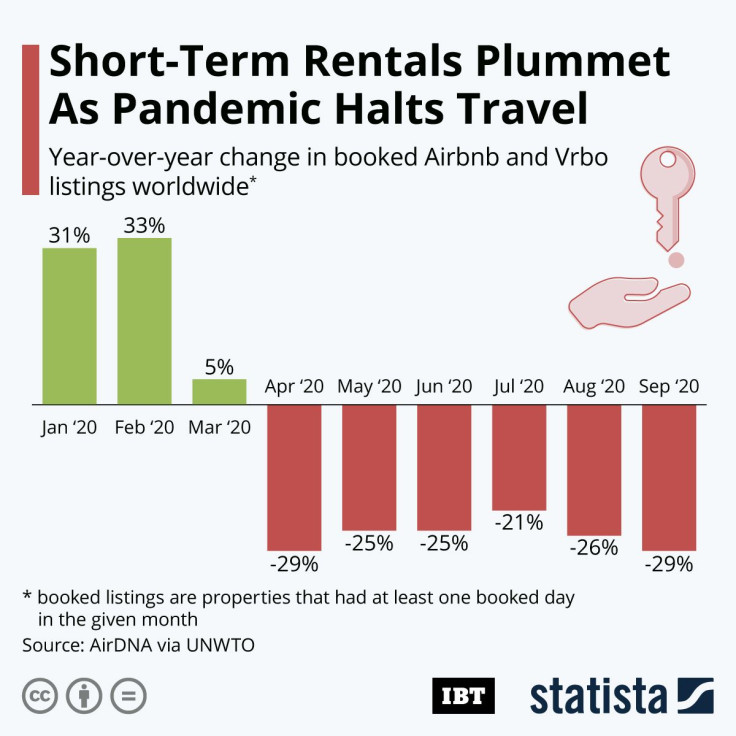

Infographic: Short-Term Rentals Plummet As Pandemic Halts Travel

Airbnb has once again delayed its long-awaited IPO filing for it not to be overshadowed by the uncertainty surrounding the U.S. election. The market-leading short-term rental company was originally planning to go public this spring, only to see its plans obliterated by the COVID-19 pandemic. The San Francisco-based unicorn could file its paperwork with the U.S. Securities and Exchange Commission as early as next Monday, even though the timing could change again if the news environment remains unfavorable.

Airbnb is reportedly aiming to raise $3 billion in its stock market debut, which would value the company at around $30 billion. According to CB Insights, Airbnb is currently valued at $18 billion, making it one of the most valuable unicorns in the world. Having been rumored to go public for years, the timing for its IPO couldn’t come at a much worse time. With international travel brought to a standstill by the coronavirus pandemic, Airbnb saw bookings plummet in the spring, forcing the company to cut a quarter of its staff.

As the following chart shows, the short-term rental market has yet to recover from the pandemic’s fallout, with booked listings on Airbnb and Vrbo still 29 percent below last year’s level in September, according to industry analytics firm AirDNA. Short-term rentals weren’t hit as hard by the crisis as hotels were, however, presumably because they are less dependent on business travelers. Interestingly some listings even performed better than usual during the crisis, as travelers sought out rural, drive-to destinations in the absence of many other travel options.