Infographic: US Imports From Vietnam Surge As US-China Trade War Drags On

As the trade war between the United States and China drags on, U.S. companies are weighing other options to avoid the tariffs currently levied on goods sourced from China. Last week, the Nikkei Asian Review cited anonymous sources saying that Apple is considering moving up to 30 percent of iPhone production out of China, with India and Vietnam the top candidates to help Apple diversify its supply chain.

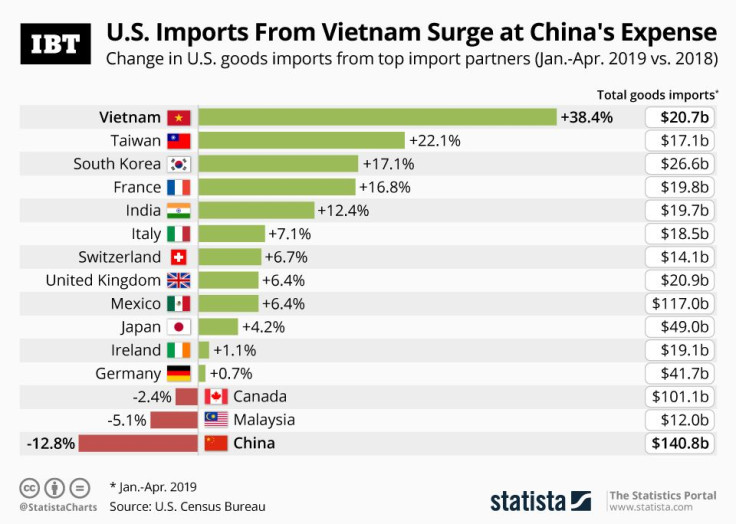

Apple isn’t alone in its efforts to reduce its dependency on Chinese imports, as U.S. import data for the first four months of 2019 shows. Imports from Vietnam, Taiwan and South Korea surged 38.4, 22.1 and 17.1 percent, respectively, compared to the same period of last year, while imports from China dropped by 12.8 percent year-over-year. Vietnam in particular has been profiting from the trade dispute as it supplies many of the goods that are typically imported from China and are now hit by tariffs.

According to data from the United States International Trade Commission, cited by the Financial Times, U.S. imports of mobile phones from Vietnam more than doubled in the first four months of 2019 compared to the same period of last year, while computer imports rose by 79 percent. Footwear, textiles and furniture from Vietnam also saw a boost in demand from the U.S., as did fish, which was typically processed in China for consumption in the United States before the tariffs were introduced.

The steep increase in U.S. imports from Vietnam has seen the Southeast Asian economy leapfrog several countries to become the eighth largest import partner for the United States in the first four months of 2019. Last year, Vietnam was only ranked 12th in that respect, trailing Ireland, Italy, India and France, all of which it has (so far) surpassed this year. The following chart ranks the United States’ top-15 import partners based on the change in U.S. goods imports from the respective country from January through April 2019 vs. the same period of 2018.