Investors Dip Into Riskier Tech, Crude At $120

Wall Street was set to open higher on Monday, tracking gains in Asia and Europe as investors took expected interest rate hikes in coming days their stride for now despite crude oil hitting $120 a barrel.

S&P 500 futures added 1% and Nasdaq futures 1.4%.

U.S. listed shares in Chinese ride-hailing firm Didi Global surged 50% premarket after the Wall Street Journal reported that Chinese regulators were preparing to allow the mobile app back in domestic app stores.

The news helped Hong Kong's Hang Seng tech index close 4.6% higher. Stocks in Europe were firmer from the open, with the STOXX index of 600 companies up 0.9%.

The shift back into riskier assets came ahead of central bank meetings that investors hope will give clarity on whether inflation has peaked and how much growth could slow down.

The European Central Bank meets on Thursday, though it is not expected to begin raising interest rates until July, with rate setters at the U.S. Federal Reserve and Bank of England gathering next week.

"There is still some doubt as to whether or not inflation has peaked," said Michael Hewson, chief markets analyst at CMC Markets.

"We are in a bit in a no-man's land at the moment with respect to peak inflation, and also China reopening and the possible tailwinds that might bring. Oil prices are still a headwind and so it's difficult to gain any direction," Hewson said.

The MSCI all country stock index gained 0.3%, its recent rebound from near bear-market territory still largely intact.

Blue chips in London were up 1.2%, along with sterling, shrugging off news that British Prime Minister Boris Johnson is to face a confidence vote by lawmakers from his governing Conservative Party on Monday.

Oil prices firmed after Saudi Arabia raised prices sharply for its crude sales in July, an indicator of how tight supply is even after OPEC+ agreed to accelerate output increases over the next two months. [O/R]

Brent was up 0.2% at $120.02 a barrel. U.S. crude rose 0.2% to $119.14 per barrel.

Gregory Perdon, co-chief investment officer at Arbuthnot Latham, said investors have to weigh up bearish factors such as inflation, rising rates, war in Ukraine and a higher dollar against still accommodative monetary policy, good though slowing economic growth and Chinese stimulus.

"On balance, I do think that risk-taking in this environment is going to be more rewarding than betting against risk assets," Perdon said.

"We had seven out of eight weeks of negativity on the S&P 500 and it's probably a decent entry point in terms of adding risk to porfolios, assuming you don't have too much risk on to begin with."

Sentiment was aided by comments from U.S. Commerce Secretary Gina Raimondo that President Joe Biden has asked his team to look at the option of lifting some tariffs on Chinese imports.

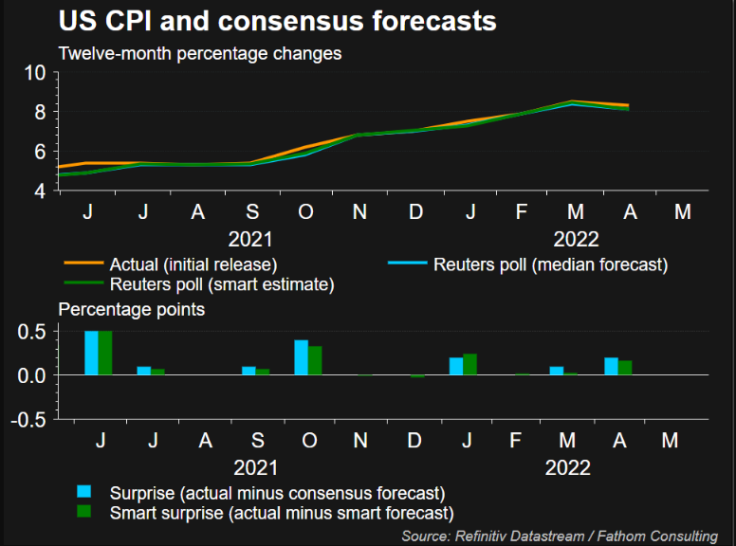

GRAPHIC: US CPI (

)

ECB, CPI LOOM

At the ECB meeting on Thursday, President Christine Lagarde is considered certain to confirm an end to bond-buying this month and a first rate increase in July, though the jury is out on whether that will be 25 or 50 bps, as some investment banks ramped up their expectations.

Money markets are priced for 130 bps of rate increases by year-end, with a 50 bps move at a single meeting fully priced in by October.

The prospect of ECB rates turning positive this year helped the euro nudge up to $1.0724, some way from its recent trough of $1.0348, though it has struggled to clear resistance around $1.0786.

The euro also made a seven-year peak on the yen at 140.39, after climbing 2.9% last week, while the dollar held at 130.67 yen having also gained 2.9% last week.

Against a basket of currencies, the dollar stood at 102, little changed on the day, after firming 0.4% last week.

After the ECB on Thursday, markets will scrutinise the U.S. consumer price report on the following day, especially after EU inflation shocked many with a record high last week.

Forecasts are for a steep rise of 0.7% in May, though the annual pace is seen holding at 8.3% while core inflation is seen slowing a little to 5.9%.

A high number would only add to expectations of aggressive tightening by the Fed next week, with markets already priced for half-point increases in June and July and almost 200 basis points (bps) by the end of the year.

In commodity markets, wheat futures jumped 4% after Russia struck Ukraine's capital, Kyiv, with missiles, dampening hopes for progress in peace talks.

Gold was at $1,854 an ounce, up 0.2%, having held to a tight range for the past couple of weeks. [GOL/]

(Editing by Alex Richardson and John Stonestreet)

© Copyright Thomson Reuters {{Year}}. All rights reserved.