Italy Leads Bond Selloff As ECB Hikes Rates And Assesses New Tool

Italy led a selloff in southern European bonds on Thursday, after the European Central Bank delivered its first interest rate hike since 2011 but left some disappointed with an announcement on a new tool to contain debt market stress.

Italian bond yields, which had already faced upward pressure following the collapse of Mario Draghi's government and the spectre of early elections, rose further - briefly pushing out the gap over top-rated German bonds to almost 250 basis points.

The ECB raised its deposit rate to 0%, breaking its own guidance for a 25 bps move as it joined global peers in jacking up borrowing costs and ending an eight-year experiment with negative interest rates.

It also unveiled a new tool, the Transmission Protection Instrument (TPI), saying it would buy bonds from countries that have seen their borrowing costs shoot up through no fault of their own, provided they stick to sound economic policy.

Analysts said it was hard to pin down what investors were focusing on, but cited a lack of detail and conditionality as possible reasons behind the selloff in Italian bonds.

"We didn't get a lot of transparency and that's not helpful," said Marchel Alexandrovich, European economist at Saltmarsh Economics in London.

Italy's 10-year bond yields rose to a one-month peak at 3.75% before pulling back to around 3.60% in late trade - still up around 12 bps on the day.

The closely watched spread over German bond yields was at around 230 bps, after nearing the 252 bps area it hit just before the ECB's emergency meeting in June.

Greek 10-year bond yields were also up around 10 bps at around 3.59%.

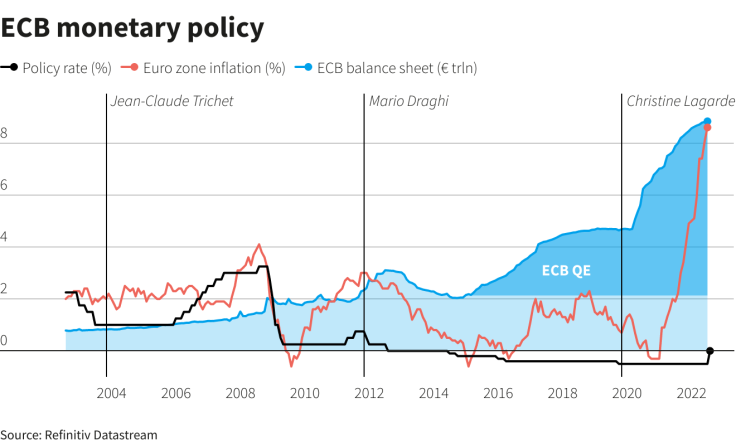

Graphic: ECB monetary policy-

The euro initially benefited from the ECB's larger-than-expected rate hike but pulled back and was last up just 0.1% at $1.0190.

The euro area's higher-rated bond markets such as Germany and the Netherlands recovered, having initially sold off after the rate hike.

Germany's 10-year Bund yield was last down 5 bps on the day at 1.22%, having been up as much as 10 bps earlier on.

The move lower in bond yields in late trade came as U.S. Treasury yields fell sharply.

Two-year German yields, more sensitive to short-term interest rate moves, remained higher but pulled back from a three-week high touched earlier..

"The market was not by any means fully priced for this development and you can see that reflected in the very sharp rise in short-dated German yields on the back of today's move," said Richard McGuire, head of rates strategy at Rabobank.

The ECB had previously flagged a 25 bps move at its July meeting, but sources told Reuters earlier this week that its Governing Council was considering the bigger 50 bps hike.

The pan-European STOXX 600 index struggled for direction, briefly falling after the ECB decision before flattening. Euro zone banks briefly jumped over 1% with the ECB's end of negative-rates seen lifting bank profits.

Money markets moved to fully price in another 50 bps rate hike in September.

© Copyright Thomson Reuters {{Year}}. All rights reserved.