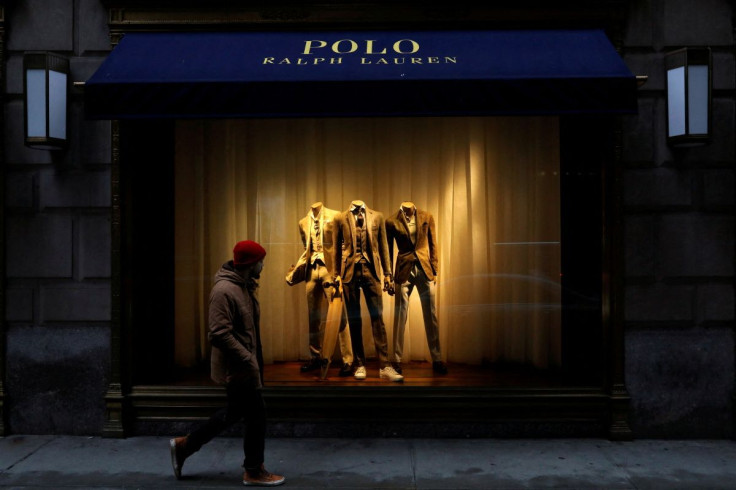

Luxury Retailers Lean On Affluent Customers To Dodge Inflation Bullet

Upbeat profit forecasts from Nordstrom and Ralph Lauren underscore the edge high-end chains have over the wider U.S. retail industry in an inflationary environment, thanks to the deep pockets of their customer base.

The retail landscape is feeling the strain of decades-high inflation as a sharp increase in prices of everything from TVs to toothpaste prompts most consumers to curb their spending habit.

In the past few weeks, major retail chains including Walmart and Target have reported steep declines in their quarterly profit due to surging costs of freight and labor as well as consumers trading down to essentials. [nL2N2XF1ZM

Their luxury counterparts, however, have dodged the inflation bullet.

"To date, we haven't seen an adverse impact on customer spending from inflationary pressures, which we suspect is due to the higher income profile of our customer base," Nordstrom Chief Financial Officer Anne Bramman said on Tuesday after the company raised its annual profit and revenue forecasts.

Ralph Lauren, which also forecast full-year sales margins above expectations, called their consumers "resilient," while premium parka maker Canada Goose said "consumer confidence remains strong".

"This earnings cycle has been showing a dichotomy between higher- and lower-income demographics," BMO Capital Markets analyst Simeon Siegel said.

"Whether that holds in the future remains to be seen but at least for now, companies like Nordstrom are suggesting that they have been more insulated given higher end customers."

But for those retailers that cater to a less-affluent demographic, the impact of four-decade-high inflation was more pronounced in the quarter ended April.

Companies, ranging from Target to Gillette-maker P&G, that were previously successful in passing on higher freight and labor costs to consumers have now started to warn of a push back.

The latest consumer price index jumped 8.3% on an annual basis, while prices for gasoline stand more than 50% higher than a year ago, according to automobile club AAA.

The change in consumer behavior is forcing retailers to offer more promotions and discounts, while luxury firms continue to sell their products at full price.

Executives at Coach owner Tapestry and Ralph Lauren have said they have enough room to raise prices without seeing a big push back from their more affluent customer base.

European luxury brands including Chanel and Burberry have reported seeing little impact on demand from rising prices.

"We continue to see pricing power across the portfolio ... Importantly, we have seen no negative impact on customer demand from these price increases," Tapestry CEO Joanne Crevoiserat said on a post-earnings call earlier this month.

© Copyright Thomson Reuters {{Year}}. All rights reserved.