Americans shrugged off high gasoline prices in March and spent more strongly than expected, suggesting economic growth in the first quarter was probably not as weak as many had feared.

Japan said on Tuesday it will provide $60 billion in loans to the International Monetary Fund, becoming the first non-European nation to commit money to boost the fund's financial firepower to contain the euro zone debt crisis.

A unit of Toshiba Corp is in talks to buy IBM Corp's point-of-sale terminal business, which includes cash registers, a source familiar with the deal said on Tuesday.

Two top Federal Reserve officials pointed on Monday to last month's surprisingly weak jobs report as all the more reason to take a wait-and-see approach to a U.S. economy that, in general, is improving.

The World Bank on Monday chose Korean-born American health expert Jim Yong Kim as its new president, maintaining Washington's grip on the job and leaving developing countries frustrated with the selection process.

The U.S. Securities and Exchange Commission is taking extra steps to bulletproof its rulemaking, after U.S. appeals court judges, Republican lawmakers and government watchdogs have criticized how the agency measures the economic impact of its rules.

Citigroup Inc posted stronger-than-expected first-quarter results as bond trading and underwriting revenue jumped compared with the 2011 fourth quarter.

Three of the biggest U.S. tobacco companies said on Monday they have paid a total of $6.5 billion this year to U.S. states, unchanged from 2011, under a 1998 national accord that obliges companies to help cover the health bills of ailing smokers.

Yet another grim development in China's ongoing battle with poor industrial and manufacturing practices -- what do you do if the pills you take make you even sicker than before?

Canada's Endeavour Silver Corp (EDR.TO) is buying two of AuRico Gold's (AUQ.TO) silver and gold mining interests in Mexico for up to $250 million in cash and stock to expand its footprint in the country.

Gold prices fell in quiet trade on Monday, following crude oil's losses, as worries about Spain's ability to repay its debt and a resurgent euro zone debt crisis extended bullion's loss to a second day.

Mexican cement maker Cemex is likely to try and renegotiate a hefty portion of its debt in coming months to avoid a potential clash with creditors in 2014.

Billionaire George Soros warned on Monday that the euro crisis is growing deeper, tearing at the fabric of European Union cohesion, because policymakers are prescribing the wrong remedies.

The Federal Reserve was neither hawkish nor dovish when it set a formal inflation target, and such a move would make sense even if the U.S. central bank had a single mandate, a top Fed official said on Monday.

Stocks rose on Monday on better-than-expected retail sales, but concerns about Spain's rising bond yields kept gains in check and a slide in Apple pushed the Nasdaq lower.

International Business Machines Corp. (NYSE: IBM), the No. 2 computer maker, has scheduled its first-quarter earnings announcement for after Tuesday’s market close.

Coty Inc on Monday urged Avon Products Inc shareholders to ask their company to give Coty a look at inside information, which would give the private cosmetics company a chance to then offer its best price.

Spain and Italy faced growing market pressure on Monday, stoking fears of a new phase in the euro zone debt crisis as Madrid's budget problems threatened to drag in other southern European economies.

The Dow rose on Monday, buoyed by big consumer staples stocks as Wall Street turned defensive, while the broader market fell as Spain's rising bond yields fed worries about Europe's debt crisis and offset optimism over a jump in retail sales.

Moody's cut its rating on Nokia to one notch above junk on Monday, prompting the Finnish mobile phone company to defend its cash position and cost-cutting plans.

Intel (Nasdaq: INTC), the No. 1 chipmaker, is scheduled to report first-quarter results after markets close Tuesday. As always, Intel’s report will be a bellwether for the semiconductor industry.

Private equity firm Carlyle Group LP said it was looking to raise between $701.5 million and $762.5 million in its initial public offering, valuing the company at as much as $7.61 billion, as it presses on with plans to catch up with rivals Blackstone , KKR and Apollo Global Management .

Jury selection in a high-stakes dispute over smartphone technology between Oracle Corp and Google Inc kicked off on Monday morning, starting a trial that could reveal financial details about the Android operating system.

Jury selection in a high-stakes dispute over smartphone technology between Oracle Corp and Google Inc is set to begin here on Monday morning, kicking off a trial in which both companies' chief executives are set to take the stand.

Citigroup Inc's quarterly profit beat Wall Street estimates as the third-largest bank cut expenses and benefited from an improved economy and more active capital markets after a dismal end to 2011.

Better-than-expected retail sales in March were unable to sustain an early rally on Wall Street as stocks struggled to come off their worst two-week period in more than four months, with a march higher in Spanish bond yields continuing to undermine confidence.

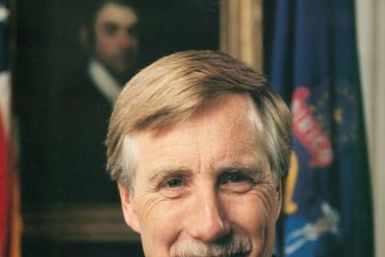

If he holds out long enough, Angus King could become a kingmaker. The insistently independent Senatorial candidate from Maine is adding extra angst to this November's closely contested Congressional elections.

Singapore state investor Temasek bought $2.3 billion worth of ICBC's Hong Kong-listed shares from seller Goldman Sachs , piling into three of China's top four banks and raising its bet on the world's second-biggest economy.

Retail sales showed unexpected vigor in March as Americans shrugged off high gasoline prices and bought a range of goods, suggesting economic growth in the first quarter was probably not as weak as many had feared.

Beauty product company Coty Inc, whose $10 billion bid for larger rival Avon Products Inc was rejected earlier this month, reaffirmed its original cash offer of $23.25 per share on Monday.