Chrysler Group LLC's top executive declined a salary and bonus for a second straight year in 2011, when the Detroit automaker repaid more than $7 billion in government loans from its bankruptcy restructuring nearly three years ago.

Athens' failure to accept Germany's help on reducing bureaucracy and boosting private investment is disappointing, German Economy Minister Philipp Roesler was cited as saying by a newspaper on Thursday.

The Treasury Department said on Wednesday it will sell $6 billion worth of American International Group stock and struck another deal for the insurer to pay down $8.5 billion more in obligations, taking a major step forward in an election year to unwind the unpopular crisis-era bailout.

The Treasury Department said on Wednesday it will sell $6 billion worth of American International Group stock and struck another deal for the insurer to pay down $8.5 billion more in obligations, taking a major step forward in an election year to unwind the unpopular crisis-era bailout.

The Treasury Department plans to sell $6 billion of American International Group stock and struck another deal for the insurer to pay down $8.5 billion more in obligations, taking a major step forward in an election year to unwind the unpopular crisis-era bailout.

Japan's economy shrank less than initially estimated in the fourth quarter as companies ramped up capital expenditure, but the current account swung to a record deficit in January as a shift away from nuclear power pushes up fossil fuel imports.

PayPal, the online payments arm of eBay Inc, has sparked a furor in the publishing world by asking some e-book distributors to ban books that contain obscene themes including rape, bestiality or incest.

Consumer credit expanded sharply in January in a generally positive sign for the economy as people borrowed money to buy cars and go to school, Federal Reserve data showed on Wednesday.

Federal Reserve officials are considering a novel approach to bond buying aimed at countering some of the worry that another round of asset purchases by the central bank could fuel inflation, according to the Wall Street Journal.

Proposed federal congressional redistricting in New York City reinforces a demographic criticism that ties the north Brooklyn neighborhoods of Williamsburg and Greenpoint, as well as Queens' Astoria, with Manhattan's Upper East Side.

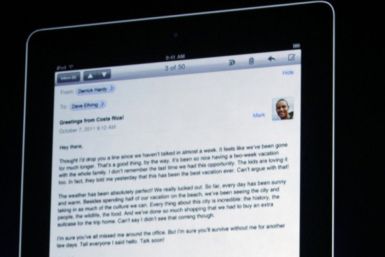

Today Apple released its latest tablet device--the new iPad--but while all of the improved features wooed bloggers, journalists and fans alike, one fact was left lingering in the minds of those that had closely followed the event: The name of the new iPad cuts against the grain of names previously given by Apple to its mobile devices.

The deadly start to the 2012 tornado season is forcing insurers to reconsider the risks of coverage in the most storm-prone parts of the United States and industry insiders say they may have to rethink how they handle the underwriting of the reoccurring natural disasters.

Stocks broke a three-day losing streak on Wednesday, recovering some recent losses after a report showed the U.S. private sector added more jobs than expected last month.

AMR Corp, the bankrupt parent of American Airlines, on Wednesday proposed a plan to freeze pensions covering many of its workers, retreating from an earlier proposal to terminate them and leave them to government insurers, which could result in lower payouts.

With the new iPad hitting stores on March 16, tech geeks are sure to be rushing in their pre-orders. Referred to as the “post PC” device, the upcoming gadget packs full HD quality into a portable 9.7-inch screen.

Purim celebrates the deliverance of the Jews of ancient Persia from destruction.

Before Apple officially introduced the third version of the iPad, investors and customers were advised to pay attention because there were three keys to watch.

The practice of banks forcing expensive homeowners insurance on borrowers could come to an end after Fannie Mae told lenders it would seek to oversee such policies itself.

Britain's banking trade body has no plans to cede oversight of Libor to regulators, saying it remains fully committed to the interbank lending rates being scrutinized by global enforcement agencies for signs of manipulation.

Luxury watchmakers are hoping a stronger-than-expected recovery in the United States and global exposure will help them sail through a more challenging market in China, where the days of unstoppable growth are ticking by.

Some hedge funds are refusing to join Greece's bond swap, threatening legal action if the government does not come up with a better offer and complicating efforts to restructure the country's debt.

Some members of Ukraine's parliament, on a visit to Damascus, expressed solidarity with Assad as well as opposition to foreign intervention in the Middle Eastern country.

A senator attacked on Wednesday an industry-backed fund that covers claims for investors of failed brokerages, saying the fund was failing to help people who had been victimized by convicted financier Allen Stanford's $7 billion Ponzi scheme.

Today's coda for investing in the market calls for rapid-fire trading and an eye for the next hot sector. The investing heroes in this world are hedge funds such as Renaissance Technologies, which made founder James Simons a billionaire with its computer-driven, high turnover trading.

Major holders of Greek bonds have pledged to sign up for the country's bond swap, making it increasingly likely that the deal will go through.

Spain is not ready to give up its seat on the Executive Board of the European Central Bank after its current representative leaves the institution in May, a spokeswoman for the Spanish economy ministry said on Wednesday.

AMR Corp , the bankrupt parent of American Airlines, proposed a plan to freeze the pensions covering many of its workers rather than terminating them and leaving them to government insurers, which in many cases would result in lower payouts.

Forget austerity in the supercar zone at the Geneva Auto Show.

Wynn Resorts Ltd said it would hold a special meeting of shareholders to remove Kazuo Okada from its board, less than two weeks after the Japanese billionaire was ousted as director of the company's Macau unit.

AMR Corp, the bankrupt parent of American Airlines, on Wednesday proposed a plan to freeze pensions covering many of its workers, retreating from an earlier proposal to terminate them and leave them to government insurers, which could result in lower payouts.