Bill Gross, co-chief investment officer at PIMCO, on Thursday took issue with a derivative panel's decision that the restructuring of Greek debt does not trigger a payout on insurance protection, even after his firm backed the move.

U.S. stocks gained on Thursday, boosted by financial shares and further signs the labor market may be on the mend.

Russia, along with China, has stymied efforts by the West and the United Nations to condemn violence perpetrated by the regime of President Bashar al-Assad of Syria, a longtime Moscow ally.

Below are highlights from the question and answer session of a Senate Banking Committee hearing with Federal Reserve Chairman Ben Bernanke testifying on monetary policy and the U.S. economy.

Stocks advanced on Thursday, reversing declines from the previous session after some positive data on the labor market and solid monthly sales from retailers encouraged buying.

Greece has not yet triggered payment on controversial bond insurance contracts but market participants still expect Athens' efforts to reduce its debt burden to prompt an eventual payout on credit default swaps.

The probability of a sharp global slowdown has eased due to recent policy measures adopted in the euro zone to tackle its debt crisis, the International Monetary Fund said on Thursday, but it warned risks to world growth remain squarely to the downside.

Investors are starting to recognize Bank of America Corp's efforts to build capital and streamline operations, but the bank still needs to show it can boost profits, Chief Executive Officer Brian Moynihan said in an interview this week.

Stocks rose on Thursday, extending this year's near-uninterrupted rally as investors jumped on recent momentum, though equities eased from session highs after a weak reading on manufacturing.

Greece's recent moves to prepare for a debt restructuring have not triggered a payout on credit default swaps, the International Swaps and Derivatives Association said on Thursday.

Major automakers including General Motors Co posted a rise in auto sales for the month of February, helped by American drivers' need to replace aging cars and trucks despite the rise in fuel prices.

New U.S. claims for unemployment benefits edged down last week, holding near four-year lows, according to a government report on Thursday that suggested the labor market was gaining momentum.

Some European Central Bank policymakers are alarmed that a dramatic loosening of lending policy stemming from a 1-trillion-euro wave of cash unleashed into the financial system will fuel imbalances in the euro zone and stoke inflationary pressures.

Growth in U.S. manufacturing unexpectedly cooled in February and consumer spending was flat in January for the third straight month after accounting for inflation, casting a pall over the economic outlook.

Andrew Breitbart, who was found dead today at 43, changed political discourcse in American forever.

They may have had Bob Geldof as headline speaker, but as private equity executives headed home after their annual industry gathering in Berlin, many acknowledged they still had much to do to repair their image as unscrupulous corporate raiders.

They may have had Bob Geldof as headline speaker, but as private equity executives headed home after their annual industry gathering in Berlin, many acknowledged they still had much to do to repair their image as unscrupulous corporate raiders.

European shares extended gains into the Wall Street open on Thursday as an already positive sentiment was further supported by unemployment data confirming the U.S. jobs market is improving.

New bonds that Greece will issue this month as part of its debt restructuring are likely to be the highest yielding in the euro zone as creditors price in a high risk of being forced to take yet more losses.

It may be strange for Democrats to cast their ballot for a man who is pro-life, anti-gay rights and a card-carrying member of the Tea Party. But there's a method to this madness.

Data protection agencies in European countries have concluded Google Inc's new privacy policy is in breach of European law, EU Justice Commissioner Viviane Reding said Thursday.

Copper miner Kazakhmys posted a flat core profit for 2011 as stronger metal prices were offset by an 18 percent rise in production costs, including soaring wages for skilled workers in Kazakhstan, home to its core operations.

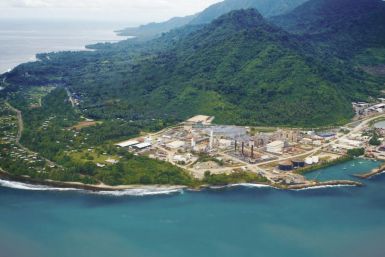

Russian precious metals miner Polymetal is eyeing acquisitions in Kazakhstan, Armenia, Ukraine, the Russian Far East and Urals, chief executive Vitaly Nesis told Moscow's RBC Daily in an interview published on Thursday.

Americans filed fewer new claims for jobless benefits last week but consumer spending was flat in January for the third straight month after accounting for inflation, casting a pall over the economic outlook.

Gold rebounded on Thursday as physical bullion investors were tempted back to the market by the previous session's 5 percent price plunge, its biggest one-day drop since before the collapse of Lehman Brothers in October 2008.

Prospects for a strong recovery in the global economy darkened on Thursday as sputtering factory activity in Europe overshadowed more upbeat data from Asia, at a time when central banks are running out of policy options and reluctant to do more.

Stock index futures pointed to a slightly higher open on Thursday as jobless claims hovered near multi-year lows, though investors had little reason to continue buying after healthy gains so far this year.

LightSquared, the beleaguered telecom startup founded by hedge fund manager Philip Falcone, is considering hiring telecommunications veteran Timothy Donahue as chief executive officer, a person familiar with the matter said on Wednesday.

Chrysler Group LLC said its auto sales jumped 40 percent, boosted by sales of its sedans last month, marking the best February for the smallest U.S. automaker since before the financial crisis.

Spanish borrowing costs fell at an auction on Thursday despite a grim economic backdrop that has pushed the government to step up its drive for leeway from Brussels on its difficult debt cutting targets.