Stock index futures dipped on Friday after JPMorgan Chase reported lower quarterly profit and ahead of trade and consumer sentiment data.

Internet giants including Google and Facebook are embroiled in a growing battle in India over offensive content with a judge warning websites may be blocked like in China, stoking worries about freedom of speech in the world's largest democracy.

Stock index futures dipped on Friday after JPMorgan Chase reported lower quarterly profit and ahead of trade and consumer sentiment data.

Italy's three-year debt costs fell below 5 percent but its first bond sale of the year failed to match the success of a Spanish auction the previous day, reflecting the heavy refinancing load Rome faces over the next three months.

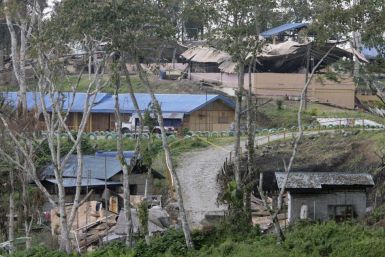

Global miner Xstrata Plc's Philippine unit said on Friday it was extremely disappointed with a government decision not to clear for now its planned $5.9 billion copper-gold Tampakan project, potentially the biggest in Southeast Asia.

Four years ago, Ron Paul was a fringe candidate. Now, he is a legitimate contender for the Republican nomination. The International Business Times talked to some of the new Paul converts about what won them over.

Gold prices struggled to hold recent gains Friday as a successful Italian bond auction buoyed optimism about the direction of the Eurozone's economy.

European shares and the euro rose on Friday on expectations debt-scarred Italy's first bond sale of the year would go well, but unease over Greece's debt swap deal and prospects for the broader euro zone economy capped gains.

Bank of America Corp , the second-largest U.S. bank by assets, has informed U.S. regulators that it is willing to draw back from some parts of the country if its financial problems worsen, the Wall Street Journal reported on Friday, citing people familiar with the situation.

China's official reserves slipped to $3.18 trillion in the final quarter of 2011, signaling that the days of rampant export-led accumulation of foreign currency are numbered and that new monetary policy steps may be needed to counter capital outflows.

A federal judge refused on Thursday to throw out a lawsuit accusing General Electric Co and its chief executive of misleading investors about the conglomerate's financial health and exposure to risky debt during the 2008 financial crisis.

The author of the Stop Online Piracy Act vowed to press ahead with his bill despite fierce opposition from internet giants such as Google and Facebook, faulting opponents for putting their profits ahead those lost by victims of counterfeit products.

Telecom startup LightSquared is asking for an investigation of a possible conflict of interest by a member of an advisory board that has already warned against its technology because of interference with the global positioning system.

A top federal prosecutor has a message for companies: If you've been hacked, tell us.

The lawmaker behind a bill to combat online piracy vowed on Thursday to press ahead in the face of fierce criticism from Internet giants such as Google and Facebook.

Asian shares rose to a one-month high and the euro clung near its strongest in a week on Friday as strong demand for Spanish and Italian debt sales tempered risk aversion ahead of another auction from Rome later in the day.

Brokerage Raymond James Financial Inc is taking a rare swing for the fences with its move to acquire Southeast rival Morgan Keegan, yet investors worry the $1.2 billion takeover won't translate to big gains until markets rebound.

New consumer financial chief Richard Cordray has been calling the heads of some of the top U.S. banks in an effort to build support for his agency, which is viewed skeptically by the financial industry.

A group of chief executives at more than 200 large U.S. companies urged a federal appeals court to undo a judge's controversial decision making it harder for companies to settle Securities and Exchange Commission fraud cases.

While Wall Street giants fight to get regulators to loosen the broad trading restrictions of the Volcker rule, a bank that sits in the heart of California's high-tech corridor has mounted its own aggressive and more focused lobbying effort.

The European Central Bank's flood of cheap three-year money is helping the euro zone's banking system substantially and supporting confidence in the bloc's economy which is showing some signs of stabilization, its president said on Thursday.

After a virtual tie with Rick Santorum in Iowa and a 16-point win over Ron Paul in New Hampshire, Mitt Romney is looking ahead to South Carolina and Florida -- and new polls show him leading in both states. But can he keep that up?

Gold rose to a one-month high on Thursday, as comments by the president of the European Central Bank on cheap money stabilizing the region's banking system extended the metal's gain to a third consecutive day.

US Airways Group , Delta Airlines and private equity firm TPG Capital are among several parties interested in potential bids for AMR Corp , the bankrupt parent of American Airlines, people familiar with the matter told Reuters.

American Honda Motor Co won a legal victory as a divided U.S. appeals court on Thursday said a nationwide lawsuit over a brake system used in some Acura RL vehicles should not have been certified as a class-action.

The world's dominant planemakers scored new orders as Airbus put the finishing touches to a record 2011, cruising peacefully for now above debt turmoil and new airline cutbacks in Europe.

The S&P 500 closed at a five-month high for the third day on Thursday but had difficulty extending gains in the face of lackluster economic data and another European bond market test.

Fitch Ratings analysts continued their saber-rattling over Italy on Thursday, making remarks observers fear signal a coming downgrade of that country's sovereign credit rating. The comments carry an element of the ratings agency playing catch-up to its two main competitors: New York-based Moody's Investor's Services and Standard & Poor's. Fitch currently holds a rating of A+ on Italian government debt, a notch above the ratings assigned by those competitors

The May 2010 flash crash was bad for almost everyone involved in the stock market, but for the Securities and Exchange Commission, it was a disaster.

Greece could reach a bond swap deal with private creditors to reduce its debt load by the end of next week, with a formal offer possible by early February, a finance ministry source said on Thursday.