The S&P 500 turned positive for the year on Friday as equities rallied again on a run of better-than-expected economic data, though volume continued to be seasonally weak.

Shares of United Continental Holdings fell about 7 percent on Friday as some analysts cut their fourth-quarter profit estimates, citing weaker-than-expected revenue.

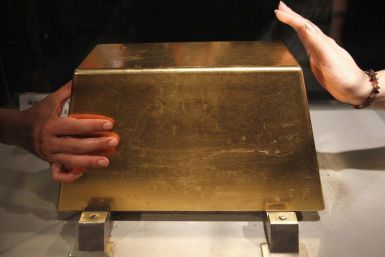

Gold extended its record bull run in 2011 for an 11th year as confidence in the world's financial leaders and their stewardship of fiat currencies plummeted.

Wall Street extended a year-end rally on Friday as the S&P 500 rose for a fourth day and turned positive for the year after a recent run of better-than-expected economic data.

Bank of America Corp is lagging behind its major U.S. competitors in complying with new capital rules, leading the bank to consider even more asset sales, sources said.

Stocks edged higher on Friday, with the S&P 500 on track for a fourth straight day of gains as a batch of economic data pointed to an economy that continued to grow at a modest pace.

Prodigy Gold Inc. raised the estimated resources of its open pit Magino gold project in northern Ontario to more than 2.6 million ounces.

The half a trillion euros the European Central Bank pumped into the financial system buys hard-hit banks valuable time but will not in itself protect them from threatened rating downgrades, one of Standard and Poor's top executives said.

Stocks were set to climb at the open on Friday, with the S&P 500 on track for a fourth straight day of gains as modest durable goods and consumer spending data was not enough to dampen optimism the U.S. recovery remained on track.

Canadian exploration and development company Detour Gold Corp said its Detour Lake gold project in northern Ontario has received a go-ahead from the federal government.

The half a trillion euros the European Central Bank pumped into the financial system buys hard-hit banks valuable time but will not in itself protect them from threatened rating downgrades, one of Standard and Poor's top executives said.

Stock index futures pared gains on Friday after mixed data on U.S. durable goods orders and consumer spending.

Denver-based Royal Gold Inc. agreed to pay $60 million for payable gold and silver produced from the Tulsequah Chief project, which is owned by Chieftain Metals Inc.

Sweden-based Nordic Mines AB will begin trading on the Stockholm Stock Exchange Mid Cap list on Jan. 2, just days after its Laiva gold mine in Finland reaches full production.

Gold demand in India, the world's top buyer, remained subdued on Friday after prices edged higher, tracking a rebound in the world market and as the local currency pared early gains, dealers said.

China's $410 billion sovereign wealth fund China Investment Corp. is set to receive additional funding of up to $50 billion, two sources said, a step that could help it move quickly to buy overseas assets, especially in Europe.

China's $410 billion sovereign wealth fund China Investment Corp. is set to receive additional funding of up to $50 billion, two sources said, a step that could help it move quickly to buy overseas assets, especially in Europe.

Signs of renewed momentum in the giant U.S. economy boosted European stocks and supported the euro on Friday, but any gains in holiday-thinned markets are likely to prove short-lived with concerns about the euro zone debt crisis undiminished.

Fresh signs the giant U.S. economy is gaining momentum drove major world stock markets and the euro higher on Friday, with activity likely to be thin in the last session before the Christmas holiday.

The economy is gaining momentum and should push through next year with only a few bruises despite an almost certain European recession and slower global growth.

Asian stocks rose more than 1 percent and U.S. index futures also gained on Friday, as signs of a strengthening economy in the United States encouraged a year-end bounce for riskier assets.

China's $410 billion sovereign wealth fund China Investment Corp. is set to receive additional funding of up to $50 billion, two sources with knowledge of the matter told Reuters on Friday.

Respected commodities hedge fund BlueGold has veered from its energy-focused strategy, betting half its money on equities and other trades that are worrying investors as it turns in its first down year.

The number of Americans filing new claims for jobless benefits hit a 3-1/2 year low last week, bolstering views the economy was gaining momentum, even though third-quarter growth was revised down.

A 2010 inspection by the U.S. audit industry watchdog faulted accounting giant Ernst & Young for a range of audit issues, including not getting enough supporting evidence and problems with testing the fair value of financial instruments.

Stocks rose on Thursday, putting the S&P 500 on the cusp of finishing out the year higher as another decline in jobless claims pointed to further improvement in the labor market.

As Wall Street traders cheered positive jobs data on Thursday, they seemed to ignore layoffs and bonus cuts on their own trading floors that will hurt growth in the broader U.S. jobs market in the coming months, TrimTabs Chief Executive Charles Biderman said.

First Colombia Gold Corp. said Thursday it agreed to buy a Lincoln County, Montana, gold prospect known as the Boulder Hill Project.

Wall Street may not be on Santa Claus's list for presents this year.

Gold struggled Friday as fund managers booked profits on the yellow metal's gains this year, offsetting the lift it normally would have gotten from rising crude oil prices and stocks.