If you needed a clue that Chicago's Eye Spy Optical does brisk business in late December - the time when many healthcare flexible spending accounts expire for American employees - just take a look at its storefront in the city's Lakeview neighborhood.

Sigh. A lot of people are predicting more of the same for 2012: Another year of stock market volatility, high unemployment, banking industry upheaval, weak housing and more talk about Facebook, mobile commerce, 401 plans and taxes.

In September, German bank Eurohypo and developer Forest City Enterprises Inc were negotiating a $65 million loan for 9 MetroTech, part of a 11-building office campus in Brooklyn, New York.

Remember way back in January, when Washington was arguing about taxes, homeowners were having trouble getting refinanced and investors were dumping gold? Hmmm...that makes it seem like 2011 was an uneventful year.

The European Central Bank's offer of cheap long-term cash is an attempt to prevent a rapid bank deleveraging shock rather than U.S.-style money printing that will filter through to the real economy and leach into other markets.

News and information provider Thomson Reuters Corp said it has pulled the sale of its healthcare business, as tough economic conditions made it difficult to fetch a good enough price.

The number of Americans filing new claims for jobless benefits hit a 3-1/2 year low last week, bolstering views the economy was gaining momentum, even though third-quarter growth was revised down.

Italy's Senate passed a vote of confidence in the government of Prime Minister Mario Monti on Thursday that put the final seal on an emergency austerity budget rushed through to restore market confidence in the euro zone's third biggest economy.

Stocks edged higher on Thursday, putting the benchmark S&P 500 index on track for its third straight advance after economic data pointed to gradual improvement in the economy.

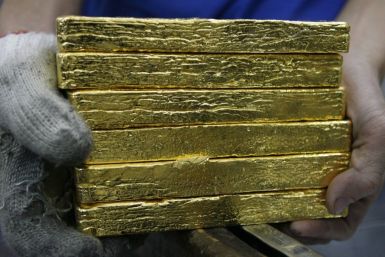

The inflows into gold-backed exchange-traded funds that helped drive bullion demand sharply higher during the financial crisis have more than halved this year, according to Reuters data, and are unlikely to recover in 2012 as appetite grows for other assets.

Stocks were poised for their third straight advance on Thursday after economic data pointed to continued gradual improvement in the economy.

Catalyst Metals Ltd. agreed to evaluate a gold mine in southeastern Australia for up to 12 months with the option of acquiring a stake in the property, Catalyst said Thursday.

New claims for unemployment benefits dropped last week to its lowest in more than 3-1/2 years, suggesting the labor market recovery was gaining speed.

EBay Inc said on Thursday it bought BillSafe, a purchase and invoicing technology provider with clients in Germany, and will combine it with its PayPal online payments service, in a move to strengthen its e-commerce capabilities in Northern Europe.

Easier European bank-to-bank lending rates and hopes a batch of U.S. data would confirm an improving economic picture, lifted world stocks and the euro on Thursday, but concerns that Europe's debt crisis could intensify kept a lid on the rises.

Stock index futures rose on Thursday, putting the S&P 500 on track for its third straight day of gains as investors looked to a batch of economic data for signs the economy will continue to slowly improve.

Stock index futures rose on Thursday, putting the S&P 500 on track for its third straight day of gains as investors awaited a batch of economic data for signs the economy was slowly improving.

Gold prices in India, the world's top buyer, eased tailing soft overseas prices, but not enough to attract buyers in a traditionally lean demand period, dealers said.

China further tightened rules on microblogs on Thursday, requiring new authors on seven websites in southern Guangdong province to register their real names, state-run Xinhua news agency reported, in a move users decried as ineffective.

Financial stocks led a solid recovery on European share markets Thursday in thin trade and bank-to-bank lending rates fell, as signs grew that the nearly half a trillion euros banks borrowed from the region's central bank will ease funding strains.

Rising European stocks and a weaker dollar supported gold Thursday, but the yellow metal remained tethered to the previous day's closing price on light volume and a lack of anything that encouraged risk taking.

Financial stocks led European share markets higher on Thursday in thin trade, while the euro rose, on hopes the nearly half a trillion euros in three-year funds that banks have borrowed from the region's central bank will ease current funding strains.

European stocks and the euro rose on Thursday, recovering much of their losses a day earlier when banks borrowed nearly half a trillion euros in three-year funds from the region's central bank, with concerns about the health of Europe's financial system keeping gains in check.

It was a Cinderella story: a pig-rearing and vegetable-growing hamlet in China's eastern Jiangsu province that transformed itself into a village boasting millionaires and expensive cars, all through plywood, ingenuity and the Internet.

On the old TV show, The Twilight Zone, people would often wake up to find that the world had changed in some weird and inexplicable way. The holidays are kind of like that. Our music tastes, our fashion, and even our work habits, are temporarily transformed.

Heungkuk Life Insurance Co has withdrawn a $47 million lawsuit against Goldman Sachs & Co over the Timberwolf collateralized debt obligation and will arbitrate the case instead.

Bank of America Corp's Countrywide Financial unit agreed on Wednesday to pay a record $335 million to settle civil charges that it discriminated against minority homebuyers, an historic settlement for the Obama administration in the wake of the subprime mortgage morass.

Activist investment fund Starboard Value has taken a 4.5 percent stake in AOL Inc and is pushing for a meeting with the Internet company's chief executive and the board to address what it sees as strategic failings.

Walgreen Co still believes it can succeed even if it stops filling prescriptions for Express Scripts Inc on January 1, and its stance suggests that the odds of the drugstore making up with the pharmacy benefits manager before the end of the year are remote.

Fitch Ratings on Wednesday reiterated the high and rising U.S. federal and government debt burden was not consistent with keeping its AAA credit rating, but said no decision on whether to cut the top level rating is likely to come before 2013.