Gold fell on Thursday, on track for its biggest one-day loss in two weeks, as fearsabout political turmoil in Italy and a deepening euro zone debt crisis prompted investors to raise cash by liquidating somepositions in the bullion market.

Stocks edged up on Thursday, rebounding from Wednesday's steep losses, but trading was choppy as nervous investors reacted to headlines painting a mixed picture of Europe's debt crisis.

Spurring stronger growth and more robust job creation in the weak recovery are top priorities for the Federal Reserve, Chairman Ben Bernanke told a military audience at a rare public forum on Thursday.

Gold has confounded market watchers by refusing to behave like a safe-haven and instead has tracked equities over the past few weeks, but the escalating European debt crisis could see bullion ditch its risk-asset mantle and return to record highs.

It is likely to take the combined forces of the European Central Bank, the IMF and the euro zone bailout fund to break Italy's financial fall, and it's far from clear that Europe's leaders are ready to take on that rescue mission.

B2Gold Corp's third-quarter adjusted profit more than doubled, helped by higher production and strong prices.

Gold exploration company Rainy River said it has completed a preliminary assessment of its Rainy River project, which indicates that the gold project in northwest Ontario is viable.

Investors stuck with gold exchange-traded products (ETPs) in October, but most other commodities ETPs saw outflows as investors remained cautious about the outlook for economic growth.

Vancouver-based Aurizon Mines Ltd. said Thursday its third-quarter profit rose dramatically as higher prices and output offset increased costs, more taxes and foreign exchange losses.

New U.S. claims for jobless benefits fell last week to their lowest level since early April and the trade deficit unexpectedly shrank in September, pointing to a slight improvement in the sluggish economy.

New U.S. claims for unemployment benefits fell last week to their lowest since early April and the trade deficit unexpectedly shrank in September, pointing to a slight improvement in the economy.

Stocks steadied on Thursday as the European Central Bank's purchase of Italian bonds helped calm markets queasy over the euro zone debt crisis.

New U.S. claims for unemployment benefits declined for the second straight week, to the lowest level since the first week of April, the Labor Department said on Thursday.

New U.S. claims for unemployment benefits fell last week to their lowest since early April and the trade deficit unexpectedly shrank in September, pointing to a slight improvement in the economy.

AuRico Gold Inc., a large Canadian gold miner, said Thursday third-quarter profit surged 76 percent on increased metals' prices and higher output, particularly from three Mexican mines.

Stocks rebounded on Thursday, a day after the S&P 500 suffered its worst day since mid-August as Italian bond yields eased.

Stock index futures rose on Thursday, indicating the S&P 500 may bounce back from its worst day since mid-August as Italian bond yields eased.

Gold Fields Ltd.'s third-quarter profit tripled from the year-earlier quarter as surging gold prices and enhanced efficiency offset higher operating costs, the world's fourth-largest gold miner reported Thursday.

The head of the International Monetary Fund urged Italy Thursday to act quickly fill its damaging political vacuum, and China said it was willing to help maintain global financial stability that was being threatened by the euro zone crisis.

Stocks were poised for a higher open on Thursday, indicating the S&P 500 will bounce back from its worst day since mid-August as Italian bond yields eased.

German travel group TUI AG is going where the world's biggest financial firms have yet to venture.

Gold prices recouped big early losses Thursday to start Comex floor trading about one percent down as the U.S. dollar fell against the euro on hopes a new Italian and Greek governments may pave the way for Europe to avert a recession.

Political and economic crisis in Italy spurred fears of a split in the euro zone with borrowing costs for Europe's third biggest economy at unsustainable levels and the bloc unable to afford a bailout.

Stock index futures rose on Thursday, indicating the S&P 500 may bounce back from its worst day since mid-August as Italian bond yields eased.

UBS is shutting its asset-backed securities business in the United States, Swiss newspaper HandelsZeitung reported on Thursday without citing sources.

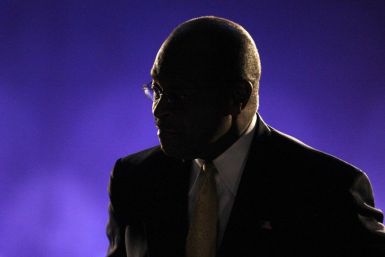

The sexual harassment scandal surrounding Herman Cain has become a messy he said, she said affair, with accusers going public and Cain fiercely denying their allegations. What's next for the Georgia businessman who shot from obscurity to the top of the polls last month?

The head of the International Monetary Fund called on Thursday for political clarity in efforts to tackle the debt crisis that has gripped Italy, saying uncertainty around who would succeed Prime Minister Silvio Berlusconi was fuelling market volatility.

World stocks hit a three-week low and the euro tumbled across the board while top-rated government bonds rallied on Thursday as fears of a break-up of the euro zone gathered pace ahead of a key debt sale in Italy.

A key gauge of Japan's corporate capital spending fell more than expected in September and manufacturers expect a further drop this quarter as business confidence sags in the face of the strong yen and slowing global growth.

Asian stocks fell around 3 percent on Thursday after soaring Italian borrowing costs stoked fears that the debt crisis in the euro zone's third biggest economy will overwhelm its financial defenses, raising the risk of a break-up of the currency area.