Nuclear Giants Concerned About Trump's US-to-China Export License Suspension

Westinghouse and Emerson are just among the affected companies.

Trade tensions between the US and China are heating up again, despite a 90-day pause on 100 percent-plus tariffs agreed on 12 May 2025. Now, the Trump administration has taken a sharp new turn by suspending licences for nuclear exports to China.

This move could hit major nuclear and energy firms hard. Here's what it means for the industry—and what could come next.

US Blocks Nuclear Trade with China

In early June, the US Department of Commerce issued orders halting the approval of export licences for nuclear materials and components headed to China. The suspension affects items ranging from reactor parts to precision tools used in the energy sector.

According to Yahoo Finance, the licence freeze is part of a broader strategy to weaken China's access to critical technology during the ongoing tariff standoff.

A US official hinted at the plan earlier, stating that Washington was reviewing exports deemed 'strategically important' to Beijing.

'In some cases, Commerce has suspended existing export licences or imposed additional requirements while this review is ongoing,' said a department spokesperson.

Nuclear Heavyweights in the Firing Line

Industry giants Westinghouse and Emerson are expected to feel the impact. Westinghouse, which powers over 400 nuclear reactors worldwide, could face stalled exports of vital nuclear technologies.

Emerson, a key provider of industrial measurement tools, also risks disruption to its supply chain.

While neither company has commented publicly, analysts warn the export freeze could hit revenue hard.

Other firms are also under pressure. GE Aerospace, which supplies hydraulic fluids and jet engines to China's state-owned aircraft maker COMAC, may face export challenges if restrictions broaden.

The knock-on effect is rippling through energy sectors too. Houston-based Enterprise Product Partners and Dallas-based Energy Transfer could lose hundreds of millions, according to Power Technology.

Two insiders confirmed that both nuclear and energy businesses have already begun feeling the financial strain.

What Comes Next?

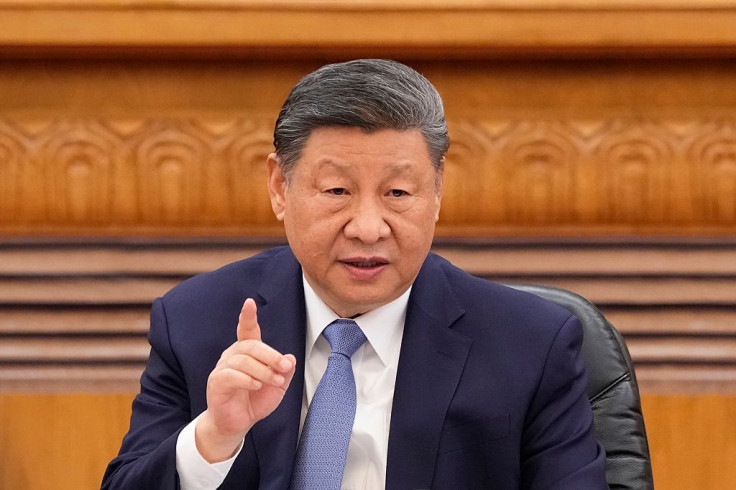

The US Department of Commerce has yet to outline its long-term plan for nuclear exports. However, President Trump is set to meet Chinese President Xi Jinping in London on Monday, 9 June 2025.

The face-to-face follows a long phone call between the leaders on Thursday, 5 June. Although the UK will host the talks, British officials confirmed they will not take part.

'We are a nation that champions free trade and have always been clear that a trade war is in nobody's interests. We welcome these talks,' said a UK government spokesperson.

It remains unclear whether nuclear exports will be discussed directly. Observers expect the agenda to include China's access to US technology, rare earth exports, and the escalating economic friction.

Industry Braces for Fallout

As tensions grow, nuclear firms are left waiting for clarity. Many now face delays, lost revenue, and uncertain futures.

Experts warn that if the licence freeze continues, it could reshape global supply chains and dent the US's influence in the nuclear sector.

For now, the world watches as diplomacy and trade collide—while one of the most powerful industries hangs in the balance.

Originally published on IBTimes UK