Six Under-the-Radar Defi Projects Worth Watching

The decentralized finance (defi) realm is positively teeming with projects purporting to be on the cusp of changing the world. In this hyperbolic milieu, it’s often difficult to separate the protocols with genuine promise from the pretenders whose aggressive marketing masks their vapidity. Amid the tumult, several defi projects are happily flying under the radar and getting stuff done. Here, we shine a spotlight on some of defi’s current unsung heroes.

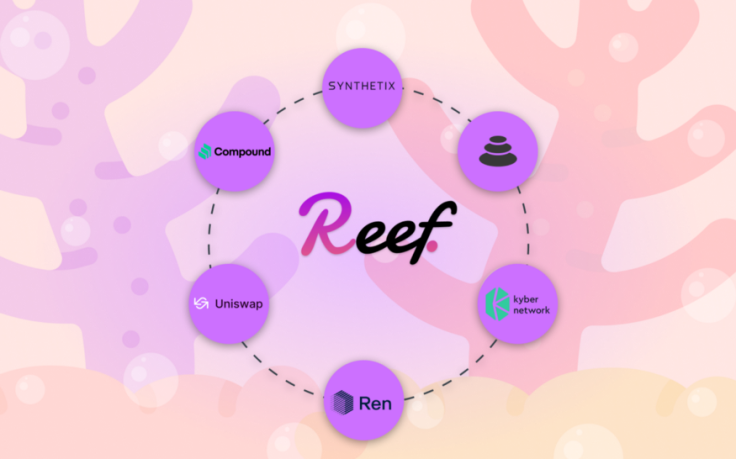

Reef

Reef Finance is a Polkadot-powered liquidity aggregator and yield engine, offering users lending, borrowing, staking and mining. A user-friendly gateway to the defi market, the platform represents intelligent crypto trading via a Global Liquidity Aggregator with access to liquidity from both CEXes and DEXes, and an AI-driven personalized Yield Farming Aggregator. The network itself, meanwhile, is governed by its community via a DAO.

Reef recently closed a $3.9m seed funding round with backing from the likes of NGC Ventures and AU21 Capital, and CEO Denko Mancheski is bullish given existing pain points in the industry, explaining: “The average retail investor entering the defi landscape is confused. They don’t know the names of the projects or how to keep up with the best strategies and stay safe and well diversified. They have to go through like five different websites and use different UI made by different vendors. It’s overwhelming. And while you do this, you’re missing out on different opportunities.”

The Reef team has plans for a treasury, vault, mobile app and debit card in 2021, a year in which Polkadot-based projects are likely to attract more and more attention.

It’s becoming clear that decentralized finance is about more than just rampant speculation. Indexes, ETFs, prediction markets, decentralized storage, anonymous cryptocurrencies – the use cases are piling up, and the tooling and products are improving with every passing day. Whether defi will eventually replace the tired traditional financial system is anyone’s guess. For now, it’s content to be crypto’s most disruptive force.

2. CORE VAULT

CORE has been a project to watch for nearly six months now since its September 2020 launch. The founding team of this yield farming project was able to successfully - and securely - raise around $60 million in locked liquidity. The CORE community is proud to be part of a project that’s dedicated to innovation.

An anonymous cadre of developers and engineers, the CORE crew recently announced coreDEX which offers a new form of liquidity provision known as OVL (open vesting liquidity), a means by which users can participate in the DEX without buying CORE LP directly. Swaps, loans, options trading and LP futures are also part of the package. Rumors are already swirling that the new open vesting system might lead to the release of a new token, with Head of Operations 0xdec4f teasing that “a lot of new features are being worked on.

Additionally, someone from the founding team at CORE recently reacted to the announcement of coreDEX with the utmost confidence that “ coreDEX is a derivatives dex unlike anything in crypto.” Defi is here to stay and it’s reassuring someone is constantly looking to improve. One to watch? Absolutely.

3. COTI (CVI)

COTI’s Crypto Volatility Index (CVI) enables traders to profit from highly-volatile cryptocurrency markets. A market fear index based on Wall Street’s equivalent and integrated with Chainlink’s decentralized oracles, the startup’s latest product expands a finance-on-the-blockchain ecosystem that already includes a digital payment platform, stablecoin issuance, a tokenized loyalty network, and a remittance solution for cross-border payments.

COTI’s suite is built on Trustchain, a proprietary consensus algorithm based on machine learning, and the platform is looking to make its fifth year its best yet. Earlier this month, it secured a major integration with Celsius Network, enabling consumers and merchants to earn interest and obtain loans directly via COTI Pay and COTI Pay Business. COTI’s credit-card processing subsidiary Paywize is also going from strength to strength, having processed a whopping 339,000 transactions for merchants in the last quarter. As far as staking is concerned, COTI is also offering the best returns at present.

4. Rocket Vault Finance

Powered by advanced predictive analytics and machine learning algorithms, Rocket Vault Finance is a smart vault that identifies the best-performing pools, eliminates risky pools, and pinpoints the best entry point for traders to earn auto-compounding rewards.

Integrated with some of the market’s biggest exchanges, namely Coinbase, Binance, Bitfinex, OKEx, Uniswap, Huobi and KuCoin, Rocket Vault claims to have achieved over 100% APY (paid in stablecoins) in all tests since early 2020, and is currently gearing up for its $RVF public sale. Rocket Vault offers two user plans in public beta, a Free for Retail package and a Paid for Institutions version, the latter entailing a 2% management fee and 5% of annual profits. The plan is to introduce a range of tier-based options in the near future.

The idea of depositing funds and sitting back while an AI-based Smart Vault identifies lucrative tokens is undeniably appealing. In an entertaining animated video on the Rocket Vault site, downbeat Chris perfectly captures the ennui of the modern defi trader, who spends all his time scouring the landscape in search of yield while sacrificing quality time with his family. Charitably, Rocket Vault wants to save your sleep, your sanity and possibly even your marriage. It's very much worth keeping tabs on.

5. Offshift

Offshift is a cryptographically private offshore storage and defi protocol, and the first dual-sided public/private protocol to be built entirely on a public blockchain. Thanks to the use of Zero-Knowledge proofs, users can for the first time wrap their digital assets into entirely anonymous, Ethereum-based versions of mainstream currencies (zkUSD, zkBTC etc), with a semi-decentralized oracle network helping to maintain price. In its whitepaper, Offshift suggests that zkAssets could offer an attractive means of storing private wealth, “away from the prying eyes of government and untraceable with blockchain analytics.”

Designed to adequately incentivize both speculation and facilitate the use of crypto as a store of value/medium of exchange, Offshift has its own utility token ( XFT ) which is currently available on Uniswap and Balancer. It also follows a multi-chain model, having integrated onto Polkadot’s Ethereum-compatible Moonbeam parachain earlier this month. Offshift plans to launch staking in Q3 to encourage storage on the private side, while incentivizing token ownership on the public side as XFT supply declines.

6. PlotX

A non-custodial prediction protocol, PlotX creates high-yield markets using an automated market maker, with all transactions processed on-chain. Launched in beta last October, the platform is the brainchild of ex-Nexus Mutual and GovBlocks developers who describe it as “Uniswap for prediction markets.” Ostensibly, it lets users wager on the future value of assets like ETH and BTC on a four-hourly, daily or weekly basis, without suffering the drawbacks of centralized prediction markets: counterparty risk, high cost and an inability to demonstrate provably fair settlements. Users can also participate in governance using the PLOT utility token.