S&P 500 Ends See-saw Session Lower As Pelosi Visits Taiwan

Wall Street ended lower after a choppy session on Tuesday, with geopolitical tensions flaring after U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan.

Pelosi said her trip demonstrated American solidarity with the Chinese-claimed self-ruled island, but China condemned that first such visit in 25 years as a threat to peace and stability.

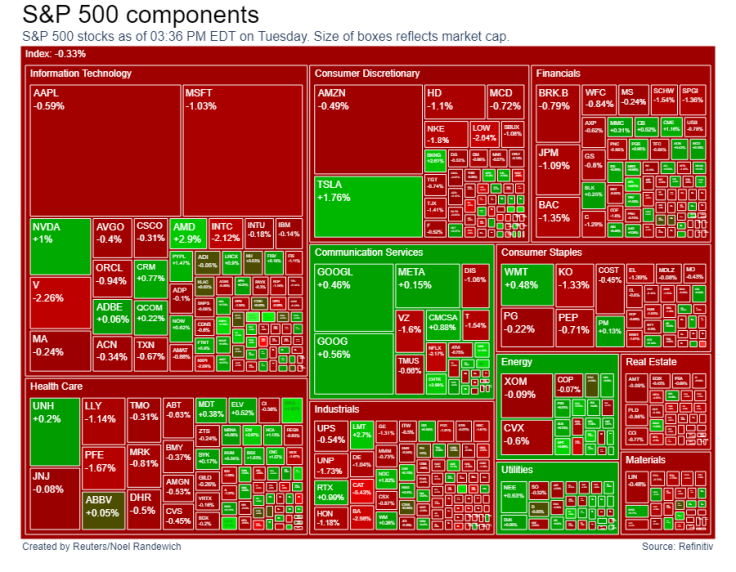

Heavy hitters Microsoft and Visa lost 1.1% and 2.4% respectively, weighing on the S&P 500. All 11 S&P 500 sector indexes lost ground, led lower by real estate, which lost 1.3%. Financials dipped 1.1%.

Shares of chipmakers heavily exposed to China were mixed. Advanced Micro Devices rallied 2.6% ahead of its quarterly report after the bell.

Industrial bellwether Caterpillar tumbled 5.8% after warning of a bigger drop in demand for its excavators in property crisis-hit China, piling more pain on the industrial bellwether grappling with supply-chain disruptions.

Financial markets have been roiled in recent months by the Ukraine war, soaring inflation and tightening financial conditions.

U.S. job openings in June fell by the most in just over two years, as demand for workers eased in the retail and wholesale trade industries. Overall the labor market remained tight.

Since the U.S. Federal Reserve raised interest rates by 75 basis points in July, investors have been speculating about whether the central bank's largest hikes are behind it.

"The market has to get really comfortable that they have fully baked in all the Fed's rate hikes, and I think that remains an open question," said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management in Seattle. "The challenges and supply constraints aren't necessarily done. They aren't done and gone yet."

Shares of U.S. defense companies Raytheon Technologies Corp, Lockheed Martin Corp, Northrop Grumman Corp and L3Harris Technologies Inc rallied for much of the session, ending with gains between 0.5% and 2.3%. The United States is Taiwan's main supporter and arms supplier.

The S&P 500 declined 0.66% to end the session at 4,091.32 points.

The Nasdaq declined 0.16% to 12,348.76 points, while Dow Jones Industrial Average declined 1.23% to 32,396.30 points.

Volume on U.S. exchanges was relatively heavy, with 11.2 billion shares traded, compared to an average of 10.8 billion shares over the previous 20 sessions.

The CBOE volatility index, also known as Wall Street's fear gauge, eased from the day's high of 24.68 points.

Graphic: Wall Street trading,

A largely upbeat second-quarter reporting season has supported markets recently, with the benchmark S&P 500 index up about 12% from lows hit in mid-June.

Uber Technologies Inc jumped almost 19% after the ride-hailing firm reported positive quarterly cash flow for the first time ever and forecast upbeat third-quarter operating profit.

The most traded stock in the S&P 500 was Tesla Inc, with $28.7 billion worth of shares exchanged during the session. Its shares rose 1.1% after Citigroup hiked its price target on the electric car maker.

Pinterest Inc surged over 11% after activist investor Elliott Investment Management became the largest shareholder of the digital pin-board firm.

Declining stocks outnumbered rising ones within the S&P 500 by a 3.1-to-one ratio.

The S&P 500 posted 2 new highs and 30 new lows; the Nasdaq recorded 40 new highs and 73 new lows.

© Copyright Thomson Reuters {{Year}}. All rights reserved.