Stocks Stumble As China Slowdown Rattles Investors

Asian stocks fell to a two-year low on Friday and were heading for a weekly loss, while the dollar was set for its third week of gains after a fresh round of rate hikes globally deepened concern about the outlook for world economic growth.

Although wagers on a 100 basis point hike from the U.S. Federal Reserve later this month eased off a little when Fed officials hosed down that possibility, bond markets remain priced for steep hikes to slam the brakes on output. [US/]

China's economy is another big worry. It contracted sharply in the second quarter, data released on Friday showed, while investors were also rattled by homebuyers' threats to cease mortgage repayments.

MSCI's index of Asia-Pacific shares outside Japan touched a two-year trough and was last down 0.6%. Property stocks in Hong Kong slumped 3% and mainland banks fell 1%, though stimulus hopes kept the rest of the market from further losses. [.HK]

"The underlying June numbers show a fairly good recovery," said Woei Chen Ho, an economist at UOB in Singapore.

"But in terms of the second half...it seems they have more issues that are emerging," she added, citing the property market as the biggest problem.

China's fragile outlook hit commodity prices, sending Dalian iron ore down 9.1% and Australia's mining index to a nine-month low, weighed further by a warning from Rio Tinto of labour shortages.

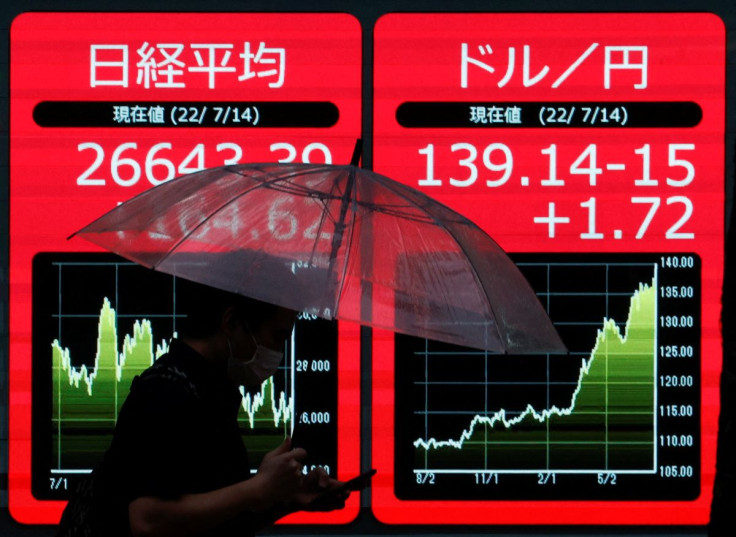

Japan's Nikkei was an outlier, rising 0.6% in thin trade before a long weekend. Uniqlo parent Fast Retailing leapt 8% after raising its profit forecast, with its international earnings flattered by the tumbling yen. [.T]

Modest positive sentiment has also come from two Fed officials pouring cold water on talk of a 100 bp rate hike later in July, against a backdrop of steep hikes in Canada, New Zealand, South Korea and surprise tightening in Singapore and the Philippines.

Futures imply about a 30% chance of a 100 bp hike and see the benchmark U.S. interest rate reaching about 3.6% by March next year before being cut back to 3% by late 2023.

S&P 500 futures rose 0.3% in Asia and European futures rose 1%.

KING DOLLAR

U.S. retail sales data is the next closely watched data point on Friday.

Weakness will further worry investors who think this week's white-hot inflation figure and subsequent Thursday data showing a strong rise in producer prices point to an unleashing of steep rate rises on a softening economy.

Short-end U.S. Treasuries held firm in Asia, but the two-year yield, at 3.1159%, is about 17 basis points higher than the benchmark 10-year yield, an unusual inversion of the yield curve that often points to recession.

"That inversion, I think, has quite a long way to go because we haven't really properly priced in that recession yet," said ING economist Rob Carnell.

In currency markets the U.S. dollar is king. The euro fell as low as $0.9952 overnight and has slid 1.5% for the week. It last steadied at $1.0022. The yen is hurtling toward 140 per dollar, and last bought 139.02.

"Not only has the greenback been supported by an almost continual ratcheting higher of Fed hawkishness ... but the U.S. dollar is picking up support from safe-haven flows," said Jane Foley, senior currency strategist at Rabobank in London.

Brent crude futures held at $99.96 a barrel and gold sat at $1,708 an ounce, just above a one-year low overnight. [O/R][GOL/]

© Copyright Thomson Reuters {{Year}}. All rights reserved.