Strong U.S. Retail Sales, Manufacturing Output Boost Economic Outlook

U.S. retail sales rose strongly in April as consumers bought more motor vehicles amid an improvement in supply and increased spending at restaurants, providing a powerful boost to the economy at the start of the second quarter.

The broad rise in retail sales reported by the Commerce Department on Tuesday suggested demand was holding strong despite headwinds from high inflation, souring consumer sentiment and rising interest rates.

It assuaged fears of an imminent recession. The economy's underlying strength was underscored by other data showing production at factories accelerated in April.

Rising wages fueled by a scramble for scarce workers and massive savings accumulated during the COVID-19 pandemic are underpinning spending. Consumers are also increasing their usage of credit cards. But the strength in spending means the Federal Reserve will need to stick with its plan to cool demand.

"The strong retail sales should limit concerns over downside risks to growth and keep Fed officials firmly focused on raising interest rates to address too-high inflation," said Matthew Massicotte, an economist at Citigroup in New York. "At some point, rising prices will damp consumer demand and slow inflation, but for now the strong tailwind from nominal income growth and available consumer credit is driving demand."

Retail sales rose 0.9% last month. Data for March was revised higher to show sales advancing 1.4% instead of 0.5% as previously reported. April's increase in retail sales, which reflected both strong demand and higher prices, was in line with economists' expectations. Sales rose 8.2% on a year-on-year basis.

Retail sales are mostly comprised of goods and are not adjusted for inflation, which appears to have peaked. Consumer price inflation increased 8.3% year-on-year in April.

The increase in retail sales was led by receipts at auto dealerships, which rebounded 2.2% after falling 1.6% in March. That offset a 2.7% decline in sales at gasoline stations. Prices at the pump retreated from record highs in April. They have, however, since surged to an average all-time high of $4.523 per gallon as of Tuesday, according to AAA.

Excluding gasoline, retail sales rose 1.3%. Receipts at bars and restaurants, the only services category in the retail sales report, increased 2.0%. Clothing store sales gained 0.8% as many workers return to offices. Online store sales advanced 2.1%.

There were also strong gains in sales at electronics and appliance retailers as well as furniture stores. But sales at building material, garden equipment and supplies stores dipped 0.1%. Sales at sporting goods, hobby, musical instrument and book stores fell 0.5%.

Stocks on Wall Street were trading higher. The dollar fell against a basket of currencies. U.S. Treasury yields rose.

STRONG DEMAND

With a record 11.5 million job openings at the end of March, wages are rising and allowing cash-squeezed consumers to take a second job or pick up extra shifts, providing some cushion against inflation. Households are sitting on at least $2 trillion in excess savings, some of which are being deployed to maintain spending. Compensation for American workers logged its largest gain in more than three decades in the first quarter.

But with the Fed adopting an aggressive monetary policy stance, retail sales are expected to slow later this year.

The U.S. central bank has raised its policy interest rate by 75 basis points since March. The Fed is expected to hike that rate by half a percentage point at each of its next policy meetings in June and July.

The National Retail Federation hailed the sales growth as a show of consumer resilience, but urged the White House and the U.S. Congress to lift tariffs on Chinese goods, pass legislation to fix the supply chain and address immigration reform to ease the tight labor market.

Home Depot Inc raised its annual profit and sales forecasts on Tuesday as it reported an increase in first-quarter comparable sales, while Walmart reported a sharp drop in quarterly earnings and cut its full-year profit outlook.

Excluding automobiles, gasoline, building materials and food services, retail sales increased 1.0% in April. Data for March was also revised higher to show these so-called core retail sales increasing 1.1% instead of dipping 0.1% as previously reported.

Core retail sales correspond most closely with the consumer spending component of gross domestic product. Last month's solid rise in core retail sales suggests that consumer spending got off to a strong start in the second quarter.

GRAPHIC: Core retail sales and GDP -

Strong consumer spending and robust business investment in equipment helped to underpin domestic demand in the first quarter even as GDP contracted at a 1.4% annualized rate because of a record trade deficit and a slight moderation in the pace of inventory accumulation relative to the October-December period.

The Atlanta Fed boosted its second-quarter GDP growth forecast to a 2.5% rate from a 1.8% pace.

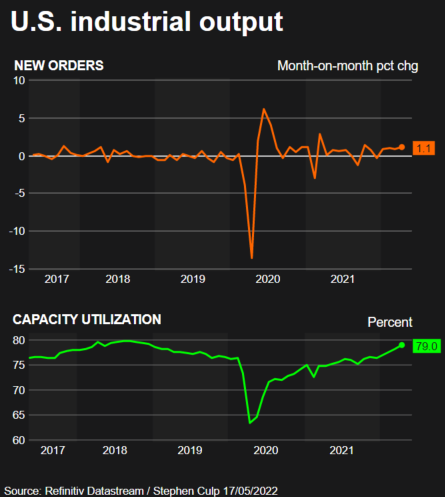

A separate report from the Fed on Tuesday showed manufacturing output increased 0.8% last month, matching the rise in March and beating economists' expectations of a 0.4% gain. Production at auto plants increased 3.9% last month after accelerating 8.3% in March.

GRAPHIC: Industrial output -

As a result, capacity utilization for the manufacturing sector, a measure of how fully firms are using their resources, increased 0.6 percentage point to 79.2% in April. That was the highest level since April 2007 and raised capacity utilization 1.1 percentage points above its long-run average.

"The rising capacity utilization rate provides further evidence that supply chain problems are abating, higher output will help slow inflation," said Gus Faucher, chief economist at PNC Financial in Pittsburgh.

© Copyright Thomson Reuters {{Year}}. All rights reserved.