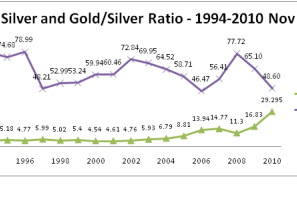

A study on charts shows that silver may not continue to enjoy the status of better investment alternative over gold in the short to medium term period.

A surge in food prices propelled Chinese consumer prices to a 25-month high in October, despite the government's efforts to control inflation.

G20 leaders say they want nations to coordinate economic policy, but even the host country is looking out for number one.

Goods and services trade deficit in the U.S. narrowed in the month of September from the previous month, but still remained high with China, according to a report released by the U.S. Commerce Department.

The suicide concoction of fiat currency, debt, military empire, and delusion has been painless for those in power, but painful for the working middle class of this country.

China is not too pleased with America's plan to inject more capital into its economy in the form of a second round of quantitative easing.

The US Federal Reserve' s quantitative easing can lead to asset bubbles as the money goes in search of equity, property and other such assets in a low-interest rate scenario, said Kaushik Basu, chief economic advisor to India's finance minister.

Peripheral Europe faces waning public demand because of austerity measures, conditions that make exports difficult, and a banking sector that has not recovered well from the financial crisis. All this comes at a time when recovery is still fragile and the risks of a double-dip recession are real.

Unemployment rate in the US remained constant for the third month in October, while nonfarm payroll employment rose more than expected, according to a report by the US Labor Department.

Michael Yoshikami, president and chief investment officer of YCMNET Advisors in Walnut Creek, Calif. discusses what exactly QE is, why it may be needed and its potential impact.

With little fanfare, equity markets have started to rally, investors have become sated with government bonds and cash levels are high enough to prompt a search for better yield.

U.S. employment fell for a third straight month in August, but the drop was far less than expected and private hiring surprised on the upside, easing pressure on the Federal Reserve to prop up economic growth.

U.S. employment fell for a third straight month in August, but the drop was far less than expected and private hiring surprised on the upside, easing pressure on the Federal Reserve to prop up economic growth.

The European Central Bank extended its liquidity safety net for vulnerable euro zone banks into next year, delaying its exit from crisis measures for now as it urged caution about the economic recovery.

The European Central Bank is expected to extend its liquidity safety-net on Thursday, delaying its exit from crisis support as policymakers confront a lopsided euro zone recovery and vulnerable banks in perimeter countries.

The U.S. Federal Reserve is committed to keeping the price of money low until the economic recovery strengthens, but should not do more to boost growth without fiscal and regulatory policies that support businesses, a top Fed official said on Wednesday.

The Federal Reserve should only embark upon further monetary easing if faced with a dangerous downward price spiral, otherwise it risks undermining its credibility, a top Fed official said on Wednesday.

The Bank of Japan expanded its cheap loan scheme on Monday, heeding government calls for action to curb a rise in the yen that threatens a fragile economic recovery and leaving the door open to more policy easing.

Most economists in a recent survey said they approved of the Federal Reserve's current course on monetary policy and see deflation as a risk for the short term.

Federal Reserve Chairman Ben Bernanke has smoothed the ruffled feathers of anti-inflation hawks at the Fed by indicating he will only press for more policy easing if the U.S. economic slowdown worsens.

Federal Reserve Chairman Ben Bernanke has smoothed the ruffled feathers of anti-inflation hawks at the Fed by indicating he will only press for more policy easing if the U.S. economic slowdown worsens.

Federal Reserve Chairman Ben Bernanke will have to address a number of pressing issues in a speech on Friday as investors search for more clarity on how close the U.S. central bank might be to another asset-buying spree to support the flagging recovery.