Monti said he would “act with urgency” to resolve Italy’s deep financial crisis.

The U.S. Labor Department announced 80,000 new jobs were added to the U.S. economy in October. The consensus among economic experts? We're not out of the woods yet.

Just when you think the United States economy is about to tip back into a recession -- the dreaded double-dip -- up pops the unexpected -- modestly encouraging economic news, in the form of worker productivity and unit labor costs.

The Canadian dollar strengthened against its U.S. counterpart in early trade on Wednesday as global markets settled between hope and fear amid Greek debt developments and ahead of a Federal Reserve meeting.

To say that the bankruptcy filing of MF Global and a Greek referendum on its bailout package have unnerved institutional investors would be an understatement. Where's the Dow headed in the next 3-6 months?

The head of the European Financial Stability Facility sought to entice China on Saturday to invest in the bailout fund by saying investors may be protected against as much as one-fifth of initial losses.

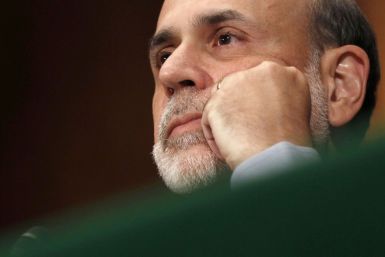

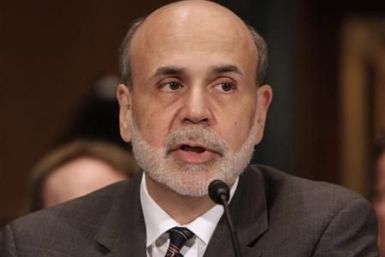

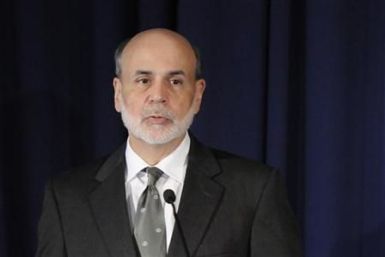

The ink is barely dry on European leaders’ plan to resolve the Greek / Europe debt crisis, and attention has already turned to the U.S. Federal Reserve. Is there enough liquidity in the global financial system or will Fed Chairman Ben Bernanke need to deploy more monetary stimulus to grease the wheels of commerce?

If Thomas Hoenig, retired chairman of Federal Reserve Bank of Kansas City, becomes the new vice chairman of the Federal Deposit Insurance Corporation, will the era of big banks come to an end?

No need to repeat all of the bad news about the U.S. economy. Further, as the stock market's bulls point out, that's history. Looking forward, the picture brightens, and accordingly here's why the bulls think the Dow Jones Industrial Average (DJIA) is headed higher in the next six months.

The Bank of Canada will keep rates on hold until the third quarter of next year amid slow global growth and the risk that Europe's debt crisis will linger on, according to a Reuters survey released on Tuesday.

While fear fosters headlines, cash is what creates stories. And cash is the route the European Central Bank has chosen to go.

Gold fell in choppy trade on Thursday after the European Central Bank held off flagging an imminent cut in interest rates, deflating an earlier rally in assets seen as higher risk, such as equities and the euro.

Twelve years after German Chancellor Helmut Kohl pushed through the monetary union over the objections of a majority of his country's citizens, the bloc is crumbling under the burden of huge debts. And the one institution that Germans were told would ensure stability, the ECB, is in deep crisis itself. In the absence of decisive action from Europe's leaders, the bank has come under enormous pressure to fill the gap.

The Bank of England voted on Thursday to buy 75 billion pounds ($115 billion) more in assets to shield Britain's economy from the euro zone debt crisis and keep the faltering recovery going.

With the economy slowing and the markets crashing, Federal Reserve Chairman Ben Bernanke put the burden squarely on Congress to act.

Although the global economy is struggling to avert a recession, we also know that central banks are working very hard to provide sufficient liquidity to ensure a smooth ride through year-end.

The Federal Reserve's new Operation Twist drew a number of objections from Richard W. Fisher, president of the Federal Reserve Bank of Dallas, who explained his opposition to the move in a speech Tuesday.

The Dow Jones Industrial Average (DJIA) is on track to record a weekly decline of more than 800 points -- its worst weekly swoon in two years. But the important question for the typical investor is, 'Where's the Dow likely to head in the next six months?'

Global Economic Crisis: Are we Better or Worse off than 2008? The Greek economic crisis is at the heart of the problems of the world economic crisis and for as long as France and Germany continue to ignore the realities that Greece must be allowed default on its debts, the European and world economies will suffer the consequences.

The U.S. Federal Reserve Wednesday announced it will sell $400 billion worth of short-maturity bonds and reinvest in bonds with maturities of 6 to 30 years by the end of June 2012, in a program commonly referred to as Operation Twist.

Gold fell on Wednesday as investors booked profits on the metal's rally earlier in the day ahead of the outcome of a Federal Reserve policy meeting that many hope will confirm the central bank's strategy to kick-start U.S. growth.

Top Congressional Republicans on Tuesday took the unusual step of telling the Federal Reserve to refrain from further intervention in the economy on the eve of the central bank's policy decision.