UAW Strike: Why The Chances Of Success Are Better In Stellantis Than In GM And Ford

Striking U.S. auto workers have better chances of getting a better deal on Stellantis than in the other two automakers. It's the most profitable among the "Big Three" automakers. Therefore, a strike at Stellantis factories better advances the United Auto Workers' (UAW) cause for fairness.

In addition, Stellantis' higher profit margins allow the company to make more generous concessions to UAW without losing its competitive edge.

In their long history, U.S. automakers have been through good and bad times.

The bad times have been when the U.S. economy slides into recession. It takes its toll on vehicle sales and earnings, like in the early 1980s and 2008-9 slumps — to mention a few.

The good times are when the U.S. economy is resilient, and vehicle sales and profits rise, like in the aftermath of the COVID-19 recession.

The trouble with this expansion is that it's accompanied by the resumption of inflation, which undermines the value of real labor incomes.

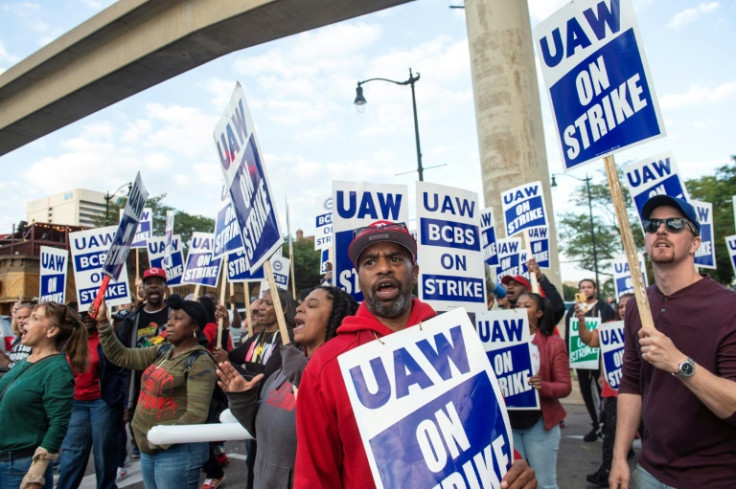

As a result, it has prompted workers in the "Big Three," represented by the United Autoworkers Union, to demand a "fair share" of the profits. It's a claim the management of the "Big Three" has denied, forcing UAW to go on strike.

But the profit situation is different in each company.

In the most recent quarter, GM's net income was $10.17 billion, up 51.70% from a year earlier.

That may sound impressive. However, GM's net profit margin is 6.05%, below Toyota's 7.72% and less than half of Tesla's 12.97%.

Meanwhile, according to Gurufocus.com, GM's EVA, the difference between the return on invested capital (ROIC) and the weighted average cost of capital (WACC) in the last four years is zero after being negative in the previous five.

That means a couple of things. First, GM has no competitive edge in the auto industry. Second, GM's management could better manage other people's money, as it creates no value for the company's capital holders.

The overall profit situation looks better on the surface for Ford. It made $4.14 billion in net income in the most recent quarter, up 187% from a year earlier.

Nonetheless, its net profit margin is just 2.44%, roughly less than half of GM's, one-third of Toyota's and 20% of Tesla's.

In addition, Ford's EVA is negative and has been that way in the last 10 years, meaning that it has no competitive advantage and destroys rather than creates value for capital holders as it grows.

Stellantis's profit situation is better among the three. In the most recent quarter, it made a net income of $19.76 billion, up 37.20% from a year earlier.

Moreover, its net profit margin stands at 10.40%, beating the margins of GM, Ford and Toyota but lagging behind Tesla's. And, unlike GM and Ford, Stellantis has a positive EVA, at least in the last three years.

Stellantis' high total profits make it a better target for UAW's fairness campaign, where they have the backing of President Biden.

Furthermore, Stellantis's high profit margins and EVA allow the company to make generous concessions to UAW without compromising its competitive edge.

Meanwhile, a broad strike that targets all three automakers could backfire on UAW, as it has a widespread impact on the U.S. economy.

"The first impact of a strike will be felt in auto worker homes and communities, who will see a drop in revenues, as strikers shift to spending less," Juscelino Colares, an international law professor at Case Western Reserve University, told International Business Times. "Next, depending on the length and scope of the strike (the UAW will not preside over a general walkout but will only target certain plants), part suppliers will see a decline in orders, which will also affect workers' compensation and their communities."

Worse, for the "Big Three," the strikes and the pressure for higher wages come at a challenging time. "They see their dealers have high inventories; they have had major losses after manufacturing EVs that few consumers can afford or want (because of high price and range issues)," continued Colares. "And they now face intense competition from Tesla and growing Chinese EV manufacturers. They have not made a big impact in the U.S. market only because of the Trump tariffs that the Biden Administration has kept in place."

"This is indeed a complicated situation," Mariano Torras, Ph.D., professor of finance and economics at Adelphi, told IBT. "Much depends on how long the strike will last, and this seems difficult to predict. UAW demands are quite reasonable, and it is unlikely they will back down unless both sides settle significantly more than halfway to the union's position."

© Copyright IBTimes 2025. All rights reserved.