Wall St Ends Down As Hot Inflation Data Raises Odds Of Steep Fed Rate Hike

U.S. stocks closed modestly lower on Wednesday after investors digested hotter-than-expected U.S. inflation data, which fueled fears that the Federal Reserve could raise key interest rates by as much as 100 basis points later this month.

While all three major U.S. equity indexes bounced off lows reached early in the day, and occasionally edged into positive territory throughout the session, they were all red by the closing bell.

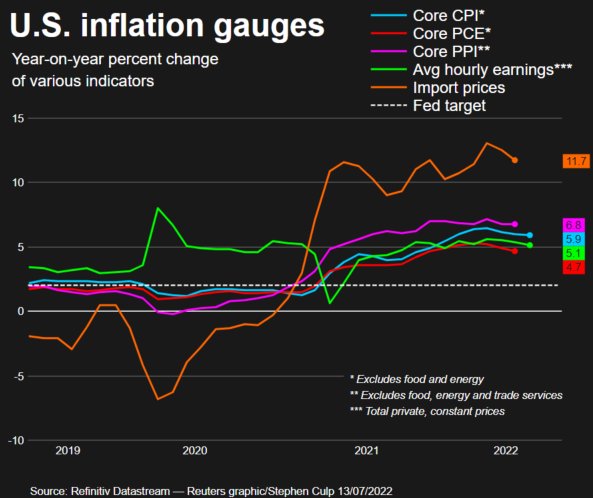

Year-on-year consumer price growth accelerated to a scorching 9.1%, the hottest reading since November 1981, driven by an 11.2% monthly spike in gasoline prices.

Stripping away volatile food and energy prices, which have abated since the report's survey period, core CPI cooled down to an annual rate of 5.9%.

"You would expect the CPI (report) that we saw would be a big risk-off event, but the market has shrugged," said Ross Mayfield, investment strategy analyst at Baird in Louisville, Kentucky. "(Investors) were already expecting a very hawkish Fed and I don't think this affects much except uncertainty and that has something to do with why markets aren't selling off today."

The report raised odds that the Federal Reserve will raise interest rates even more than the 75 basis points previously expected. Traders of futures tied to the Fed funds target rate have now priced in the probability of a larger, 100 basis point, hike at the conclusion of its policy meeting later this month.

"If the Fed looks past the headline number, they'll see commodity prices have already begun to soften a bit" since the CPI survey period, Mayfield said, adding that a 100-basis-point rate hike based on the June CPI report could put central bank policy "behind the curve."

As seen in the graphic below, core CPI appears to confirm that inflation continues to ease from the March peak, but still has a long way to go before approaching the central bank's average annual 2% inflation target:

(Graphic: Inflation:

)

The question over whether the Fed's policy tightening could rein in inflation without tipping the economy into recession appears to be shifting to how severe the downturn is likely to be.

The Dow Jones Industrial Average fell 208.54 points, or 0.67%, to 30,772.79, the S&P 500 lost 17.02 points, or 0.45%, at 3,801.78 and the Nasdaq Composite dropped 17.15 points, or 0.15%, to 11,247.58.

Nine of the 11 major sectors of the S&P 500 lost ground, with industrials and communications services suffering the largest percentage drop, while consumer discretionary enjoyed the biggest gain.

The second-quarter earnings season will hit full stride on Thursday, when JPMorgan Chase & Co and Morgan Stanley are due to post results, followed by Citigroup and Wells Fargo & Co on Friday.

As of last Friday, analysts saw aggregate annual S&P earnings growth of 5.7% for the April to June period, down from the 6.8% forecast at the beginning of the quarter, according to Refinitiv.

Shares of Delta Air Lines slid 4.5% after the carrier's second-quarter earnings missed expectations, although Chief Executive Ed Bastian said strong travel demand will result in "meaningful" full-year profit.

The broader S&P 1500 Airlines index fell 1.7%.

Tesla Inc advanced 1.7%, while chipmakers also gained ground.

Twitter Inc jumped 7.9% after Hindenburg Research said it had taken a significant long position in company's stock.

Declining issues outnumbered advancers on the NYSE by a 1.37-to-1 ratio; on Nasdaq, a 1.08-to-1 ratio favored decliners.

The S&P 500 posted one new 52-week high and 41 new lows; the Nasdaq Composite recorded 16 new highs and 231 new lows.

Volume on U.S. exchanges was 10.66 billion shares, compared with the 12.56 billion average over the last 20 trading days.

© Copyright Thomson Reuters {{Year}}. All rights reserved.