Why a Greek Debt Restructuring Deal Could Still Collapse

Eurozone finance ministers are expected to formally endorse Greece's second bailout package on Monday. The final deal to funnel a rescue package worth 130 billion euros ($170.9 billion) is an important lifeline to the debt-hit country, for without it, Greece will default on a 14.5-billion-euro bond redemption due on March 20.

There is a lot of optimism in financial markets that the deal would be sealed today as major Eurozone powers have assured that they would not allow a disorderly Greece default.

However, according to some analysts, there are indeed chances that the proposed deal could actually collapse.

The most significant hurdle to a final deal is Greece's unwillingness to agree to further tough conditions, like the requirement of implementing a 3.3-billion-euro spending cuts and tax rises.

Clearly, if Greece does not meet the new demands, it might be politically difficult for core governments to back down, and it could make it harder for them to ratify the rescue deal in their domestic parliaments, Capital Economics analyst Ben May wrote in a research note.

He also points out that in some policy circles a disorderly default is not seen as a fearsome eventuality. After all, some core policymakers have suggested that the negative effects of a disorderly default might be limited and are therefore willing to walk away if Greece does not agree to additional tough conditions, May wrote.

May also points out that even though the deal comes through, Greece will not be free of legal wrangles as private sector creditors could sue the country. There is also the possibility that a deal agreed by Eerozone finance ministers could still be undermined if the IMF does not endorse it. And the IMF will have plenty of reasons to do so, as according to the latest proposal Greece will lower the public debt to GDP ratio to 128 percent by 2020, not 120 percent as demanded by the monetary body.

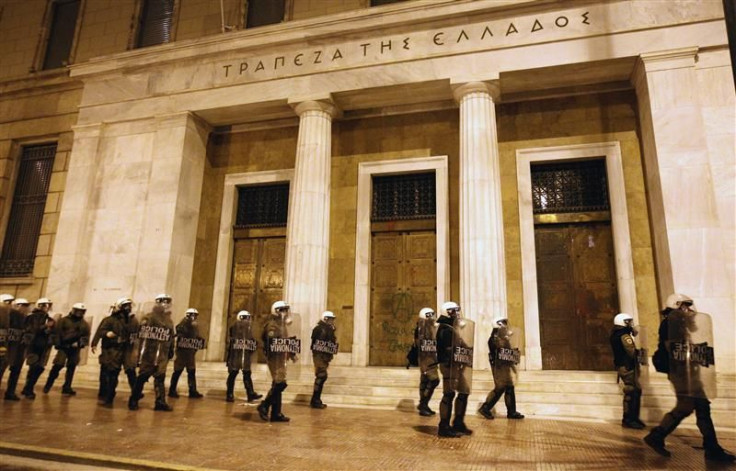

Again, the political volatility in Greece and the surging popular anger at the ever-toughening austerity measures have rankled nerves in many capitals in the Eurozone. It is pointed out that the final deal would have to be ratified by national parliaments in Germany, Finland and the Netherlands for it to become effective.

The final deal, which could be signed today, will be a relief for Greece though it will not solve all its problems.

Of course, Greece will still have to jump through plenty more hoops before it actually receives the money, writes the Wall Street Journal.

The conditions include Athens securing a 100-billion-euro debt relief deal with private bond holders and complying with some 20 outstanding conditions under its previous 110-billion-euro bailout, the Journal points out.

© Copyright IBTimes 2025. All rights reserved.