Will The Fed Cut Interest Rates? FOMC Split Amid Pressure From Trump

Money policymakers head into this week’s Federal Open Markets Committee meeting split over whether to cut interest rates for the third time in a row amid moves to expand the Federal Reserve’s portfolio.

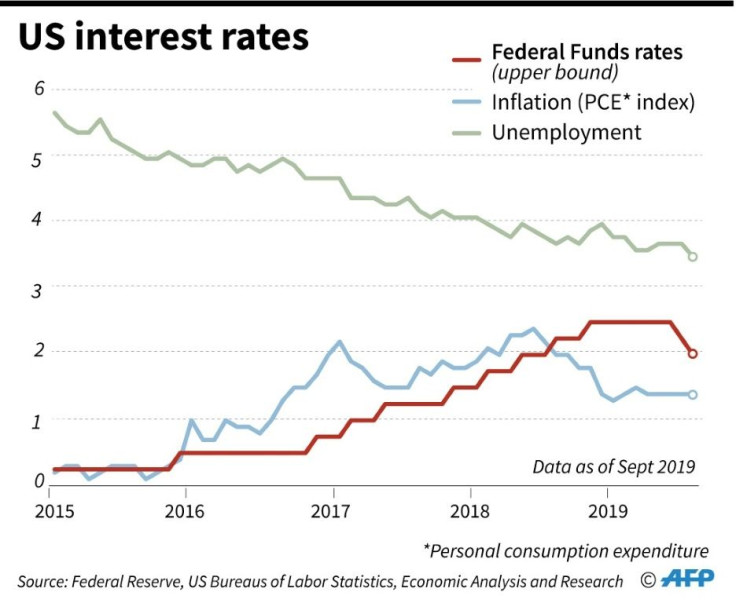

The FOMC meets Tuesday and Wednesday to consider whether to cut the federal funds rate, the rate at which banks borrow overnight, which currently stands at 1.75% to 2%, by 25 basis points as it did in July and September.

Anticipation of a cut sent markets higher Monday with the S&P 500 touching record territory.

“The Federal Reserve has had plenty of opportunities to talk the market out of an interest rate cuts this past month but have not. Not cutting rates this week will lead the market to not trusting the Fed's rhetoric,” said Charles Self, chief investment officer at iSectors, adding that the real question is how much more should the Fed cut rates.

Goldman Sachs economists put the likelihood of a rate cut at 95%. However, Boston Fed President Eric Rosengren and Kansas City Fed President Esther George already have indicated they would prefer to keep rates steady, and even if rats are cut, the accompanying statement is expected to indicate the cut will be the last for a while.

Diane Swonk, chief economist at Grant Thornton, said she thinks a rate cut would be a mistake. She said though the economy is slowing, holding off on a rate cut would make any action down the line more meaningful.

“The lesson of 1998 cuts was that the last (third) cut was not necessary; worse yet, it fueled tech bubble. There may be a very real need for a cut later this year, depending on growth and trade, but [I] still think it would be wise to wait and see at this delicate phase of cycle,” Swonk tweeted.

She said any action should await the outcome of trade talks with China and Britain’s departure from the European Union.

Fed officials have said previous rate cuts were made in response to a slowing global economy, in part due to the U.S. China trade war and uncertainty over Brexit.

Little has changed since the September meeting. Forecasts indicate the U.S. economy is slowing but the labor market remains tight. President Trump is pushing for drastic action, supporting a rate of zero or even negative rates.

The minutes from the September meeting indicate the governors voted 7-3 in favor of the rate cut. The Fed has been frustrated by its inability to boost inflation to its target 2% range, but, at the same time, needs to keep interest rates high enough to have maneuvering room if the economy falls into recession.

The Fed began buying $60 billion of Treasurys a month earlier in October after two years of reducing its holdings to boost reserves held by banks at the Fed. Chairman Jerome Powell has declined to characterize the action as quantitative easing, instead calling it a mid-cycle adjustment. The buys are intended to create a buffer to keep overnight rates from spiking.

© Copyright IBTimes 2025. All rights reserved.