Apple profit view raised at ThinkEquity

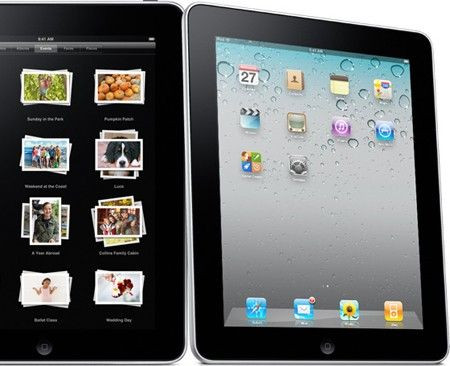

ThinkEquity has increased its profit estimates and price target on Apple Inc. (AAPL), saying that the recent expansion of iPad distribution in the U.S. and iPad's launch in more international markets, easing of supply constraints this quarter are strong positives for the company.

Apple has expanded distribution of the iPad to several retail locations such as Amazon.com, Wal-Mart, Best Buy, TJ Maxx, Marshalls, and to Verizon Wireless stores during the current quarter.

Analyst Rajesh Ghai, who has a buy rating on Apple stock, said the recent launch of iOS 4.2.1 enhances the enterprise appeal of the iPad and the successful launch of the MacBook Air provides compelling reasons to raise his estimates.

The analyst raised his fiscal 2011 profit forecast for Apple to $20.14 a share from $19.23 a share and increased revenue estimate for the same period to $95.06 billion from $91.33 billion. Wall Street expects California-based Apple to earn $18.92 a share on revenue of $86.92 billion for fiscal 2011.

Ghai expects December-quarter iPad units to be 6.5 million, iPod units to be 12.7 million and iPhone units to be 17 million.

Ghai also noted that the recent Black Friday figures released by National Retail Federation (NRF) augur well for Apple's products. NRF said shoppers have spend an estimated $45 billion over Black Friday weekend, with 212 million shoppers visiting stores and websites, up from 195 million last year.

In our opinion, this is a very positive sign for Apple, considering the high aspirational value assigned to the company's products by consumers, in our view. We also note that the iPad, the iPhone, and the iPod, according to data released by Nielsen prior to Thanksgiving, continue to top lists of products most desired by U.S. consumers this holiday season, Ghai said.

In addition, the lukewarm response to recently launched competitor Tablets, strengthens his view that the iPad is likely to maintain its lead based on its superior design, access to Content/Apps, and the Apple brand, Ghai added.

Meanwhile, the analyst expects the likely launch of the next-generation iPad (the iPad 2) equipped with a USB port to support wired connectivity to accelerate penetration into the enterprise markets in the first quarter.

We believe the likely 1QCY11 launch of iPad2 and iPhone on Verizon increase the likelihood of a stronger-than-seasonal March-ending quarter and potentially guide, said Ghai, who increased the price target on Apple stock by $25 to $375.

Shares of Apple closed Monday's regular trading session at $316.87 on Nasdaq.

© Copyright IBTimes 2025. All rights reserved.