Apple Shares Back Below 21% From Record Highs

Shares of Apple (NASDAQ:AAPL), the world's most valuable company, fell another 6.4 percent in Wednesday trading, bringing its loss since its record high of $705.07 on Sept. 21 briefly above 21 percent. The Wednesday fall was Apple's biggest daily decline since 2008.

Shares of the Cupertino, Calif., company fell $37.05 to $538.79 by the close, or 19.6 percent below the record high. Apple's low since the record high was set was $505.75, on Nov. 16.

Usually, shares of high-growth companies like Apple that gain sharply undergo a correction of about 10 percent before starting their rebound. So far, Apple seems to be defying that.

The plunge has wiped out $145 billion in the company's market capitalization, which now is about $506 billion, still way above that of No. 2, Exxon Mobil Corp. (NYSE:XOM), with a market capitalization of $400 billion.

Analysts have warned Apple, which has lost the No. 1 slot in smartphones to Samsung Electronics (KRX:005930) and faces heightened competition to its iPad from rivals including Amazon.com (NASDAQ:AMZN), Google (NASDAQ:GOOG) and Microsoft Corp. (NASDAQ:MSFT), might report reduced earnings ahead.

On Tuesday, analysts at IDC suggested high costs for the iPhone 5 may impede sales in emerging markets.

On the other hand, analysts such as Steven Milunovich of UBS rate the shares a “buy” with a price target of $780, in part due to “user confusion,” which he said benefits Apple in sales of all kinds of electronics, including MacBooks.

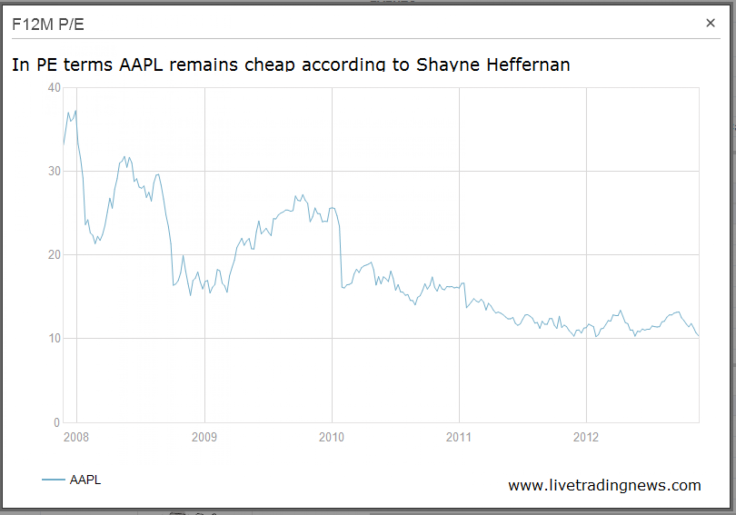

As well, at a lower share price, Apple's price-to-earnings (P/E) ratio has declined to 12.2 now, compared with 21.59 for Google and 14.29 for Microsoft. That makes the shares more attractive to investors.

© Copyright IBTimes 2024. All rights reserved.