Apple stock still cheap relative to its quality: Einhorn

Apple (NASDAQ:AAPL) stock is still cheap relative to its growth potential and quality, said hedge fund manager David Einhorn on Bloomberg TV.

Einhorn, most famous for predicting the demise of Lehman Brothers, said that usually companies with Apple's quality of brand and products sell at 40 times, 60 times, or even 80 times their earnings.

However, Apple is actually selling at only 21 times its earnings currently. However, if one takes into account the massive hoard of cash the company is sitting on -- which was at $25.6 billion as of third quarter 2010 -- its price to earnings multiple is actually the same as that of the broader market, according to Einhorn.

Currently, the S&P 500 index is trading at roughly 14 times its earnings.

At Apple's current valuation, investors do not even need to be too concerned about some of the risks Apple bears often cite, said Einhorn.

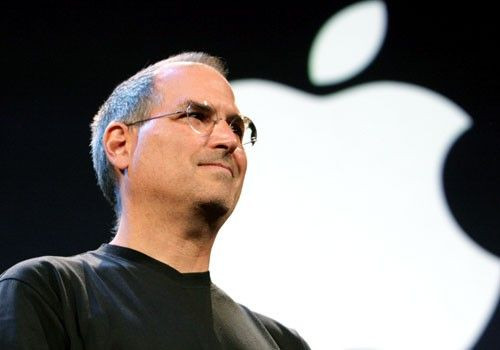

One, they should not unduly worry about Steve Jobs' health.

Two, they should not be too apprehensive about the failure of Apple's next product. Einhorn said Apple has a broad portfolio and is not dependent on any single product.

Furthermore, he said Apple has natural growth opportunities.

First, the iPad is still in the early stages of its product life and there is little risk that it will not succeed. Second, the iPhone, which was previously only available on AT&T, will soon be available on Verizon. Einhorn also said he wouldn't be too surprised if all of the cell phone networks eventually carry it.

© Copyright IBTimes 2025. All rights reserved.