'King of Bonds' sees municipal bonds collapse, plans to buy after carnage

Jeffrey Gundlach of DoubleLine Capital, dubbed 'King of Bonds' by Barron's, sees a major collapse in the municipal-bond market. After the carnage happens, he plans to scoop up the bargains left behind.

Bond investors should pay attention to what he says. After all, he's a leading candidate for the title 'King of Bonds' (the other is PIMCO's Bill Gross). He earned that title by consistently notching top-tier returns for many years and for predicting the sub-prime mortgage crisis back in 2006.

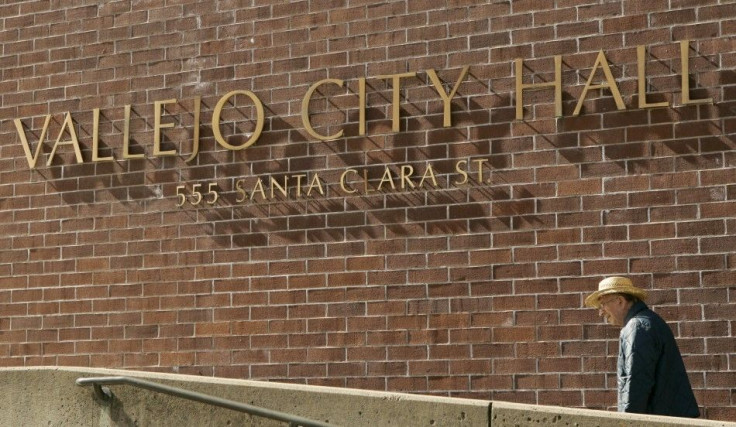

Now, he thinks municipal bonds may be the next victim. On the fundamental side, he sees the weakness of state and local government finances, something that's more or less obvious to many analysts.

Gundlach, however, supplements that fundamental view with an astute observation: the municipal bond market has a weak psychological underpinning.

He said many investors in this market are wealthy individuals who buy the securities purely because of their tax advantages and have little knowledge of the fundamentals of the paper they own.

Moreover, they tend to be all-in investors who don't really own other financial assets.

Therefore, as billions of dollars of defaults pour in (the actually amount doesn't matter, said Gundlach), these investors will panic and sell.

Closed-end municipal bond funds may drop to as low as 40 percent of net asset value, according to Gundlach. In other words, relative to the worth of the funds' portfolios, the shares of these funds would trade at a 60 percent discount.

When that happens, Gundlach plans to use a joint venture he set up with RiverNorth Capital to buy up these funds.

Gundlach also has a bearish prognostication for the US real estate market: he expects it to fall by another 10 to 15 percent.

Email Hao Li at hao.li@ibtimes.com

Click here to follow the IBTIMES Global Markets page on Facebook

Click here to read recent articles by Hao Li

© Copyright IBTimes 2024. All rights reserved.