Solyndra Scandal: E-mails Show White House Questioned Solyndra's Viability Early On

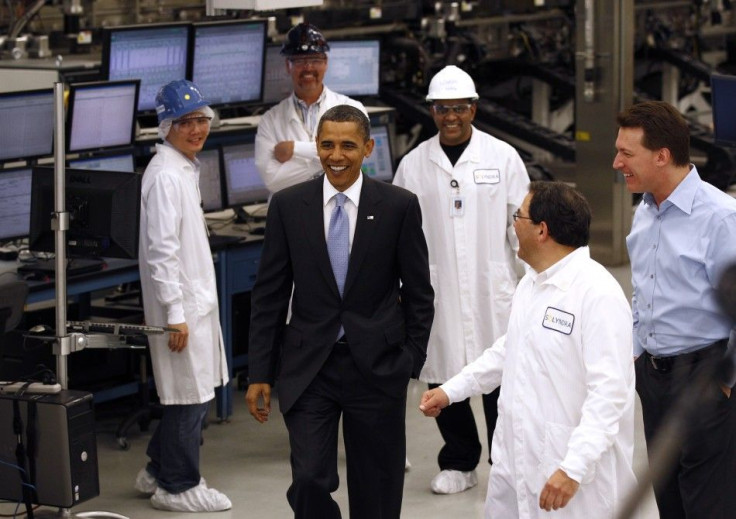

Before President Obama's May 2010 to now-bankrupt solar equipment manufacturer Solyndra, a Silicon Valley investor as well as White House officials urged the Obama administration to reconsider the president's visit to the start-up company because of its escalating financial problems.

The information, discovered in newly disclosed e-mails released by Democrats on the House Energy and Commerce Committee, indicate the White house was repeatedly warned that Solyndra -- which filed for bankruptcy in late August and subsequently announced it was laying off 1,100 employees --was close to a financial collapse. Moreover, a seven-page report based on the new documents reveals that top White House officials recognized that the solar energy company faced serious business problems and that a government investment could potentially reflect poorly on the president.

A number of us are concerned that the president is visiting Solyndra, Silicon Valley investor and Obama fundraiser Steve Westly wrote to Obama senior adviser Valerie Jarrett in May 2010. Many of us believe the company's cost structure will make it difficult for them to survive long term. . . . I just want to help protect the president from anything that could result in negative or unfair press.

The e-mail, written shortly before the president made his Solyndra visit on May 25, also warns that if the White House was unable to reschedule the event the president should be careful about unrealistic/optimistic forecasts that could haunt him in the next 18 months if Solyndra hits the wall, files for bankruptcy, etc.

Jarrett contacted Vice President Joe Biden's Chief of Staff Ron Klain about Westly's warning, who then contacted officials at the Department of Energy (DOE) to inquire about Solyndra's stability. The agency defended Solyndra, arguing that the company was growing strongly, although there were hints that it could face some long-term struggles.

In an e-mail sent on May 24, 2010 Matt Rogers, a senior adviser to Energy Secretary Steven Chu on stimulus funding, wrote that the concerns were typical among Silicon Valley start-ups and the company should be strong going into the fall with their new facilities on line.

Klain forwarded the response to Jarrett and gave her his own assessment, acknowledging that while there were inherent risks to investing in the project that's true of any innovative company that [the president] would visit. It looks like it is OK to me, but if you feel otherwise, let me know.

Redpoint Ventures Questioned Summers

That was not the only probe into Solyndra's financial stability. In an earlier December 2009 e-mail exchange, Brad Jones, an executive at Redpoint Ventures -- which, invested in Solyndra -- questioned Lawrence Summers, the Director of the National Economic Council, on why the government was investing so much money into the company when there were questions surrounding its future.

One of our solar companies with revenues of less than $100 million (and not yet profitable) received a government loan of $580 million, he wrote to Summers, who was the president's chief economic adviser at the time. While that is good for us, I can't imagine it's a good way for the government to use taxpayer money.

The investment, according to Jones, indicated there were broad problems surrounding the DOE's $38 billion program to monitor clean energy projects, saying the allocation of spending to clean energy is haphazard and the government is not equipped to decide which companies should receive investments.

Moreover, officials at the White House's Office of Management and Budget (OMB) were concerned about how the Department of Energy handled the loan deals after they were finalized.

DOE's 'system' for monitoring loans is quite problematic (barely any review of materials submitted, no synthesis for program management, inherent conflicts in origination team members monitoring the deals they structured, etc) and does not seem to be a program priority, one Management and Budget official wrote in the spring of 2010.

If the OMB is right, then Solyndra may be a precursor to widespread problems with companies getting loan guarantees from the U.S. government.

What's terrifying is that after looking at some of the ones that came next, this one started to look better, said one April 2010 e-mail, referring to the Solyndra decision, and others that followed, The New York Times reports. Bad days are coming.

In the report, the House Committee on Energy and Commerce wrote that while messages show there was some disagreement surrounding the government's interest in Solyndra, there is no indication that the administration showed political favoritism towards the company, who counts a major Obama fundraiser among its investors.

Moreover, the committee concluded that while in hindsight it is obvious that OMB officials were right about Solyndra's future and DOE officials were wrong, that does not mean it was incorrect for the White House to rely on the agency's advice. The report cites Title 17 of the Energy Policy Act, which is intended for projects that employ new or significantly improved technologies that necessarily entail risk. Moreover, the report said the newly released documents show that senior officials who were aware of Solyndra's risk consulted with relevant officials and made their ultimate choice based on an assessment of the company's intrinsic worth, not political pressure.

© Copyright IBTimes 2024. All rights reserved.