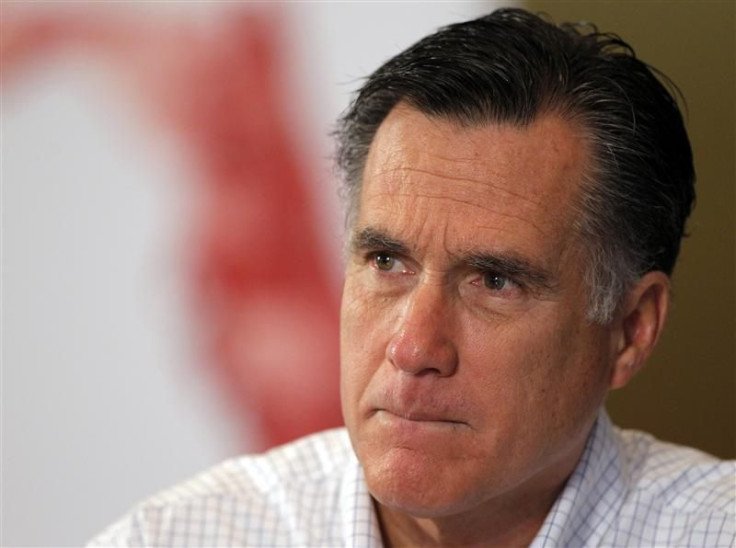

Mitt Romney Tax Returns - 52% of Americans Want Higher Capital Gains Tax: Poll

The release of Mitt Romney's tax returns Tuesday has added fuel to the national debate over how income from wages and investments should be taxed.

Returns showed that the wealthy former Massachusetts governor's effective tax rate for 2010 was 13.9 percent because his income for the year, $21.6 million, was mainly derived from capital gains and dividends, which are taxed lower than regular wages.

A slight majority of Americans favor taxing capital gains and dividends -- a payment from corporation to a shareholder -- at the same rate as work income, according to a new poll from The New York Times and CBS.

The poll showed 52 percent of Americans want a tax policy that does not discriminate sources of income, whether it comes from a pay check or a profit from an investment. More than a third Americans, however, wants investment and shareholder-related income taxed lower than wages to spur investments that boost the economy.

Currently, the top tax rate for long-term capital gains is 15 percent, compared to 35 percent for wage earners. In Romney's case, he paid $6.2 million in federal taxes on $42.5 million in income in 2010 and 2011.

The fairness of the tax code is going to play a major role in the 2012 presidential elections. President Barack Obama is planning to discuss the Warren Buffett Rule -- a tax increase on individuals earning more than a million dollars that is named after the billionaire investor who noted that he has a lower tax rate than his secretary.

The poll from the Times and CBS shows that support for higher tax rates for capital gains and dividends breaks on partisan lines. More than two-thirds of Democrats surveyed want these sources of income taxed like regular wages, while more than half of Republicans want to keep the tax rate lower, the poll said.

Independents, the oft-courted group of voters, sided with Democrats in wanting the same tax rate for investment and wage income, at 54 percent, according to the poll.

© Copyright IBTimes 2025. All rights reserved.