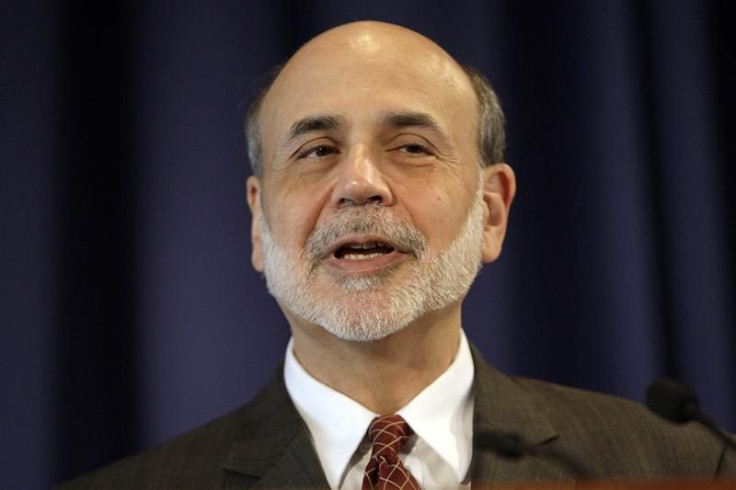

Bernanke Calls For More Shadow Banking Curbs

Federal Reserve Chairman Ben Bernanke is pushing for new steps to stem risks he said arise from shadow banking and said the economy is still suffering from the 2008 financial crisis.

The heavy human and economic costs of the crisis underscore the importance of taking all necessary steps to avoid a repeat of the events of the past few years, Bernanke said Monday night in a speech at a conference hosted by the Federal Reserve Bank of Atlanta in Stone Mountain, Ga.

Bernanke said the Fed is aiming to avoid the mistakes of the last crisis and that merely to address problems exposed by the crisis was not enough.

Gaps in the regulatory structure, which allowed some systemically important nonbank financial firms to avoid strong, comprehensive oversight, were a significant contributor to the crisis, he said.

Even as the Fed makes progress on known vulnerabilities, it must be mindful that the financial system is constantly evolving, and that unanticipated risks to stability will develop over time, Bernanke added.

An important lesson learned from the financial crisis is that the growth of what has been termed 'shadow banking' creates additional potential channels for the propagation of shocks through the financial system and the economy, Bernanke said.

Shadow banking typically refers to institutions and financial practices that are not regulated as traditional commercial banking activity is regulated. Shadow banking institutions include hedge funds, money market funds and so-called structured investment vehicles. It also includes such practices as off-balance sheet securitizations and hedged risk through off-balance sheet credit default swaps.

Given the substantial stakes arising from shadow banking, Bernanke expressed concern about the risks posed by money market funds and the tri-party repo market, while also noting some areas of improvements. In a tri-party repo, the seller of a security agrees to buy back that security from its buyer with a third party acting as an intermediary.

Bernanke supported efforts to increase the resiliency of money market funds, referring to Securities and Exchange Commission proposals to require funds to maintain loss-absorbing capital buffers or to redeem shares at the market value of the underlying assets rather than at a fixed price of $1.

The Fed chief also pointed to reform efforts such as rules requiring structured finance vehicles to be brought onto bank balance sheets and an industry panel's recommendation to eliminate intraday credit in the tri-party repo market.

Intraday credit, while a great convenience in normal times, may foster systemic risk by creating large mutual exposures between securities dealers and clearing banks. The sector is subject to sharp volatility when participants lose confidence in one another, and this market played a key role in the fall of Lehman Brothers in 2008.

About three and a half years have passed since the darkest days of the financial crisis, but our economy is still far from having fully recovered from its effects, Bernanke said.

Bernanke did not touch on the economy or interest-rate policy during his appearance Monday night.

© Copyright IBTimes 2024. All rights reserved.