Worldwide Smartphone Market Soaring, Samsung To Take Global Lead: IDC

The worldwide smartphone market grew by 42.5 percent year-over-year in Q1 2012, with South Korean technology giant Samsung overtaking Cupertino-based Apple for the smartphone leadership position.

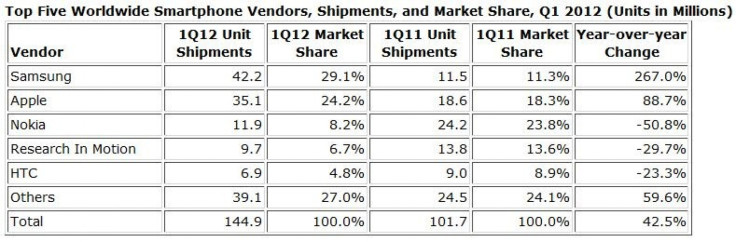

According to the International Data Corporation (IDC), vendors shipped 144.9 million smartphones in Q1 2012, compared to 101.7 million units in Q1 2011. The 42.5 percent year-over-year growth was 1 percent higher than IDC's forecast of 41.5 percent for the quarter. However, it was lower than the 57.4 percent growth in the fourth quarter of 2011.

While Samsung captured 29.1 percent of the smartphone market as compared to just 11.3 percent last year, Apple captured 24 percent of market share, which was a growth of around 6 percent. Both Samsung and Apple gained at the expense of other players like Nokia, RIM, and HTC, whose market share plunged heavily over the last year.

Chart: Top Five WW Smartphone Vendors, 1Q 2012, Five Quarter Market Share Changes (Units)Description: Source: IDC Worldwide Quarterly Mobile Phone Tracker, May 1, 2012Note: Vendor shipments are branded shipments and exclude OEM sales for all vendors. IDC's Worldwide Quarterly Mobile Phone Tracker provides smart phone and feature phone market data in 54 countries by vendor, device type, air interface, operating systems and platforms, and generation. Over 20 additional technical segmentations are provided. The data is provided four times a year and includes historical and forecast trend analysis. For more information, or to subscribe to the research, please contact Kathy Nagamine at 1-650-350-6423 or knagamine@idc.com. For more information about this tracker go to: http://www.idc.com/tracker/showproductinfo.jsp?prod_id=37Tags: IDC, Tracker, Mobile Phone, Mobile Phones, Mobile Phone Tracker, 1Q201 ...Author: IDCcharts powered by iCharts

Below are the highlights of the top five smartphone vendors, provided by IDC:

Samsung: Samsung reclaimed the smartphone leadership position and established a new market record for the number of smartphones shipped in a single quarter. Propelling the company forward was continued expansion of its Galaxy portfolio in nearly all directions - new and old smartphones, product and market segmentation, and multiple price points, screen sizes, and processor speeds.

Apple: Apple slipped to second place in the worldwide smartphone market, but nonetheless posted strong year-over-year growth to reach 35.1 million units shipped. Apple's gains in the market benefited from iPhone availability at additional mobile operators worldwide, as well as sustained end-user demand among both consumers and enterprise users.

Nokia: Nokia's Symbian phone shipments declined precipitously last quarter as demand dropped in key emerging markets, such as China. The company's current smartphone woes make a speedy transition to products powered by the Windows Phone operating system, upon which it has bet its smartphone future, critical.

Research In Motion: RIM's BlackBerry unit decline continued last quarter, reaching levels not seen since 2009. Like Nokia, RIM is a company in transition. Smartphones running on its new platform, BB 10, will be released later this year. Until then, results like these may be a sign of things to come.

HTC: HTC's struggles in the US market once again negatively affected its overall performance. However, its relatively strong performance in Asia/Pacific still allowed the company to maintain its position among the top 5 smartphone vendors. The company is staking future success in large part on its One X and S products.

The race between Apple and Samsung remained tight during the quarter, even as both companies posted growth in key areas, said Ramon Llamas, senior research analyst with IDC's Mobile Phone Technology and Trends program. Apple launched its popular iPhone 4S in additional key markets, most notably in China, and Samsung experienced continued success from its Galaxy Note smartphone/tablet and other Galaxy smartphones. With other companies in the midst of major strategic transitions, the contest between Apple and Samsung will bear close observation as hotly-anticipated new models are launched.

Overall Decline In The Mobile Phone Market

Despite the growth of the global smartphone market, the overall worldwide mobile phone market declined 1.5 percent year-over-year in the first quarter of 2012 with vendors shipping 398.4 million units during the quarter, compared to 404.3 million units in the first quarter of 2011.

Thanks to its gains in the smartphone market over the past two years, Samsung again topped the chart with 23.5 percent of the market share, dwarfing long-time global market leader Nokia with 20.8 percent of the market share.

According to Kevin Restivo, senior research analyst with IDC's Worldwide Mobile Phone Tracker program, Samsung used its established relationships with carriers in a mix of economically diverse markets to gain share organically and at the expense of former high fliers such as Nokia.

The Verge reported that the shift towards smartphones and overall decline in the mobile market could be part of the cause for Samsung overtaking Nokia. The Finnish mobile phone manufacturer has focused more on selling low-priced handsets to developing markets over the past year.

Both Nokia and HTC seem to make powerful attempts to get themselves back into the competition with the launch of new handsets recently (HTC with the One series, Nokia with the Lumia). However, given that Samsung is releasing its flagship Galaxy S3 smartphone on Thursday and the next Apple iPhone is expected later this year, it will be interesting to see whether devices from Nokia and HTC can regain their lost ground.

© Copyright IBTimes 2025. All rights reserved.