Get Ready For The Fed?s Summer Sequel - Operation Twist 2

Let's Twist again

The prolonged sovereign debt crisis in the euro zone, coupled with signs the U.S. economic recovery is faltering, have led to speculation the Federal Reserve will provide more monetary stimulus, most likely through extending its Operation Twist program, at the June two-day Federal Open Market Committee meeting, which concludes on Wednesday.

The current $400 billion Operation Twist, which is set to expire at the end of June, twists the yield curve -- that is, changes the normal shape of the yield curve -- by selling short-term securities that the Fed holds while buying longer-term securities. The aim is to keep downward pressure on long-term interest rates.

The Fed may not want to let the program expire at a time when concerns about the health of the economic recovery are growing, Paul Dales, senior U.S. economist at Capital Economics, wrote in a note.

Activity data released since the last FOMC meeting have been disappointing. Job creation has been barely chugging along at a pace of around 150,000 over the past 12 months. Goldman Sachs downgraded its outlook on U.S. gross domestic product for the second quarter to an annualized growth rate of 1.6 percent from their earlier call of 1.8 percent. This would be the fourth quarter of the past five with below 2 percent growth.

Meanwhile, May headline Consumer Price Index inflation dipped to 1.7 percent annually, but core held steady at 2.3 percent. With declines in oil prices and recent weakness in employment, the FOMC will likely judge inflation risks as dissipating.

However, unless the U.S. economy loses a lot more momentum or the eventual financial contagion from the crisis in Europe is much greater than expected, many economists doubt that the Fed will launch a third round of quantitative easing, or QE3, particularly not as soon as this Wednesday.

In Greece, the newly elected New Democracy party is supportive of Europe's bailout plan for Greece and its attached austerity measures. This has dampened some imminent fear over the euro zone crisis, as well as the hope for a more aggressive asset purchasing program.

Michael Hanson, senior economist at Bank of America Merrill Lynch, sees roughly a 1-in-3 chance of the Fed pursuing an extension of Operation Twist at the June FOMC meeting, rather than a more aggressive action.

This action would give the Fed a few more months to sort out whether the recent softness in data is mainly payback for gains during the warm winter weather, or a more prolonged slowdown. If the latter is the case, then more outright asset purchases that expand the balance sheet -- QE3 -- would become likely.

Hanson thinks the June FOMC will produce a dovish statement and negative forecast revisions, which could pave the way for QE3, by the Aug. 1 or Sept. 13 FOMC meeting. Moreover, the Fed might not start hiking interest rates until mid-2015 at the earliest.

The aim of Operation Twist is to push down long-term interest rates, thereby making it cheaper for businesses to get loans and consumers to get mortgages.

While Operation Twist's effect on the economic recovery remains questionable, it did push down long-term Treasury yields. Since the program started in October, the interest rate on 10-year bonds touched an all-time-low of 1.44 percent on June 1. Mortgages are tied to 10-year Treasury rate, and the move has brought down home loans.

According to Freddie Mac, mortgage rates have fallen to a new record low in the week ended June 7. The 30-year fixed-rate mortgage dropped to an average of 3.67 percent - its sixth consecutive week of declines and well below the year-ago rate of 4.49 percent.

However, Operation Twist is a one-shot deal in the sense that once the stock of short-maturity financial instruments are used, you cannot continue to extend the maturity of the portfolio, Hakan Danis, senior U.S. economist with BBVA Compass, the trade name of Compass Bank, pointed out in a note.

According to statistics in Fed's Vice Chair Janet Yellen's recent speech, the Fed has just around $180 billion left in 3-month to 3-year Treasuries and around $550 billion in holdings of 3- to 6-year Treasuries. This means Operation Twist could be extended for only a maximum of about six months.

One option for the Fed could be to sell all its remaining stock of short-term Treasuries, but price discovery in the market may not be to the Fed's liking and usually the Fed holds on to a proportion of the issuance it purchases.

The next plausible choice is for the Fed to sell its holdings of 3- to 4-year Treasuries. However, this would offer less maturity extension than selling short-term Treasuries.

The Fed will therefore decide to convert the proceeds of these sales partially into purchases of Agency Mortgage-Backed Securities (MBS). This will have the effect of more directly stimulating residential investment and offsetting the less-efficient maturity extension, according to Danis.

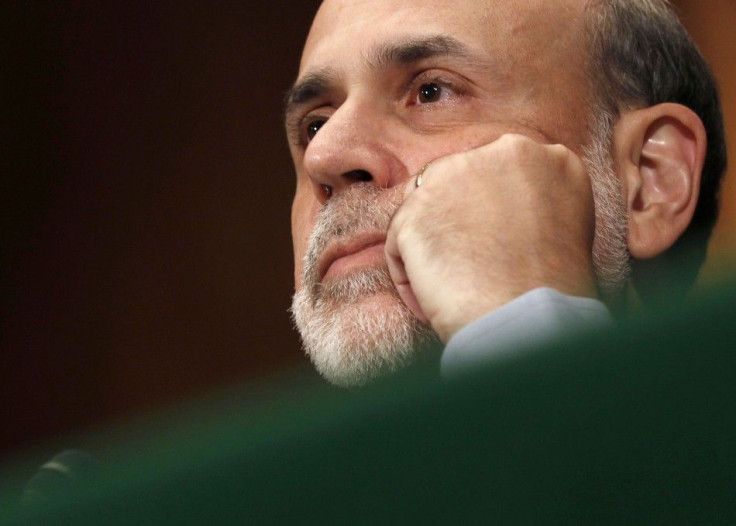

In his congressional testimony on June 7, Fed Chairman Ben Bernanke gave few details about whether or not the market should expect any accommodative action in the next meeting. That said, he did confirm that QE is still on the table as an option and that they are ready to adjust the balance sheet if necessary.

However, it is hard to imagine that any further policy action would miraculously alter the economic outlook, Dales said.

© Copyright IBTimes 2025. All rights reserved.