Shrinking Share Of Exports To Asia Has Cost US Economy A Fortune, Countless Jobs

Four years ago, for every five shipping containers that Asia sent to the U.S., America sent back only two, resulting in gluts of empty containers at U.S. West Coast ports and a widening trade deficit with countries like China and Japan.

The Asia-Pacific region has been the fastest-growing destination for U.S. exports, expanding by 89 percent between 2001 and 2010, compared with 48 percent growth in U.S. exports to Europe. The value of U.S. imports into 12 key Asia-Pacific markets rose from $208.4 billion in 2000 ($253 billion in 2010 dollars) to $358.6 billion in 2010.

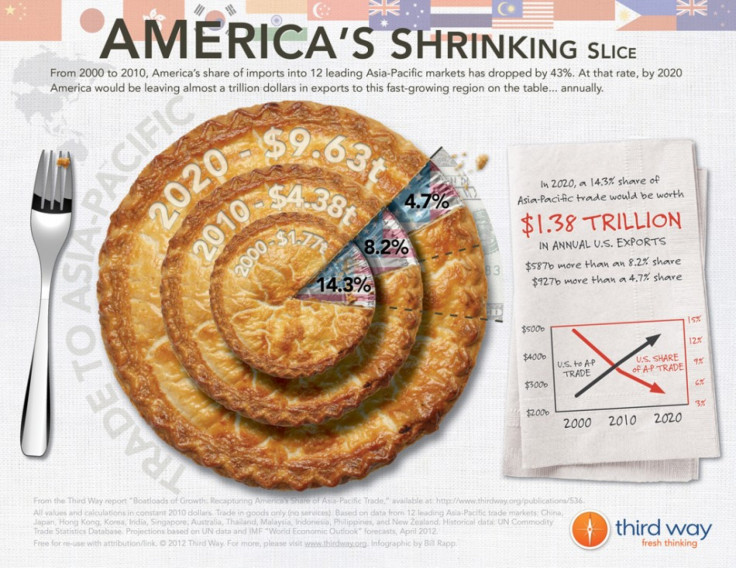

Yet, at the same time, America's share of Asia-bound trade has been declining. In 2000, the U.S. accounted for 14.3 percent of the imports of goods into 12 key Asia-Pacific nations. By 2010, that share had fallen to 8.2 percent. If the trend continues, the U.S. is on track to claim just 4.7 percent of a nearly $10 trillion market in 2020, according to a new analysis by the think tank Third Way.

This 'shrinking slice' has cost the U.S. economy hundreds of billions of dollars in trade and untold numbers of jobs, said the report's author, Ed Gerwin, senior fellow for trade and global economic policy at the Washington-based think tank.

One of the main reasons for the falling U.S. market share in the Asia-Pacific is the continuing proliferation of trade deals among other countries in the region.

According to the report, in 2000, the Asia-Pacific region had four major trade arrangements. Today, there are 39 major pacts. Since most of these trade arrangements exclude the U.S., American exporters are being left out when new opportunities arise in growing Asian markets.

As countries in the region continue to pursue trade deals that reduce trade barriers among themselves, their existing barriers to U.S. exports will loom even larger, Gerwin said.

The U.S. can't afford to let the opportunity to fill more boxes bound for Asia-Pacific markets with Made in the USA products slip away.

The days when Asia was primarily a low-cost producer of goods for American and European consumers are over. In fact, an Ernst & Young report showed that container traffic into China is already expanding faster than China's outbound shipments.

Six of the world's 10 fastest-growing major economies in the coming decade (including China and India) will be Asian countries, creating a rapidly expanding flock of new middle-class consumers who are increasingly demanding high-quality products.

The Asia-Pacific middle class is expected to triple by 2020, growing from 525 million in 2009 to 1.75 billion in 2020, vaulting from less than one-third to over one-half of the world's total.

In turn, this swelling and increasingly urban middle class will power a huge escalation in private consumption across developing Asia, in countries including Indonesia, Malaysia and Vietnam. By 2020, China's private consumption alone is forecast to increase some ten-fold, to $10 trillion.

Most importantly from America's perspective, this robust growth will power surging trade in the Asia-Pacific, creating countless opportunities for U.S. exporters. By 2020, annual imports of goods by 12 leading Asia-Pacific economies will surge to $9.63 trillion (in 2010 dollars), more than double their value ($4.38 trillion) in 2010, according to Third Way's analysis.

The prize for cracking open the Asia-Pacific market is enormous, Gerwin said.

If the long-term decline in the U.S. share of Asia-Pacific markets continues, America will be missing out on a major economic boost from the growth in Asia-Pacific trade in the years ahead.

To put this vast 2020 Asia-Pacific market in perspective, an import market of $9.63 trillion (in 2010 dollars) would be two-thirds the size of the entire U.S. economy in 2010. And Third Way's projection does not include Asian imports of services, such as finance, logistics, entertainment, and professional services, which will account for hundreds of billions of dollars or more in additional imports in 2020.

In 2020 alone, if the U.S. can recapture the 14.3 percent share it had in 2000, the report projects U.S. exports can yield $587 billion more -- equivalent to almost half of America's total goods exports to the entire world in 2010 -- and more than 3 million more U.S. jobs than America's 2010 share of 8.2 percent.

© Copyright IBTimes 2025. All rights reserved.