Jackson Hole QE3 Guessing Game Heats Up

Financial world waits for Bernanke's Aug. 31 speech

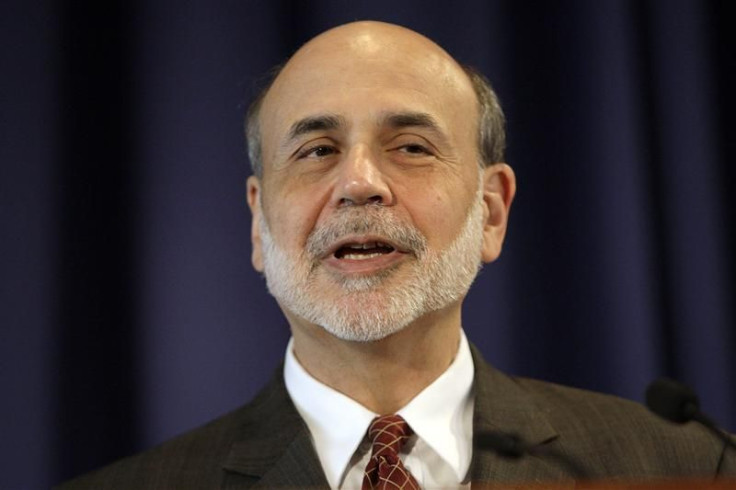

Two years after Federal Reserve Chairman Ben Bernanke announced plans for a massive second round of monetary stimulus at a yearly Fed summit in Jackson Hole, Wyo., market watchers are beginning to take odds on the chances that his speech at this year's Jackson Hole summit could produce a similar announcement.

Even though Bernanke's speech is more than two weeks away, a slow economic calendar this month plus the fact that many developments in Europe are on pause as the Continent's leaders go on their cherished August vacations, has stoked a high degree of guessing.

On Monday, Bank of America released a report estimating what the gains in stock market prices from a Fed announcement of further easing could be, estimating the increase in equity prices last time around to about 8 percent. Even earlier, on Aug. 9, Art Cashin at UBS noted that it was his expectation that "Bernanke may flesh [further action] out in coming weeks and certainly at Jackson Hole."

Of course, not everyone is bullish on what the Fed will do. Goldman Sachs, for one, sees recent positive economic data as taking away some pressure from inflation hawks, making it less likely Bernanke will announce a third round of stimulus, also known as quantitative easing or QE3.

"We believe that continued weakness is necessary to prompt a substantial easing move. And so far, that weakness is not showing up in the data," Jan Hatzius, chief economist at Goldman Sachs, wrote in a note Wednesday

"Our call remains that the return to QE will not happen until late 2012/early 2013, and at the margin the recent data have made us a bit more confident."

With two weeks to go, a lot more guessing is in the works.

© Copyright IBTimes 2025. All rights reserved.