Asian Stocks Open Mixed After China Manufacturing, Share Slump Roiled Global Markets

UPDATE: 9 P.M. EST -- Asian stocks are mixed late Tuesday morning, with Shanghai down 0.7 percent and Shenzhen off by 0.3 percent. However Singapore's STI has reversed earlier losses to rise 0.3 percent, while Japan's Nikkei 225, which opened lower, has swung between gains and losses. South Korea remains up, Australia and New Zealand down.

Original story:

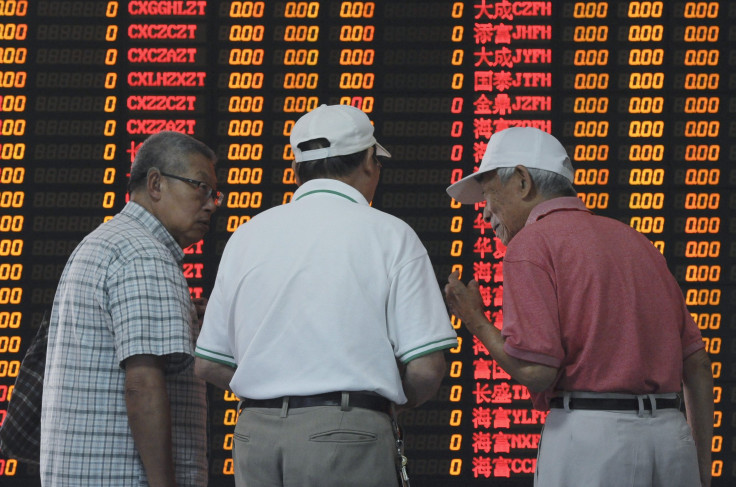

Asian stocks fell for the second day in the new year, battered by weak manufacturing data and a stock slump in China, and by worsening tension between Saudi Arabia and Iran.

Japan's Nikkei 225 fell 0.4 percent, Singapore's STI dropped 1.6 percent and Australia's ASX 200 and New Zealand's NZX 50 both declined more than 1 percent. South Korea's KOSPI gained 0.2 percent.

In the U.S. Monday, the Dow Jones Industrial Average and Standard & Poor's 500 both fell more than 1.5 percent. The Nasdaq Composite dropped 2.1 percent. It was the worst first day of trading in the U.S. since 2008.

Over the weekend, Saudi Arabia executed Shiite cleric Nimr al-Nimr on terrorism charges, drawing an official protest from Iran and a demonstration that left the Saudi Embassy in Teheran in flames. Saudi Arabia — dominated by the Sunnis, the other main branch of Islam — then cut diplomatic ties with Iran. Oil rose as much as 3 percent on Monday, before closing lower, which some analysts attributed to the global stock slide.

On Monday, China's Caixin Purchasers Managers Index, which measures industrial activity at private and small enterprises, came in at 48.2 for December, a 10th straight decline and an unexpected one. Analysts had expected a reading of 49. On Jan. 1, the government already reported a fifth straigtht decline in its official PMI.

These data dragged down China's CSI 300 stock index, which tracks stocks traded in Shanghai and Shenzhen, by 7 percent, triggering an automatic trading suspension. Other Asian markets followed, and then Europe and the U.S.

"There was the turmoil overnight overseas that kind of set the tone," said Michael O'Rourke, chief market strategist at JonesTrading in Greenwich, Connecticut, as reported by Reuters.

© Copyright IBTimes 2025. All rights reserved.