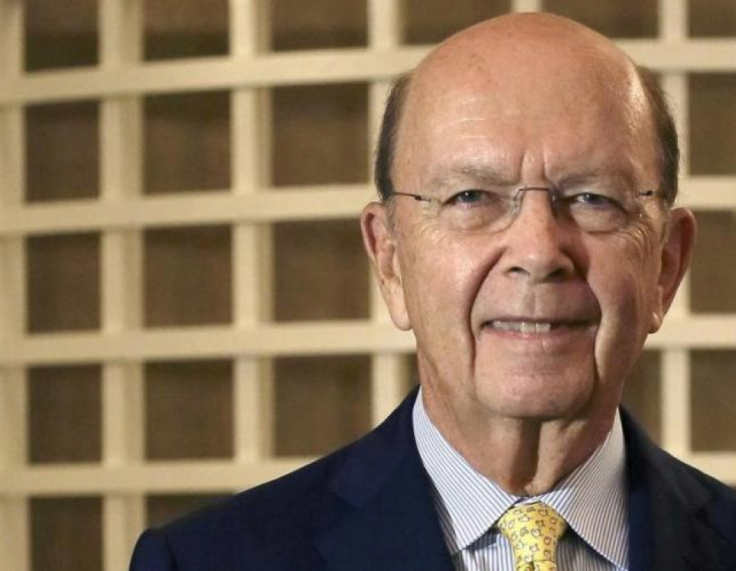

Billionaire Investor Wilbur Ross Says Greece’s Approach To Bank Recapitalization May Turn Off Investors

ATHENS, Greece (Reuters) -- Billionaire investor Wilbur Ross, a major shareholder in Greece's Eurobank, said Saturday that diluting shareholders of the banks during their recapitalization could turn off private-investor interest in the lenders. "In view of the volatility of politics in Greece, investors will not be comfortable with committing new equity capital to banks that are effectively nationalized," Ross, chairman and chief strategy officer of the WL Ross & Co. LLC investment company, said in a statement.

Ross said this applies particularly in the case of Eurobank, the only one of the four big banks that is majority-owned by the private sector. "In view of how well Eurobank performed in the [European Central Bank] analysis, there is clearly no justification to interfering with its management or governance," he said.

The ECB's health check showed that Eurobank, which is 35.4 percent owned by the bank-rescue fund called the Hellenic Financial Stability Fund (HFSF), needs to cover a capital shortfall of 2.12 billion euros ($2.33 billion) -- the lowest amount among the four lenders.

"Since it was the actions of the government that caused the imposition of capital controls and since these in turn have led to the need for equity, it would be nonsensical for the government now to dilute shareholders at share prices that are a small fraction of the underlying value," Ross said. "Doing so will endanger the success of the private-sector financing and reduce the likelihood of investor participation in the forthcoming privatizations."

(Reporting by George Georgiopoulos)

© Copyright Thomson Reuters {{Year}}. All rights reserved.