BlackBerry Ltd. (BBRY) Posts Minuscule Profit In Fiscal Q3 As Revenue Continues To Slide

BlackBerry Ltd. (NASDAQ: BBRY) is far from being the highly profitable company it once was, but its fiscal third quarter showed signs of improvement.

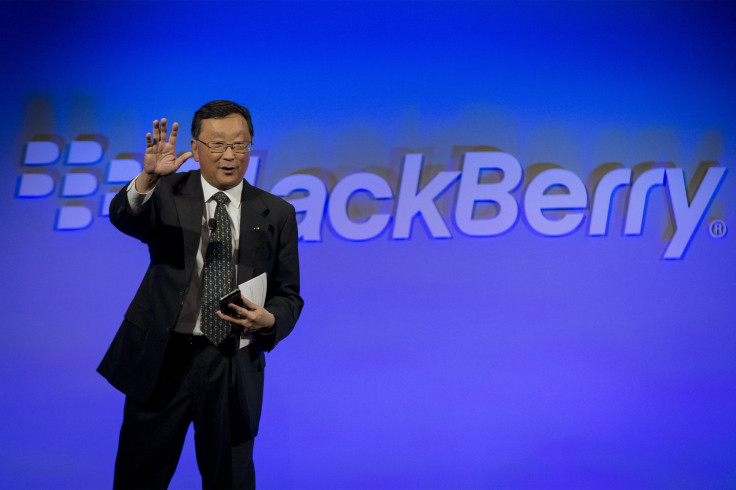

CEO John Chen’s aim, since taking the helm in November 2013, has been to get the company back in the black, but he admits that’s going to take some time. “We achieved a key milestone in our eight-quarter plan with positive cash flow,” Chen said in a press release. “Our focus now turns to expanding our distribution and driving revenue growth.”

BlackBerry reported on Friday a net loss (GAAP) of $148 million, or 28 cents per share for its third fiscal quarter, an improvement from the loss of $4.4 billion, or $8.37 per share posted in the year-prior quarter. Revenue fell 34 percent to $793 million. Adjusted figures, not including charges and other items, indicate that BlackBerry earned 1 cent per share. Analysts polled by Thomson Reuters were expecting a loss of 5 cents per share on revenue of $932 million.

Amid the explosion of touchscreen smartphones, BlackBerry, which is known for handsets that feature physical keyboards, has largely fallen out of favor with consumers. To offset its decline in sales to the public, the company lately has focused on providing high-security hardware and mobile device management software to business users, including those working in health care, finance and the government.

Attempts to market touchscreen devices like the BlackBerry z10 in 2013 had lackluster results. The manufacturer has since gone back to its roots, releasing the BlackBerry Passport in September and the BlackBerry Classic on Wednesday. Both devices have physical keyboards.

BlackBerry shipped about 2 million devices during the past quarter. Hardware sales made up 46 percent of the company’s revenue, while services, software and other factors made up 54 percent of revenue. Having sold about 5.7 million handsets so far during its 2015 fiscal year, the company would need to see revenue on 4.3 million additional phones during its final quarter to break even, according to the Wall Street Journal.

During its fiscal third quarter, BlackBerry acquired the German telecommunications company Secusmart GmbH and U.K virtual SIM startup Movirtu, and also announced partnerships with such companies as Samsung, Vodafone, Ingram Micro, Brightstar and Salesforce.com. The company also launched new enterprise software and services, including BES12, WorkLife, Enterprise Identity, VPN Authentication and SecuSuite.

BlackBerry shares were down more than 4 percent in midday trading Friday as investors digested the news.

© Copyright IBTimes 2025. All rights reserved.