The Boeing Company (BA) Earnings Preview: Expect A Q4 Beat, But Conservative 2014 Guidance

The Boeing Company (NYSE:BA), the global aerospace and defense giant, will likely report strong fourth-quarter performance as rising commercial aircraft sales offsets softer defense sales in the U.S.

Boeing will report fourth-quarter 2013 earnings before the market opens on Jan. 29. Management will host a conference call at 10:30 a.m. ET.

The company will also provide initial 2014 guidance when it reports fourth-quarter results. However, if history is a predictor, the initial guidance for this year will likely be conservative.

Other key things to watch for, according to Goldman Sachs analyst Noah Poponak, are: 1) the commercial aerospace cycle; 2) 787 costs and learning curve improvement; 3) 787-9 and 777X development; 4) individual aircraft production rate outlooks; 5) recent defense budget changes; and 6) capital deployment priorities and levels.

“We're expecting Boeing results to come in well above consensus on the back of strong military deliveries as much as commercial deliveries,” Deutsche's Myles Walton wrote in a Jan. 13 note.

Chicago-based Boeing is expected to post a profit of $1.10 billion, or 1.30 a share, on revenue of $22.74 billion in the last three months of 2013. In the year-ago period, Boeing recorded a profit of $978.00 million, or $1.28 a share, on revenue of $22.30 billion. Excluding one-time items, the company likely made $1.57 a share last quarter, compared with $1.28 a share in the fourth quarter of 2012.

For the full year of 2013, analysts expect Boeing to report net income of $4.92 billion, or $5.71 a share, on revenue of $85.42 billion. Excluding one-time items, Boeing probably earned $6.75 a share.

Boeing raised its full-year core earnings guidance back in October to between $6.50 and $6.65 a share from a previous outlook of $6.20 to $6.40. It also lifted the forecast for unadjusted 2013 earnings to between $5.40 and $5.55 a share from $5.10 to $5.30.

It left unchanged its full-year revenue forecast at between $83 billion and $86 billion, and its target for delivering between 635 and 645 commercial aircraft for the full year.

The company expects fourth-quarter margins to be influenced by dilution from the 787 deliveries, higher R&D primarily associated with the 737 MAX and timing of supplier payments along with increased investments associated with higher deliveries and production rates.

Commercial Aircrafts

Aircraft sales and output are surging as carriers globally take advantage of low-cost financing to replace older models with newer, fuel-sipping jets. The commercial unit accounts for roughly 60 percent of Boeing’s revenue.

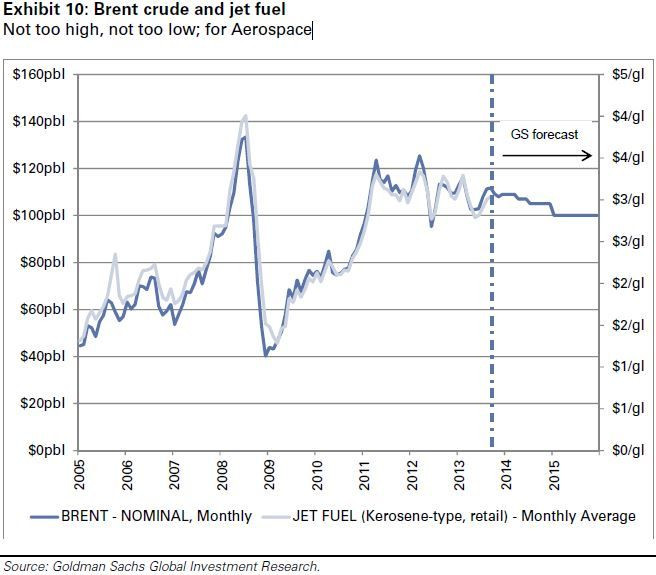

“We believe the current crude oil price, and therefore jet fuel price, is at a Goldilocks level,” Goldman Sachs’ Poponak said.

“It is high enough to incentivize the purchase of modern and much more fuel-efficient aircraft to replace old, but it is not too high to impede strength in airline profits,” Poponak said. “That double-edged sword also hedges the risks to the sector in the event fuel prices move in either direction, within a certain band.”

According to UBS analyst David Strauss, Boeing delivered 110 737s, 25 777s, four 767s, eight 747s and 25 787s for 172 total commercial aircraft deliveries.

“We estimate that 43 787s remain in inventory, including 17 early line number aircraft at Boeing's Everett Modification Center (EMC), with four having been added in 2013,” Strauss added.

He estimates that the 11 787s delivered in December took 11 months, on average, to deliver after coming off the production line, including two early line number aircraft from EMC (line units 30 and 36). In addition, the 114 787s delivered so far have taken eight months to deliver, on average, with 46 coming out of EMC.

Boeing said on Jan. 6 it delivered a record number of jetliners last year. The 648 jets Boeing delivered in 2013 topped the company's previous record of 620 aircraft delivered in 1999, following its merger with McDonnell Douglas Corp.

Boeing’s 1,355 net orders for the year were the second-highest annual sales tally, and an increase from the 1,338 a year earlier.

Last Friday, Boeing announced it accelerated the 787’s production rate to 10 jets a month. That’s the highest-ever output for a wide-body aircraft model.

That said, last year was not without its challenges. The 787 Dreamliner, which was supposed to be a game-changer for the aviation industry as its lighter body and sophisticated engines can cut fuel consumption by 20 percent, has been beset by problems. Boeing halted deliveries of the 787 for three months after regulators ordered the global fleet grounded due to hazards from the lithium-ion batteries

Defense Division

Boeing, the No. 2 defense contractor after Lockheed Martin Corporation (NYSE:LMT), has been trying to grow its international defense sales to offset the impact from weak defense spending at home.

International defense sales are expected to constitute around 30 percent of Boeing’s total defense sales for 2013, up from around 7 percent five years back.

“Almost roughly 40 percent of our backlog today is outside of the U.S., which provides some robustness, and no single program in our backlog is more than 10 percent,” Dennis Muilenburg, the former head of Boeing's defense unit who was promoted to chief operating officer in December told analysts at an industry conference in December.

This significant share of international defense sales in Boeing’s defense business will help it offset the negative impact from U.S. defense budget cuts.

Boeing is also aggressively cutting down costs, taking nearly $4 billion out already over the last two to three years. “Our headset is we have to assume a worst-case budget scenario will occur in the U.S. that sequestration will occur in full,” Muilenburg said.

“We are attacking every single dimension of cost structure. We have taken out about 30 percent of our overhead costs. We are down a little over 30 percent on executive headcount over the last three years, management headcount down a little over 20 percent, taken out about 15 percent of our facilities and infrastructure like closing our Wichita site, closing down the C-17 line,” Muilenburg added.

Stock Performance

Boeing’s stock has gained more than 80 percent in 2013.

With December's announcement of a $10 billion increase to share repurchase authorization and a doubling of the dividend, Boeing also announced that it had completed its repurchase activity for the 2013.

Given that $800 million remained on the repurchase authorization at the time of the announcement, this implies fourth-quarter share repurchases of about $1 billion (translating to $2.5 billion for full-year 2013), based on Credit Suisse analyst Robert Spingarn’s calculation.

Boeing’s closest rival in the aerospace and defense industry, Lockheed Martin Corporation (NYSE: LMT), reported disappointing fourth-quarter results last week as reduced military spending hit the company’s top line.

Boeing’s other main competitors include: Honeywell International Inc. (NYSE: HON), General Dynamics Corporation (NYSE: GD), Embraer SA (NYSE: ERJ), Raytheon Company (NYSE: RTN), Northrop Grumman Corporation (NYSE: NOC), EADS NV (EPA: EAD) and BAE Systems plc (LON: BA).

Shares of The Boeing Company (NYSE:BA) closed up 0.52 percent, or 71 cents, to $137.36 apiece in Monday’s session.

© Copyright IBTimes 2024. All rights reserved.