Bombardier (BBD.B) Airplanes Could Profit From Dubai Air Show 2013

Disruptive aircraft maker Bombardier Inc. (TSE:BBD.B) could profit significantly from the upcoming Dubai Air Show, which starts this Sunday, according to a note from industry analysts at William Blair & Co.

“Bombardier Inc. appears solidly positioned for improving operational execution beginning this quarter and could see significant new aircraft orders across several of its business, regional and commercial aircraft product lines at next week's Dubai Air Show,” wrote William Blair analysts in a morning update on Wednesday.

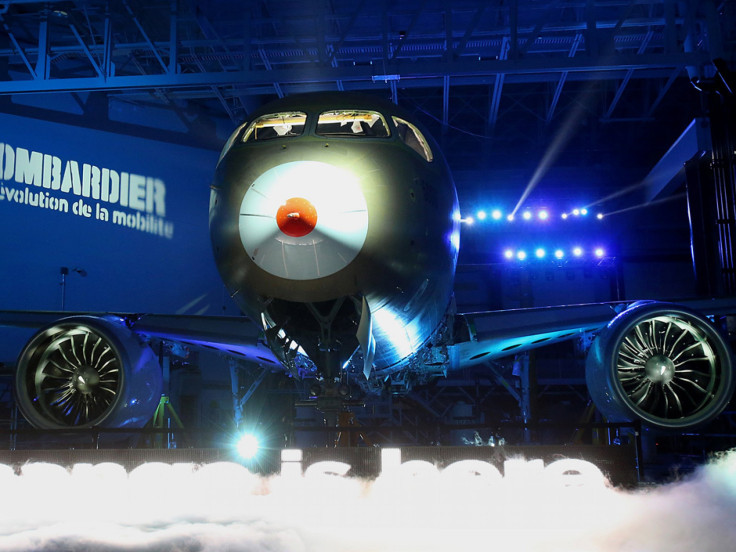

The analysts, who track the industrial sector, met with Bombardier management on Tuesday. Canada’s Bombardier is a rival to leading aircraft makers like the Boeing Company (NYSE:BA) and Airbus S.A.S., of EADS NV (EPA:EAD), especially given its successful launch of its C-Series commercial jet earlier in September.

Profit margins for Bombardier Aerospace and Bombardier Transportation are set to improve quarter over quarter, wrote the analysts. The company should also benefit from strong cash flows, and should quell doubts about its business strategy execution by the fourth quarter, following a third-quarter miss in expectations for earnings.

Bombardier’s narrow-body C-Series aircraft rates “extremely well” in engine performance, fuel consumption, noise reduction and maintenance, William Blair & Co. analyst Nick Heymann told IBTimes earlier in September.

The aircraft series seats 100 to 150 people, and the slightly larger version, the CS300, is likely to dominate the company’s orders at the Dubai Air Show, according to the note.

Bombardier, the world’s third-largest civil aircraft manufacturer, will make about $17.6 billion in revenues in fiscal 2013, with about $602 million in profits, estimated UBS AG (VTX:UBSN) analysts in early November. That compares to an expected $85.4 billion in revenue and $4.3 billion in profit at Boeing, according to UBS.

The company reported lower revenues and profits in its latest third quarter, with net income down to $147 million from $172 million a year ago. The company also won a major customer in China in October.

The Dubai Air Show, runnung Sunday through Nov. 21, could draw up to 60,000 trade show visitors, along with more than 1,000 exhibitors. In 2011, more than 150 aircraft were displayed at the show, and $63.3 billion in orders were booked.

Watch September’s maiden flight of Bombardier’s C-Series jet, courtesy of Bloomberg. The aircraft is expected to be operational and in broad commercial use within the next decade or so.

UBS analysts were more bearish on the Canadian company. On Nov. 5, they cut their price target for the stock.

“We have cut our price target and remain at Neutral as we don’t think the stock can work in the face of C-Series delays, downward estimate revisions, and meaningfully negative FCF [free cash flow],“ they wrote then.

© Copyright IBTimes 2024. All rights reserved.