BRICS May Decide On $100B Reserve Fund By Early 2014

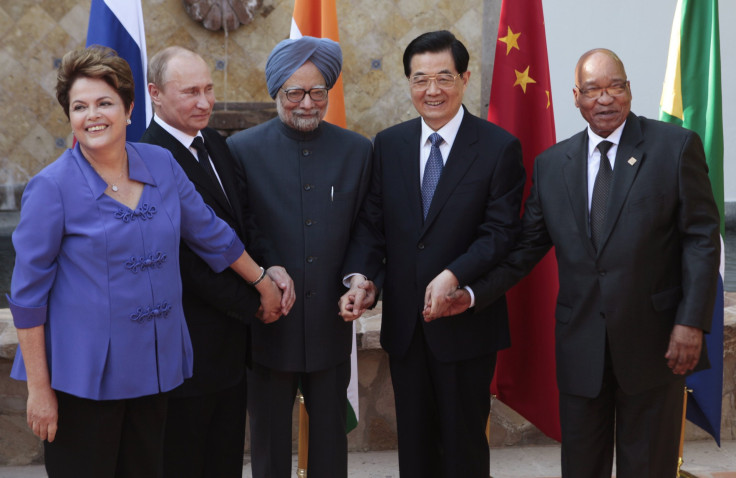

The biggest emerging markets -- Brazil, Russia, India, China and South Africa, known collectively as the BRICS nations -- may decide by early 2014 on a proposed $100 billion pool of currency reserves intended to serve as a buffer against currency-market volatility, Russia’s Finance Minister Anton Siluanov said on Friday.

The BRICS group, gathering on the sidelines of the Group of 20 meeting on Thursday, failed to make much progress in resolving differences in setting up the reserve fund, Reuters reported.

“At the next BRICS meeting early in 2014, I believe that this matter may be discussed there and a final decision may be made on that,” Siluanov said at a press briefing following the G-20 meeting.

BRICS nations last year announced the setting up of a joint development bank, along the lines of the International Monetary Fund and World Bank, to counter what they called the domination of the global financial apparatus by the U.S. and the Western countries. Meanwhile, the currency-reserve fund would be designed to hedge the impact of potentially massive movements in the currency markets caused by changes in U.S. monetary policy.

However, progress in establishing the joint development bank and the currency-reserve fund has been slow as the nations have yet to arrive at consensus over the power and burden sharing, and where the bank should be based.

The setting up of the reserve fund came to an impasse, as China -- the world’s largest holder of foreign-exchange reserves -- demanded greater power in managing the currency pool. China is expected to contribute the most to the reserve fund and wants the development bank to be based in the nation, a BRICS official told Reuters. “They feel that since they’re giving the most, they should have an advantage,” the official said.

The proposed bank with capital of $50 billion has yet to be incorporated, and the members reportedly had agreed on its capital structure with each nation agreeing to contribute the capital equally, in a group meeting held at New Delhi in August. But recent media reports suggest that BRICS is still debating the issue.

China -- with an economy about 20 times larger than South Africa’s and four times as large as either Russia’s or India’s -- wants the bank’s capital base to be bigger, and wants to contribute more to it.

“Brazil and India want the initial capital to be shared equally. We know that China wants more,” a Brazilian official told Reuters. “However, we are still negotiating, there are no tensions arising yet.”

© Copyright IBTimes 2024. All rights reserved.