California $600 Stimulus Payments: Who Is Eligible? Time And Mode Of Payment

KEY POINTS

- The beneficiaries include those earning $30,000 a year or less

- Households with ITINs and income below $75,000 will get checks

- Those under state programs, including SSI and CAPI recipients, are also eligible

- Governor Newsom will sign the $9.6 billion coronavirus aid package Tuesday

Lawmakers are still wrangling over a coronavirus stimulus package in Washington, but California is not waiting to get emergency help to the state's individuals, families and businesses. The state's lawmakers approved a stimulus bill that entails at least $600 in one-time payments for 5.7 million people as part of a state-sized coronavirus relief package aimed at helping those with low-to-moderate incomes weather the pandemic.

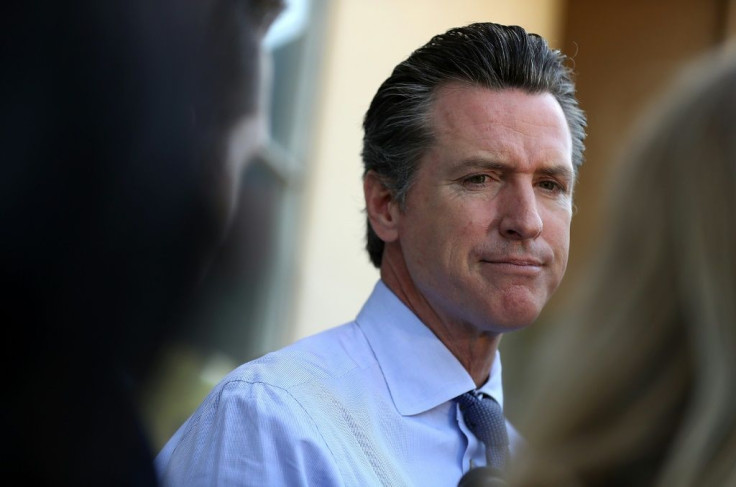

Gov. Gavin Newsom will sign the Immediate Action Agreement, the state's ambitious $9.6 billion coronavirus relief bill, on Tuesday. The state legislature Monday passed the bill by a wide margin, NBC News reported. The checks would be in addition to the two earlier federal stimulus checks and the $1,400 check that's in the works in Congress.

The bill's beneficiaries will include those receiving the California Earned Income Tax Credit for 2020 — namely, people who earn $30,000 a year or less. Taxpayers with Individual Tax Identification Numbers (ITIN), whose income is below $75,000, also will benefit. This includes illegal immigrants without Social Security numbers who file tax returns.

It will be a sweeter deal for some people who fit into both categories — that is, ITIN taxpayers who also qualify for the California Earned Income Tax Credit would earn $1,200, ABC News said. This has been done to benefit immigrants not eligible for federal stimulus checks approved by Congress last year.

People who already get help from state programs targeting low-income families, the elderly, the blind and the disabled, also will get the checks. This includes recipients of Supplemental Security Income and the state’s Cash Assistance Program for Immigrants.

According to the Franchise Tax Board, people eligible for the money should get it between 45 days and 60 days after receiving their state tax refunds. Newsom's office has not specified when the $600 payment would be sent out and how. But the release from his office said "grant payments for CalWORKS households are expected by mid-April; timing for the delivery of SSI/SSP and CAPI grants is currently under discussion with federal officials."

As a part of California’s new COVID-19 relief package, low-income Californians, who have been hit the hardest by the pandemic, will receive one-time $600 stimulus payments. Click here to learn more: https://t.co/f0SyAgxsg4. pic.twitter.com/pQgZkcvxKw

— InnerCityLawCenter (@InnerCityLaw) February 23, 2021

The $9.6 billion COVID-19 aid package is in addition to the relief aid coming out of Washington, which includes the $600-per-person stimulus checks already approved by Congress and direct payments of up to $1,400 per person mooted by House Democrats.

"We don’t want to wait until July," Newsom said. "We want some immediate actions to distribute $2.4 billion in what we call the Golden State stimulus. This is our version of what the federal government just did. But we want, instead of $600 checks landing in people’s pockets based upon what the Feds just did, we want to double that. We want to get $1,200 into people’s pockets.”

Under the plan, over 750,000 small businesses would be able to deduct on their state taxes up to $150,000 in loans they received under the Paycheck Protection Plan.

An additional $24 million will be provided as financial assistance and services for farmworkers, besides a combined $35 million for food banks and diapers. A sum of $100 million will go as emergency financial aid for qualifying low-income students carrying six or more class units. Another $6 million will go to support outreach and application assistance to the University of California, California State University and California Community College students made newly eligible for CalFresh — the state-administered federal program for supplemental food assistance.

As many as 59,000 restaurants and bars licensed through the state’s Department of Alcoholic Beverage Control will get two years of fee relief, which can range annually from $455 to $1,235.

California, one of the most populous states, could come up with the package as it has many wealthy taxpayers who continued to pay their taxes and were less impacted by the pandemic.

© Copyright IBTimes 2025. All rights reserved.