California Governor OKs Bill for Minibonds

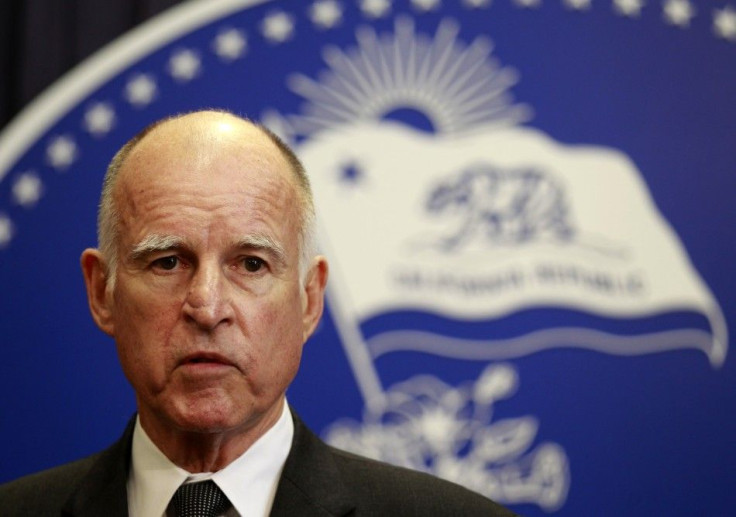

California Governor Jerry Brown has signed a bill that drops the minimum face value on the state's general obligation debt to $25 from $1,000 to help sell minibonds to retail investors, his office said in a statement on Wednesday.

The bill was promoted by State Treasurer Bill Lockyer, who has made selling bonds to individuals a priority to help lower interest rates on California's debt.

It just gives us the flexibility to offer a small denomination product, said Lockyer spokesman Tom Dresslar, adding there were no immediate plans for offering the so-called minibonds, which would trade on the New York Stock Exchange.

Dresslar said decisions for selling the smaller denomination debt would be made by Lockyer's office on a case-by-case basis for bond sales.

Lockyer plans to sell more than $8 billion in debt this month, including more than $5 billion of short-term notes to pay off debt his office sold in July.

His office's biggest deal this month will be its sale of $5.4 billion of revenue anticipation notes on September 15. Proceeds from the sale will be used to pay off interim revenue anticipation notes sold in July that served as a bridge loan for the state's cash-flow needs.

July's sale was held to avoid potential financial market turmoil had policymakers in Washington failed to reach a deal on the U.S. debt ceiling.

Lockyer this month will also sell $245 million in revenue bonds for the California State University system and $1.3 billion in various purpose general obligation bonds to pay down commercial paper. His office may also sell up to another $1.3 billion of the debt, depending on market conditions, for refunding purposes.

© Copyright Thomson Reuters {{Year}}. All rights reserved.