California's estate tax laws to spur budget deficits: Moody's

The new federal estate taxes proposed for the State of California will result in a much higher budget deficit in the state, according to a report by Moody's Investor Services.

Last week, President Obama and top Republicans agreed to re-impose federal estate taxes: a 35 percent tax rate on estates worth more than $5 million for individuals and $10 million for couples, compared to the current 55 percent rate with $1 million exemption that was expected to take effect in January 2011.

If the lower rate becomes law, it will raise California's estimated budget gap for the next 18 months by $2.7 billion to $28 billion, a negative development that will increase pressure on the state's already strained finances and credit, Emily Raimes, a senior analyst at Moody's, said in a note.

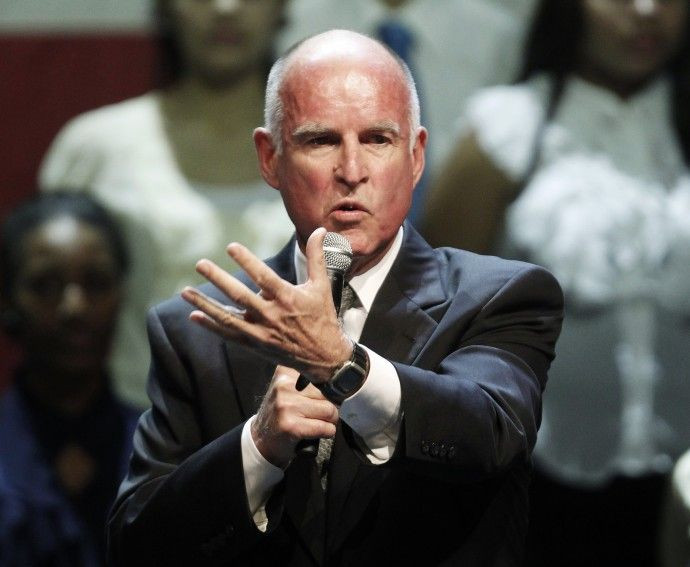

A decline in estate tax revenues will make the California governor-elect's job of crafting a budget proposal for fiscal year 2012 more difficult, and the diminished cash revenue in the next eight months could force IOU issuance or tax refund deferral, the state controller said, according to the report.

Washington insiders say the terms are not likely to change much from there, although the road to passage in the House may be bumpy, according to the Wall Street Journal.

The new law could cut by more than half the number of taxable estates compared with an extension of the 2009 tax, the paper said, citing estimates by economist Roberton Williams on the nonpartisan Tax Policy Center.

While most citizens of the state could be cheering this news, it means further budget woes for the golden state.

California was one of the hardest hit states during the recession. Unemployment rates are around 12.4 percent, higher than the nation's average of 9.8 percent.

The housing market is on a slow road to recovery. The California Association of Realtors, in a report issued Nov. 23, stated that the housing market was being slowed statewide by sellers who are having difficulty adjusting to the new reality of the housing market.

More than half of the states, including California, Florida, Michigan, Texas, and Wisconsin, have estate taxes tied to the federal taxes and may have budgeted revenues based on an assumption that the federal estate tax would return to the higher 55 percent rate with a $1 million exemption, Raimes said in the note.

Even though Democrats are pushing for a higher tax rate, it would still remain below the 55 percent California built into its budget, she added.

Among other proposed changes, there could be a lower tax payroll tax rate at 4.2 percent, down from the existing 6.2 percent, meaning fatter paychecks for employees.

Much of the budget deficit will translate into bad news for the state's public education system, which was already reeling from massive budget cuts.

It is abundantly clear that we will be looking at another round of cuts from the state.The amount of cuts remains to be seen, but it is fiscally prudent for any district to try to plan for the worst-case scenario, said Wayne Joseph, superintendent of the Chino Valley Unified School District, told The Sun.

Joseph said he believes the cuts will probably result in layoffs in the future.

Most state schools receive majority of their funding from the State, and the rest from federal funding or private donations. Due to the recession, private donations have mostly dried up.

Further budget cuts would have to result in the schools and community colleges applying for federal aid to function.

© Copyright IBTimes 2025. All rights reserved.