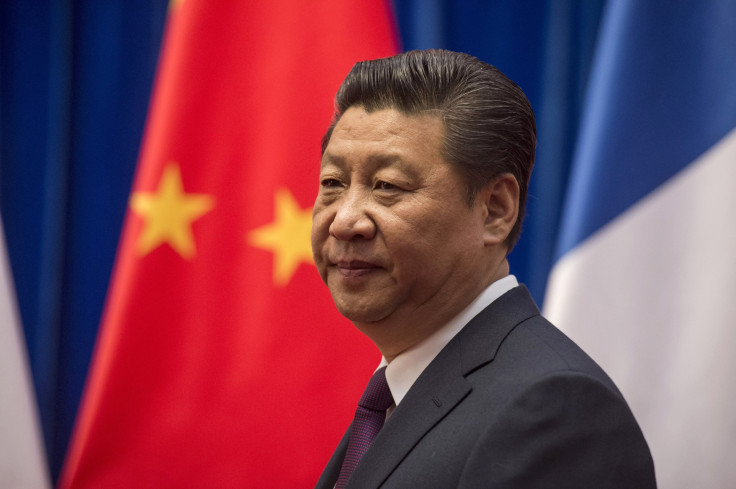

China Courts Silicon Valley: Premier Xi Jinping To Meet With Apple, IBM, Microsoft Ahead Of White House Visit

Chinese President Xi Jinping is calling U.S. tech leaders to Seattle for a series of meetings as part of the first stop on his U.S. visit in two weeks. The meetings will precede his state visit to the White House, where issues such as trade protectionism and cybersecurity are expected to be high on the agenda.

Tech executives and others with deep ties to China started receiving invitations to Seattle a few weeks ago for a series of meetings to be held Sept. 22 and 23. Apple CEO Tim Cook, Microsoft Corp. CEO Satya Nadella and IBM CEO Ginni Rometty are all expected to take private, face-to-face meetings with Xi, according to the Financial Times. He is also set to attend a private dinner at the home of Microsoft co-founder Bill Gates.

It is unclear if Google has been invited, and the report states that Mark Zuckerberg, the founder and CEO of Facebook Inc., has yet to decide if he will attend, despite it being a good opportunity for him to show off his Mandarin skills. Facebook is blocked in China, and Google pulled out in 2010 rather than comply with government censors.

Some are seeing the meetings as a way for Xi to show the Obama administration that the lure of access to the Chinese economy is greater than the threat of sanctions being imposed against China for alleged intellectual property theft or cyberattacks against the U.S. Others are predicting that Xi could offer a carrot -- greater access to Chinese markets, perhaps -- in exchange for tech sector pressure on the Obama administration.

"There is obviously a message here; it is also a demonstration that he has the clout because a lot of U.S. tech execs don't want to be seen as kowtowing to the Chinese," said Joel Backaler, VP at Frontier Strategy Group and author of "China Goes West." "At the same time, China is a very large market; Apple is killing it there and a lot of other tech companies hope to do so as well."

Google and Facebook are two of the companies that could benefit most from an easing of tensions with China, though both now have extremely established competitors in China in the form of Baidu, which dominates search, and social apps such as WeChat that are deeply woven into Chinese society. "Chinese government would want to make sure Chinese technology are well-established enough to compete before the real competition starts," said Bessie Lee, CEO of WPP China and founder of Shanghai-based incubator withinlink.

"For Facebook specifically, their other challenge would be if they will be offering anything new to Chinese users that WeChat are not at the moment," Lee said.

A report last month from the Information suggests that Google is preparing to relaunch at least some of its products in China, with a limited version of its Google Play Store set to launch for Android smartphones and tablets. Sundar Pichai recently took complete control of Google as part of a massive restructuring at the company now known as Alphabet, and in March he indicated his wish to enter the Chinese market at the Mobile World Congress:

"It is important to remember that most of the innovation [happening with Chinese smartphones like Xiaomi and OnePlus] is powered by Android," he said. "So we are very committed, we work very hard. I met with partners from China this morning, so it’s a big part of what we do. We would of course love to see Google services on top of their experience.”

The meetings also come amid the steep decline of the Chinese stock market, though it's unclear how representative that is of real economic conditions on the ground. Pre-sales of the pricey new iPhone 6S were robust in China over the weekend, Apple said Monday. Backaler, who recently returned from China, said he spoke to more than 20 CEOs and CFOs, none of whom seemed the least bit worried about China's future.

“There was not a single Chinese exec I spoke to who was expressing the least bit of a doomsday scenario," he said. "There is a recognition that the double-digit growth of yesterday will not repeat itself — but none of them were looking at it as ‘my days are numbered.'"

© Copyright IBTimes 2024. All rights reserved.