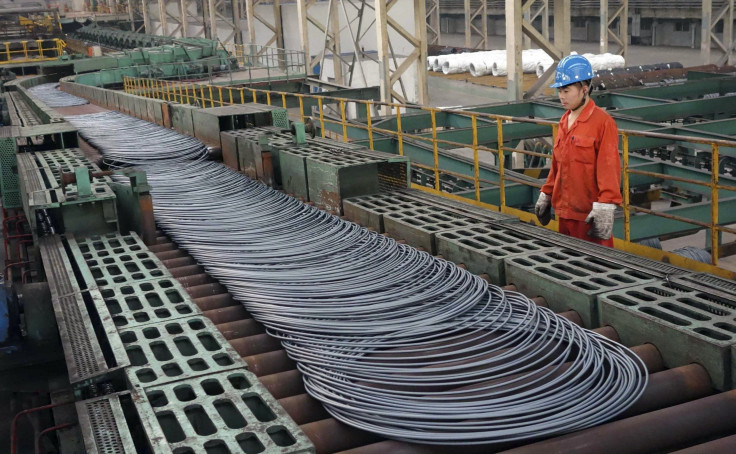

China’s Struggling Steel Producers Made Record $10B Loss In 2015, Industry Chief Predicts More Problems Ahead

SHANGHAI — China’s steelmakers, hit by falling global and domestic demand and slumping prices — and criticized for dumping — saw their worst ever loss last year, according to the nation’s official industry association.

Losses in primary business rose to $15.5 billion, compared to less than $1 billion in 2015, while total losses, after investment returns were taken into account, were around $10 billion, the official Xinhua news agency reported. This compared to an overall industry profit of some $3.5 billion in 2014.

China’s steelmakers expanded massively over the past decade and a half, but have been hard-hit by a slowing global economy and a major slowdown in construction in China’s real estate sector, which is now burdened with a massive quantity of unsold inventory.

Liu Zhenjiang, party chief and secretary general of the China Iron and Steel Association (CISA), told an industry meeting in Beijing that there had been some sign of recent improvement — with China's steel price index up some 20 percent over the past three months.

But Chinese steel producers still lost some $1.75 billion in January and February, and Liu said there was little reason for optimism.

"The sharp downturn sent life-or-death signals to some companies and posed grim challenges for our business in 2016," he said, according to Xinhua.

Oversupply was still a problem, Liu added, noting there was “a significant chance” that China’s steel exports would continue to drop this year. And he called on steelmakers to “cut capacity, curb output and improve efficiency.”

The struggles of China’s steelmakers have attracted global attention, with anger in the U.K. at the recent decision by Indian giant Tata Steel to put its U.K. steel plants up for sale, in the face of cheap Chinese imports. There have been calls for the European Union to enact tough anti-dumping measures on Chinese producers, while the U.S. and India have already slapped new duties on Chinese imports — though some Chinese experts say this is unfair.

The Chinese government has pledged to reduce overcapacity in its commodity sector as part of supply side reforms — it recently announced that it would cut crude steel production capacity by 100 million tonnes to 150 million tons over the next five years. One steel-producing province, Hebei, has said it will close 60 percent of its steel mills over the next five years. The government has also said some 500,000 workers will be laid off from the steel industry over the coming years.

There have been some signs of such policies being implemented: Late last month, one major steelmaker in northeast China defaulted on loan repayments of some $130 million, after state banks refused to bail it out.

And one Chinese expert said recently that many steelmakers would be “wiped out of the market once their capital chains are broken.”

But scaling down an industry that grew exponentially during China’s real estate boom in the decade to 2013 is no easy task. In many areas, steel mills are major employers, and despite a government pledge to allocate at least some $15.4 billion to cover layoffs from such industries over the coming year, large-scale layoffs will be a painful challenge for many local governments. The nation has already seen several strikes by steelworkers in recent weeks.

And some observers have questioned whether the government will be able to meet its targets for cutting overcapacity.

"Normally in this situation steel capacity should fall by 10-20 percent," Joerg Wuttke, president of the European Union Chamber of Commerce in China and author of a recent study on overcapacity in the nation, told International Business Times recently, "but so far it is only down by about 4 percent."

Indeed, with the recent rebound in prices, some steelmakers have been tempted to increase production. Shanghai-based industry giant Baosteel recently announced it would increase production by 20 percent — some 4.4 million tonnes — this year.

And some economists have questioned the impact of any planned cuts. Christoper Balding, Professor of Political Economics at the Peking University HSBC Business School told IBT that new capacity was still coming onstream in China's steel sector:

“If you look at the steel and coal industries, with the capacity under construction and coming online right now, you may not actually be looking at a net cut over next five years, but a pretty significant net addition to these industries,” he said.

© Copyright IBTimes 2025. All rights reserved.